- South Korea

- /

- Personal Products

- /

- KOSDAQ:A194700

Why Investors Shouldn't Be Surprised By NOVAREX Co.,Ltd.'s (KOSDAQ:194700) 31% Share Price Plunge

NOVAREX Co.,Ltd. (KOSDAQ:194700) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

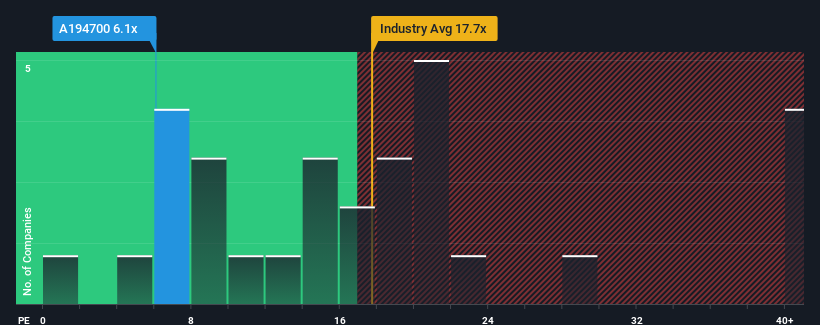

In spite of the heavy fall in price, NOVAREXLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.1x, since almost half of all companies in Korea have P/E ratios greater than 11x and even P/E's higher than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, NOVAREXLtd has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for NOVAREXLtd

Is There Any Growth For NOVAREXLtd?

In order to justify its P/E ratio, NOVAREXLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 28% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 24% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 1.2% each year over the next three years. With the market predicted to deliver 15% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that NOVAREXLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On NOVAREXLtd's P/E

NOVAREXLtd's recently weak share price has pulled its P/E below most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of NOVAREXLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for NOVAREXLtd that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if NOVAREXLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A194700

NOVAREXLtd

Manufactures, wholesales, and retails health and functional foods in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives