- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A261200

Market Might Still Lack Some Conviction On DENTIS CO.,Ltd (KOSDAQ:261200) Even After 29% Share Price Boost

DENTIS CO.,Ltd (KOSDAQ:261200) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 38%.

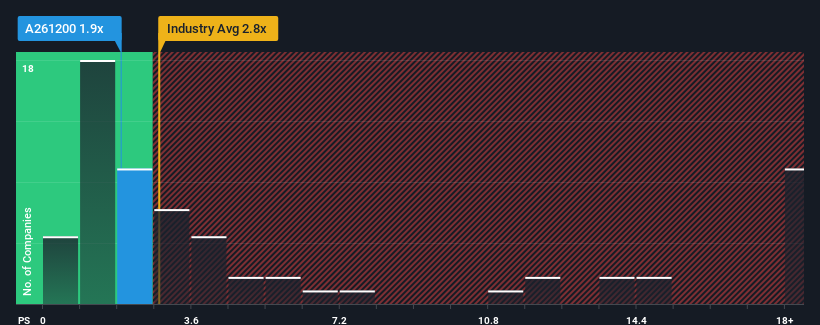

In spite of the firm bounce in price, DENTISLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.9x, considering almost half of all companies in the Medical Equipment industry in Korea have P/S ratios greater than 2.8x and even P/S higher than 10x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for DENTISLtd

How DENTISLtd Has Been Performing

DENTISLtd has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on DENTISLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for DENTISLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is DENTISLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as DENTISLtd's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Pleasingly, revenue has also lifted 79% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 21% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that DENTISLtd is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From DENTISLtd's P/S?

Despite DENTISLtd's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that DENTISLtd currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

And what about other risks? Every company has them, and we've spotted 2 warning signs for DENTISLtd you should know about.

If these risks are making you reconsider your opinion on DENTISLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A261200

DENTISLtd

Manufactures and sells dental implants and medical devices in Korea and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives