As December 2024 unfolds, global markets have shown mixed signals, with U.S. consumer confidence dipping and major indices experiencing a roller-coaster week amid economic uncertainties. In this environment, stocks with high insider ownership often attract attention as they suggest that those closest to the company have faith in its growth prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lunit Inc. is a South Korean company specializing in AI-powered software and solutions for cancer diagnostics and therapeutics, with a market cap of ₩1.77 trillion.

Operations: The company's revenue is primarily derived from its healthcare software segment, which generated ₩39.54 billion.

Insider Ownership: 20.8%

Revenue Growth Forecast: 49.9% p.a.

Lunit is positioned as a growth company with significant insider ownership, capitalizing on its innovative AI solutions in oncology. The company's revenue is projected to grow substantially faster than the market, and it aims to achieve profitability within three years. Recent advancements include the commercialization of its Universal Immunohistochemistry AI model and strategic partnerships with major healthcare entities like AstraZeneca, enhancing its global reach. However, Lunit's share price has been highly volatile recently.

- Take a closer look at Lunit's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Lunit's current price could be quite moderate.

Keda Industrial Group (SHSE:600499)

Simply Wall St Growth Rating: ★★★★☆☆

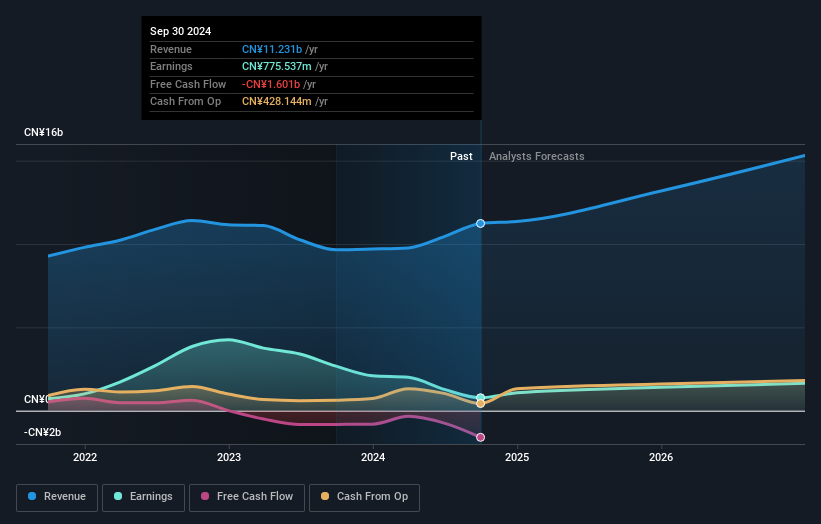

Overview: Keda Industrial Group Co., Ltd. manufactures and sells building material machinery both in China and internationally, with a market cap of CN¥14.97 billion.

Operations: The company's revenue is primarily derived from its building material machinery segment, serving both domestic and international markets.

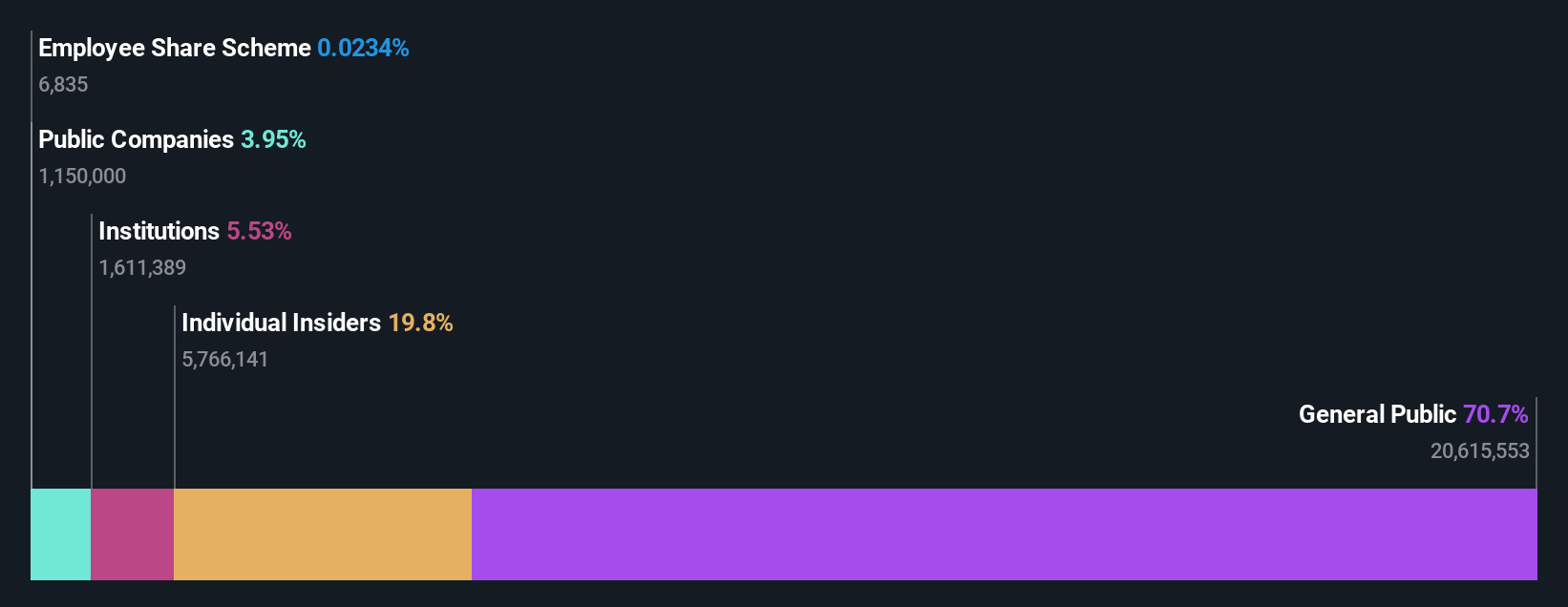

Insider Ownership: 32.3%

Revenue Growth Forecast: 14.5% p.a.

Keda Industrial Group's insider ownership aligns with its growth trajectory, supported by a share buyback program aimed at equity incentives. Despite a decline in net income to CNY 702.9 million for the nine months ending September 2024, revenue increased to CNY 8.56 billion from the previous year. The company offers value with a price-to-earnings ratio of 19.5x, below market average, and earnings are forecasted to grow significantly at 28.9% annually over three years.

- Delve into the full analysis future growth report here for a deeper understanding of Keda Industrial Group.

- In light of our recent valuation report, it seems possible that Keda Industrial Group is trading behind its estimated value.

Jiangsu Kuangshun Photosensitivity New-Material Stock (SZSE:300537)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Kuangshun Photosensitivity New-Material Stock Co., Ltd. operates in the field of photosensitive materials and has a market capitalization of CN¥4.17 billion.

Operations: The company generates revenue from the Fine Chemicals Industry segment, amounting to CN¥501.59 million.

Insider Ownership: 37.5%

Revenue Growth Forecast: 26.2% p.a.

Jiangsu Kuangshun Photosensitivity New-Material Stock shows promising growth potential with forecasted annual earnings growth of 67.9%, significantly outpacing the Chinese market average. Despite recent volatility in its share price and a decline in profit margins, revenue is expected to grow at 26.2% annually, surpassing market expectations. Recent financial results indicate stable net income year-over-year, while upcoming shareholder decisions may impact future capital structure and governance policies.

- Dive into the specifics of Jiangsu Kuangshun Photosensitivity New-Material Stock here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Jiangsu Kuangshun Photosensitivity New-Material Stock's current price could be inflated.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1507 Fast Growing Companies With High Insider Ownership now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Keda Industrial Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Keda Industrial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600499

Keda Industrial Group

Manufactures and sells building material machinery in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives