- South Korea

- /

- Personal Products

- /

- KOSDAQ:A194700

NOVAREX Co.,Ltd.'s (KOSDAQ:194700) Shares Bounce 31% But Its Business Still Trails The Market

NOVAREX Co.,Ltd. (KOSDAQ:194700) shares have continued their recent momentum with a 31% gain in the last month alone. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

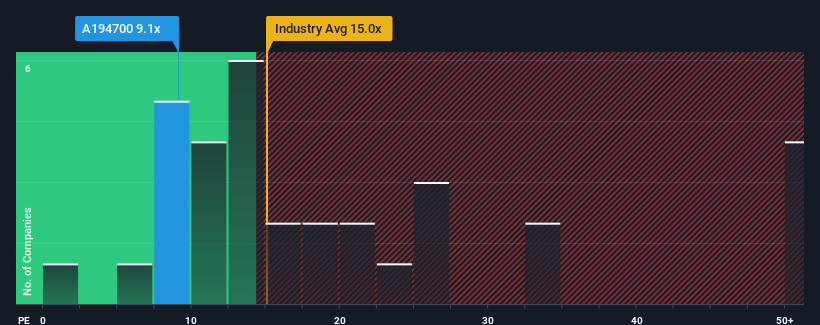

In spite of the firm bounce in price, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 12x, you may still consider NOVAREXLtd as an attractive investment with its 9.1x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about NOVAREXLtd. View them for free.Earnings have risen at a steady rate over the last year for NOVAREXLtd, which is generally not a bad outcome. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for NOVAREXLtd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as NOVAREXLtd's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 4.5% gain to the company's bottom line. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 22% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 20% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that NOVAREXLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On NOVAREXLtd's P/E

The latest share price surge wasn't enough to lift NOVAREXLtd's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of NOVAREXLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for NOVAREXLtd that you should be aware of.

You might be able to find a better investment than NOVAREXLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NOVAREXLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A194700

NOVAREXLtd

Manufactures, wholesales, and retails health and functional foods in South Korea and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives