- South Korea

- /

- Healthcare Services

- /

- KOSE:A118000

There Are Some Holes In Wooridul Huebrain's (KRX:118000) Solid Earnings Release

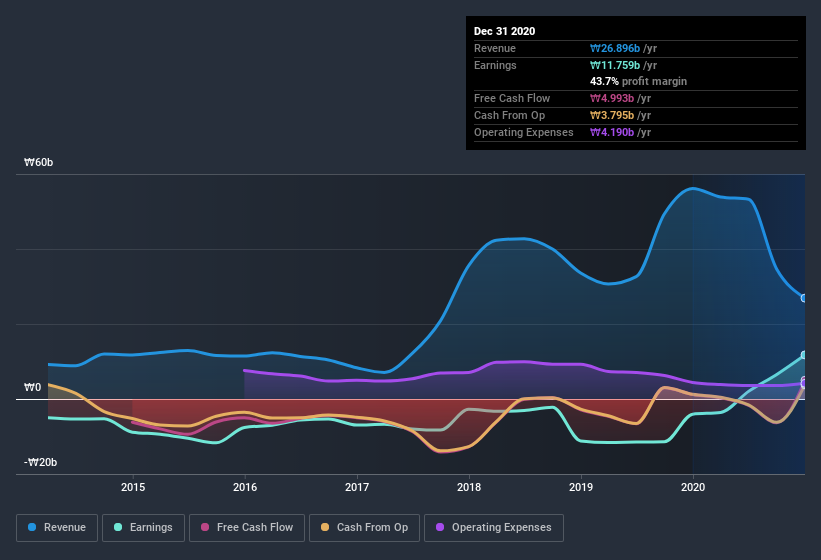

Following the release of a positive earnings report recently, Wooridul Huebrain Limited's (KRX:118000) stock performed well. Investors should be cautious however, as there some causes of concern deeper in the numbers.

Check out our latest analysis for Wooridul Huebrain

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Wooridul Huebrain increased the number of shares on issue by 40% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Wooridul Huebrain's historical EPS growth by clicking on this link.

A Look At The Impact Of Wooridul Huebrain's Dilution on Its Earnings Per Share (EPS).

Wooridul Huebrain was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, if Wooridul Huebrain's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Wooridul Huebrain.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that Wooridul Huebrain's profit was boosted by unusual items worth ₩17b in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. We can see that Wooridul Huebrain's positive unusual items were quite significant relative to its profit in the year to December 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Wooridul Huebrain's Profit Performance

To sum it all up, Wooridul Huebrain got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. For the reasons mentioned above, we think that a perfunctory glance at Wooridul Huebrain's statutory profits might make it look better than it really is on an underlying level. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example - Wooridul Huebrain has 2 warning signs we think you should be aware of.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Wooridul Huebrain, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A118000

Slight risk with imperfect balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026