- South Korea

- /

- Electrical

- /

- KOSE:A267260

KRX Stocks That May Be Priced Below Their Estimated Value In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a 2.8% decline, although it remains up by 5.5% over the past year with earnings forecasted to grow by 29% annually. In light of these conditions, identifying stocks that may be priced below their estimated value involves assessing factors such as strong fundamentals and growth potential relative to current market valuations.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| T'Way Air (KOSE:A091810) | ₩2900.00 | ₩5448.93 | 46.8% |

| PharmaResearch (KOSDAQ:A214450) | ₩226500.00 | ₩423962.53 | 46.6% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7550.00 | ₩14906.57 | 49.4% |

| TSE (KOSDAQ:A131290) | ₩54700.00 | ₩99447.76 | 45% |

| Wonik Ips (KOSDAQ:A240810) | ₩29150.00 | ₩48581.87 | 40% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Oscotec (KOSDAQ:A039200) | ₩33700.00 | ₩65156.22 | 48.3% |

| Intellian Technologies (KOSDAQ:A189300) | ₩51900.00 | ₩90832.21 | 42.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1489.00 | ₩2866.61 | 48.1% |

| Hotel ShillaLtd (KOSE:A008770) | ₩44200.00 | ₩75218.76 | 41.2% |

We're going to check out a few of the best picks from our screener tool.

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.69 trillion.

Operations: The company generates revenue primarily from its Surgical & Medical Equipment segment, amounting to ₩204.37 billion.

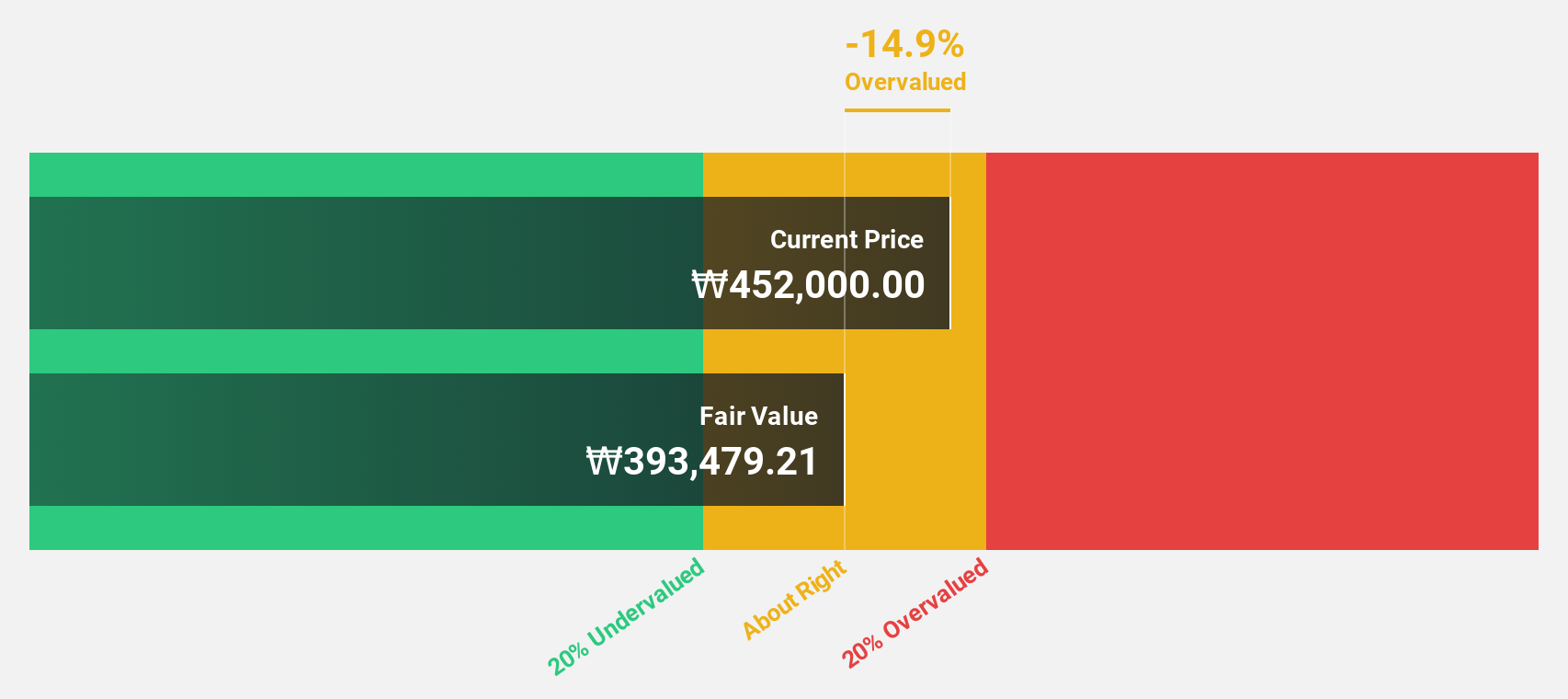

Estimated Discount To Fair Value: 12.8%

CLASSYS is trading at ₩56,300, approximately 12.8% below its estimated fair value of ₩64,599.73. While not significantly undervalued by a large margin, the company's revenue is projected to grow at 22.5% annually—outpacing the South Korean market's 10.2%. Despite earnings growth trailing the market average of 29.3%, CLASSYS anticipates a robust annual earnings increase of over 20%, underscoring its potential as an undervalued opportunity based on cash flows.

- The growth report we've compiled suggests that CLASSYS' future prospects could be on the up.

- Get an in-depth perspective on CLASSYS' balance sheet by reading our health report here.

HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540)

Overview: HD Korea Shipbuilding & Offshore Engineering Co., Ltd. operates in the shipbuilding and offshore engineering industry, with a market capitalization of ₩13.92 trillion.

Operations: The company's revenue segments include Shipbuilding at ₩21.80 billion, Engine at ₩4.21 billion, Green Energy at ₩467.66 million, and Marine Plant at ₩802.72 million.

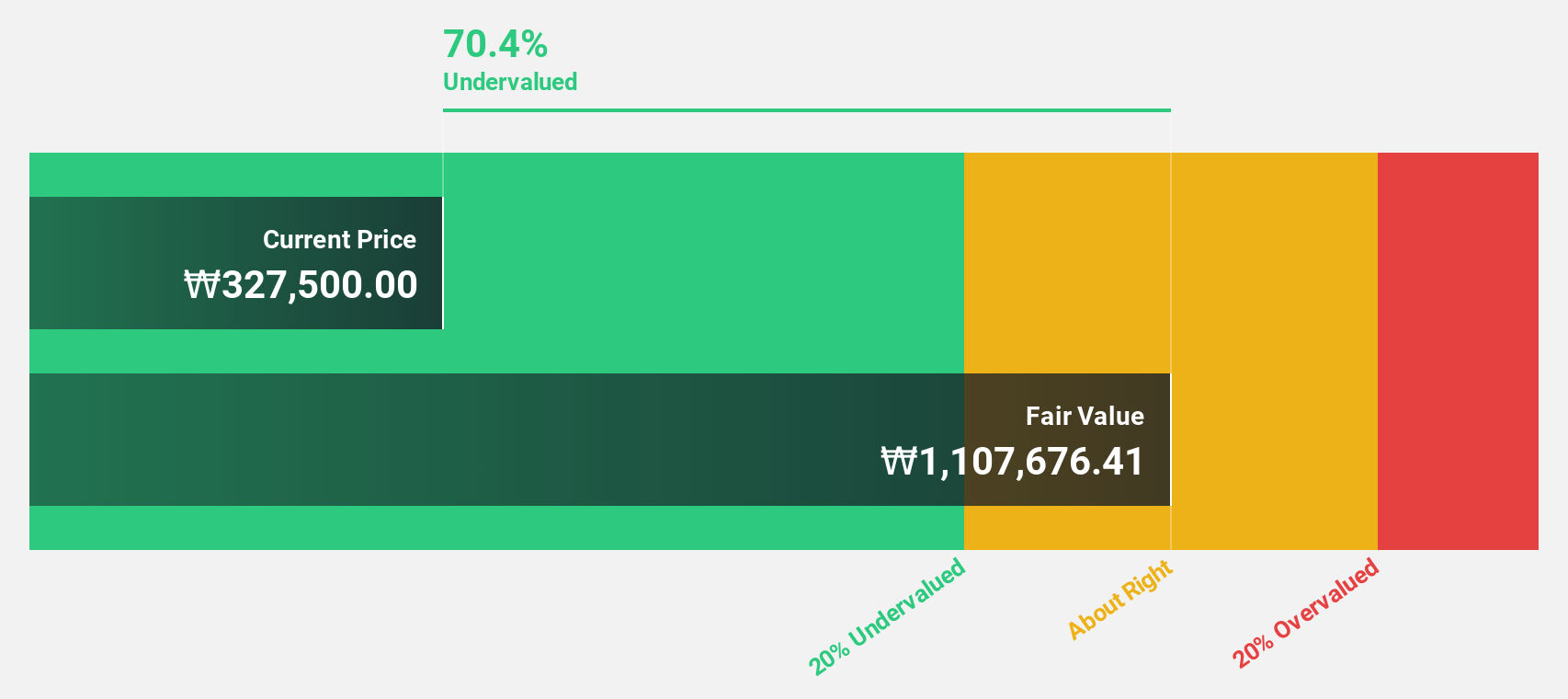

Estimated Discount To Fair Value: 17.2%

HD Korea Shipbuilding & Offshore Engineering is trading at ₩196,800, about 17.2% below its estimated fair value of ₩237,767.69. The company has reported substantial earnings growth over the past year and anticipates a significant annual profit increase of 39.2%, outpacing the South Korean market's average of 29.3%. Despite this growth potential, its Return on Equity is forecasted to remain low at 14.3% in three years.

- Our comprehensive growth report raises the possibility that HD Korea Shipbuilding & Offshore Engineering is poised for substantial financial growth.

- Click here to discover the nuances of HD Korea Shipbuilding & Offshore Engineering with our detailed financial health report.

HD Hyundai Electric (KOSE:A267260)

Overview: HD Hyundai Electric Co., Ltd. manufactures and sells electrical equipment in South Korea with a market cap of ₩12.18 trillion.

Operations: The company's revenue primarily comes from its Electric Equipment segment, generating ₩3.21 trillion.

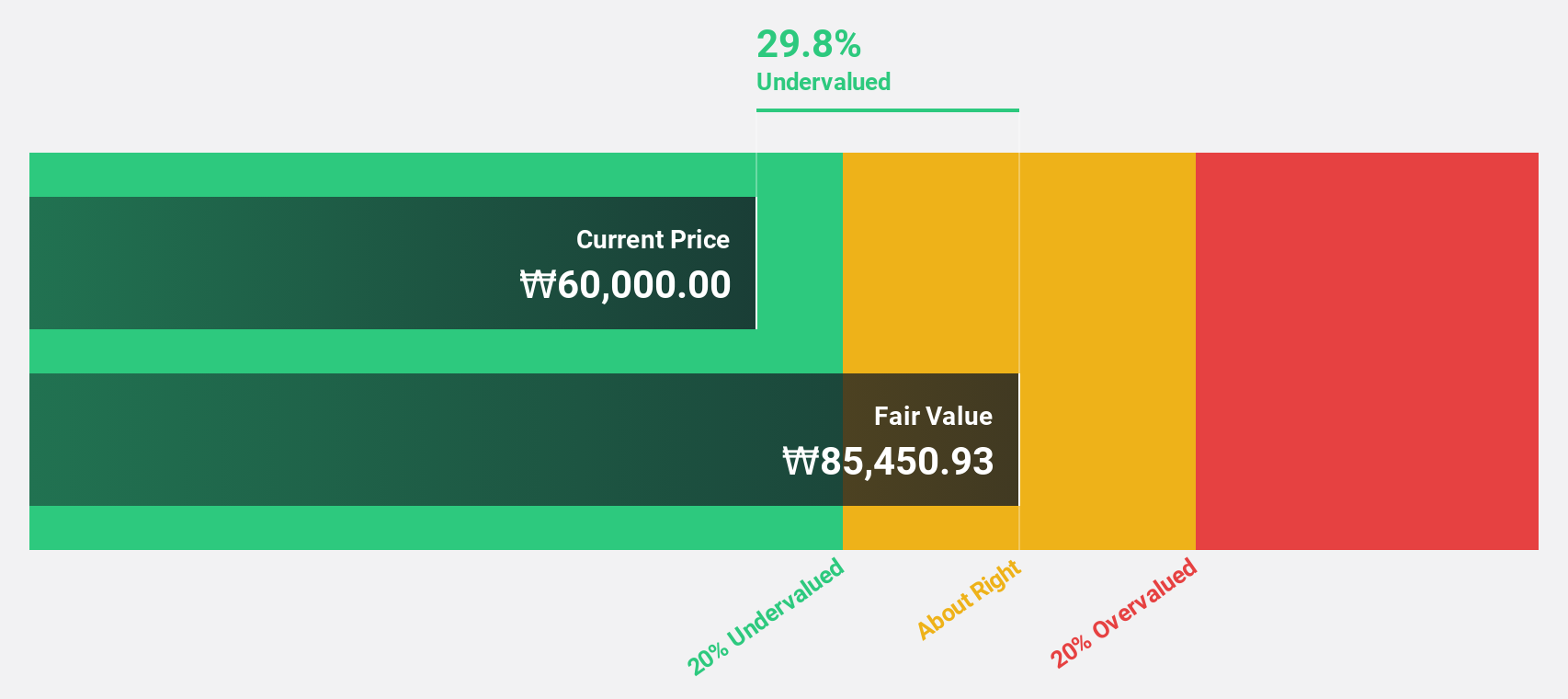

Estimated Discount To Fair Value: 25.4%

HD Hyundai Electric is trading at ₩338,500, significantly below its estimated fair value of ₩453,507.54. Despite high earnings growth of 109.3% last year and expected annual profit growth of 23.8%, it lags behind the South Korean market's average of 29.3%. Revenue is projected to grow faster than the market at 14.4% per year, yet share price volatility remains a concern despite recent inclusion in the FTSE All-World Index.

- The analysis detailed in our HD Hyundai Electric growth report hints at robust future financial performance.

- Dive into the specifics of HD Hyundai Electric here with our thorough financial health report.

Where To Now?

- Access the full spectrum of 32 Undervalued KRX Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A267260

HD Hyundai Electric

Manufactures and sells electrical equipment in South Korea.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives