- South Korea

- /

- Personal Products

- /

- KOSDAQ:A044480

The Market Lifts BLADE Entertainment CO.,LTD. (KOSDAQ:044480) Shares 58% But It Can Do More

BLADE Entertainment CO.,LTD. (KOSDAQ:044480) shares have had a really impressive month, gaining 58% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 29%.

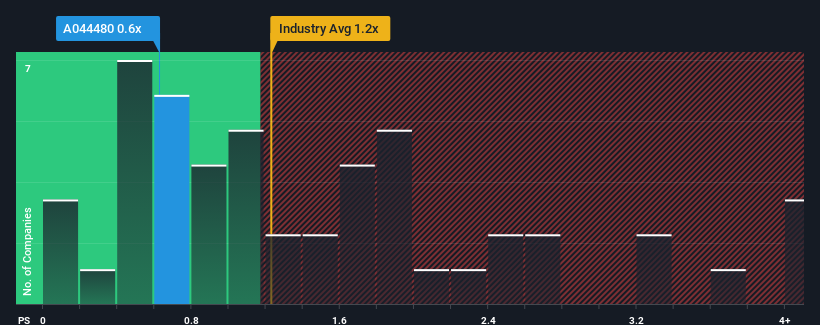

In spite of the firm bounce in price, when close to half the companies operating in Korea's Personal Products industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider BLADE EntertainmentLTD as an enticing stock to check out with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for BLADE EntertainmentLTD

What Does BLADE EntertainmentLTD's P/S Mean For Shareholders?

Recent times have been quite advantageous for BLADE EntertainmentLTD as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on BLADE EntertainmentLTD will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for BLADE EntertainmentLTD, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is BLADE EntertainmentLTD's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as BLADE EntertainmentLTD's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 18%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that BLADE EntertainmentLTD's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From BLADE EntertainmentLTD's P/S?

Despite BLADE EntertainmentLTD's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see BLADE EntertainmentLTD currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for BLADE EntertainmentLTD (1 is a bit concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if BillionsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A044480

Slightly overvalued very low.

Market Insights

Community Narratives