- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A246710

Further weakness as T&R Biofab (KOSDAQ:246710) drops 13% this week, taking three-year losses to 81%

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of T&R Biofab Co., Ltd. (KOSDAQ:246710), who have seen the share price tank a massive 81% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And the ride hasn't got any smoother in recent times over the last year, with the price 32% lower in that time. More recently, the share price has dropped a further 25% in a month. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for T&R Biofab

Because T&R Biofab made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, T&R Biofab saw its revenue grow by 12% per year, compound. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 22% per year is due to the revenue. More likely, the market was spooked by the cost of that revenue. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

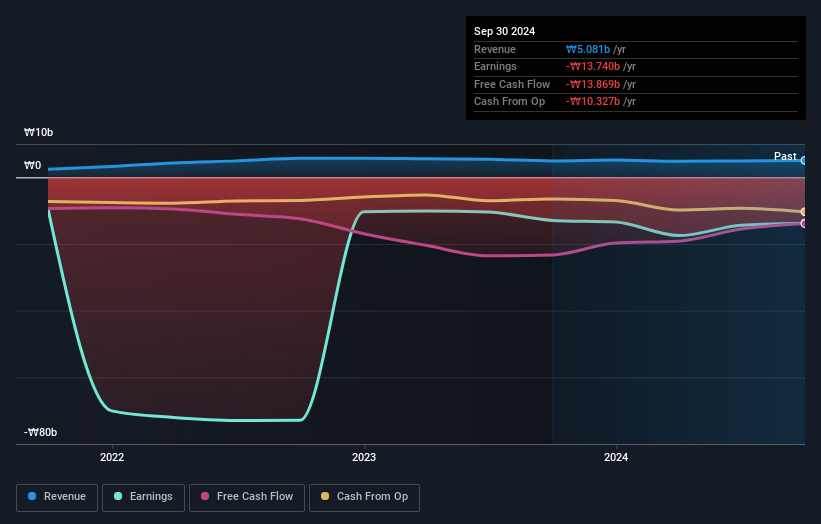

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling T&R Biofab stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 8.0% in the twelve months, T&R Biofab shareholders did even worse, losing 32%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 0.4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with T&R Biofab (including 1 which is potentially serious) .

Of course T&R Biofab may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

If you're looking to trade T&R Biofab, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if T&R Biofab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A246710

T&R Biofab

Develops and commercializes various regenerative medical technologies.

Moderate with weak fundamentals.

Market Insights

Community Narratives