- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

KRX Growth Leaders With High Insider Stakes In June 2024

Reviewed by Simply Wall St

The South Korean market has shown steady growth with a 6.5% increase over the past year, despite remaining flat in the last week. In this context, companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those closest to the business amidst expectations of significant earnings growth in the coming years.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| HANA Micron (KOSDAQ:A067310) | 19.9% | 93.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| Devsisters (KOSDAQ:A194480) | 26.7% | 67.5% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

We'll examine a selection from our screener results.

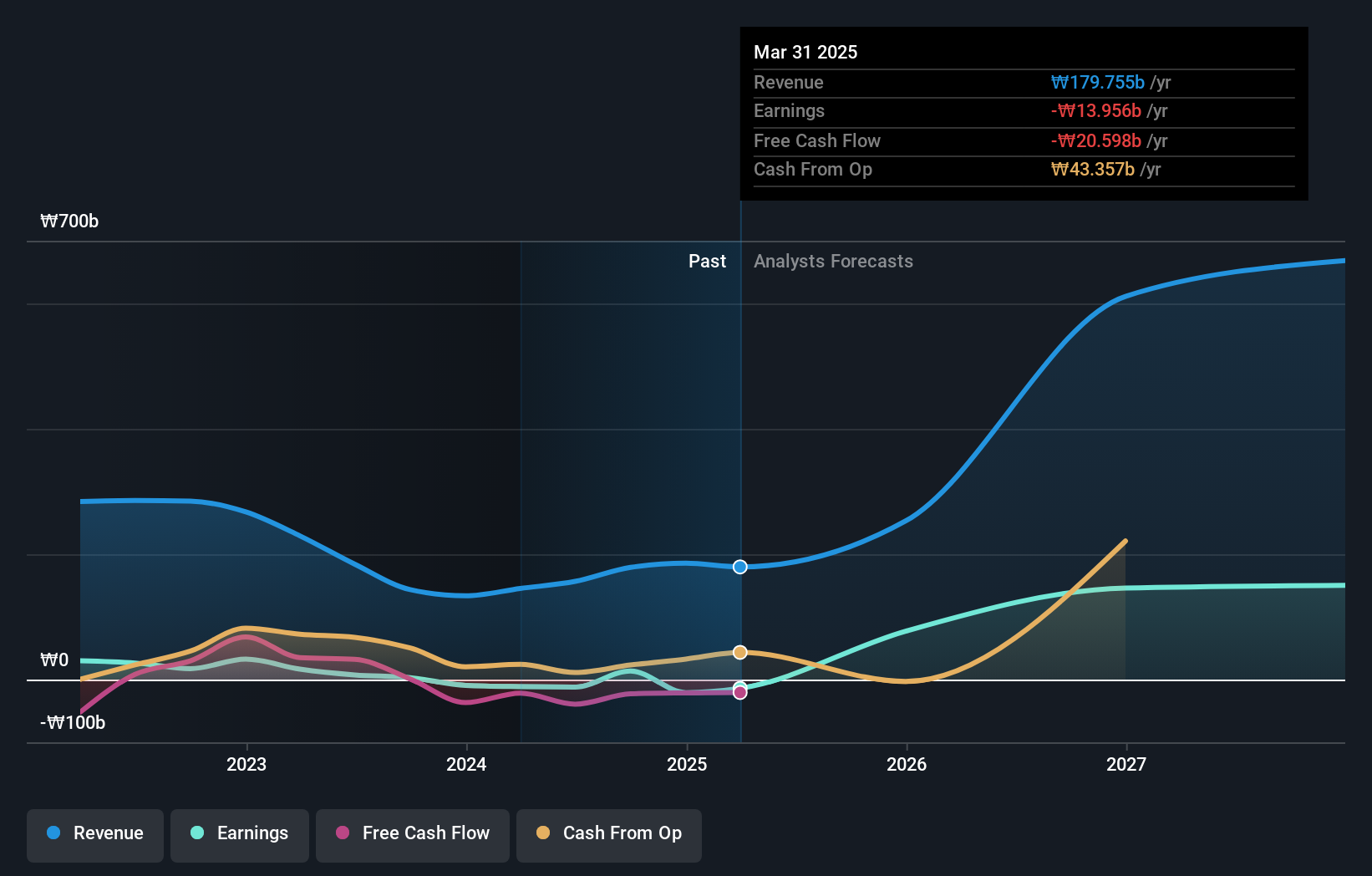

Techwing (KOSDAQ:A089030)

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. is a company that develops, manufactures, sells, and services semiconductor inspection equipment both in South Korea and internationally, with a market capitalization of approximately ₩1.83 trillion.

Operations: The firm operates primarily in the semiconductor inspection equipment sector, generating revenues from development, manufacturing, sales, and services across domestic and global markets.

Insider Ownership: 18.7%

Techwing, a South Korean company, is poised for significant growth with its revenue expected to increase by 41.3% annually, outpacing the local market's 10.5%. Although it currently struggles with covering interest payments from earnings, making its financial position less robust, the forecast for profitability within three years and a projected high Return on Equity of 33.1% highlight its potential. However, investors should note the absence of recent insider trading activity and be cautious of the stock's high volatility in recent months.

- Click here to discover the nuances of Techwing with our detailed analytical future growth report.

- Our valuation report here indicates Techwing may be overvalued.

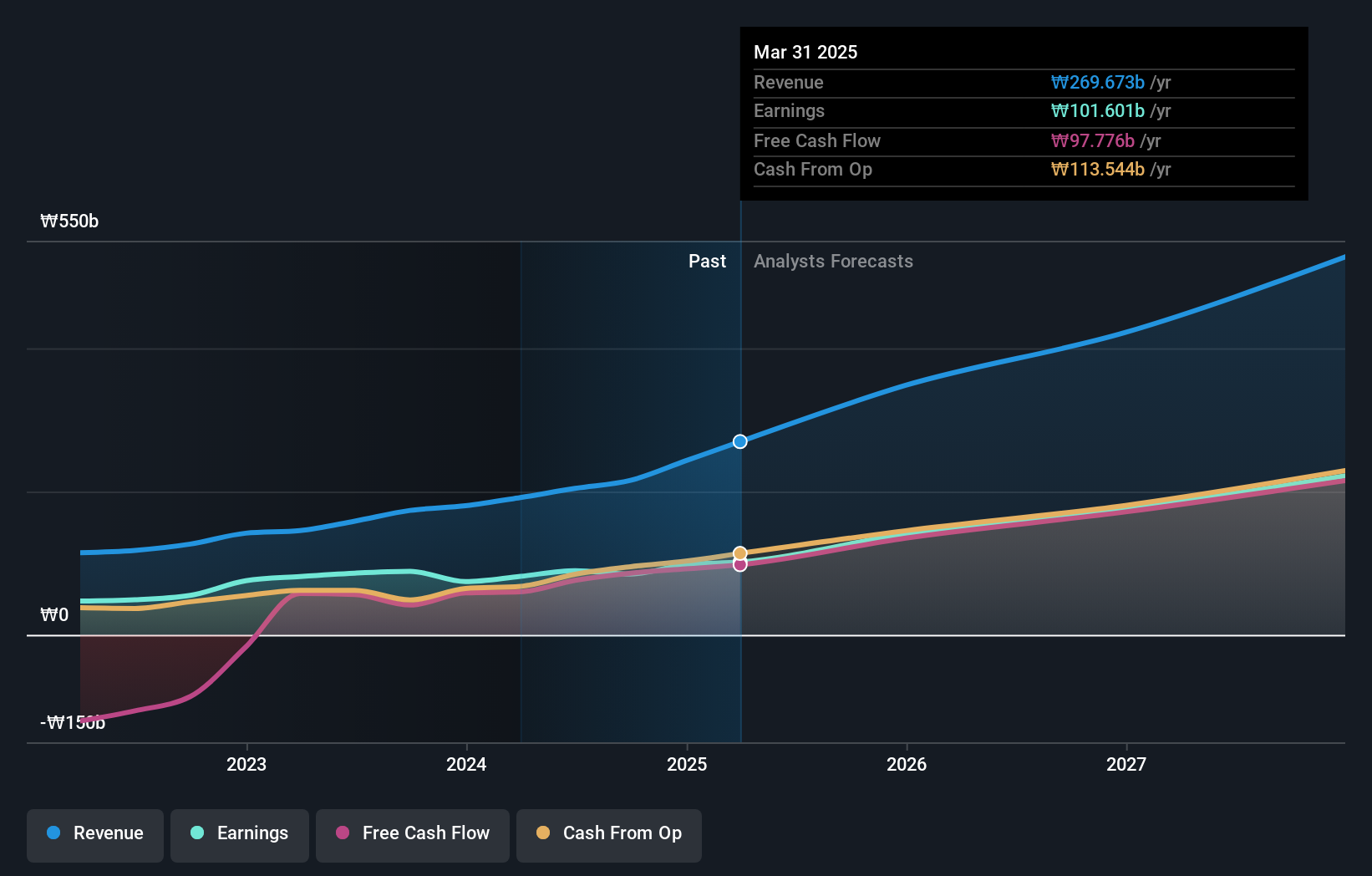

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biopharmaceutical company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩14.93 billion.

Operations: The company generates revenue through the development of enhanced biologics, targeted cancer therapies, and similar versions of existing antibody products.

Insider Ownership: 26.6%

ALTEOGEN, a South Korean biotech firm, has recently turned profitable and is set for rapid growth with revenue and earnings forecasted to outstrip the local market significantly at 48.3% and 73.1% annually, respectively. Despite its high volatility in share price over the past three months, it trades at a substantial discount to estimated fair value. The company's Return on Equity is expected to be very high within three years, although shareholder dilution occurred last year.

- Click here and access our complete growth analysis report to understand the dynamics of ALTEOGEN.

- According our valuation report, there's an indication that ALTEOGEN's share price might be on the expensive side.

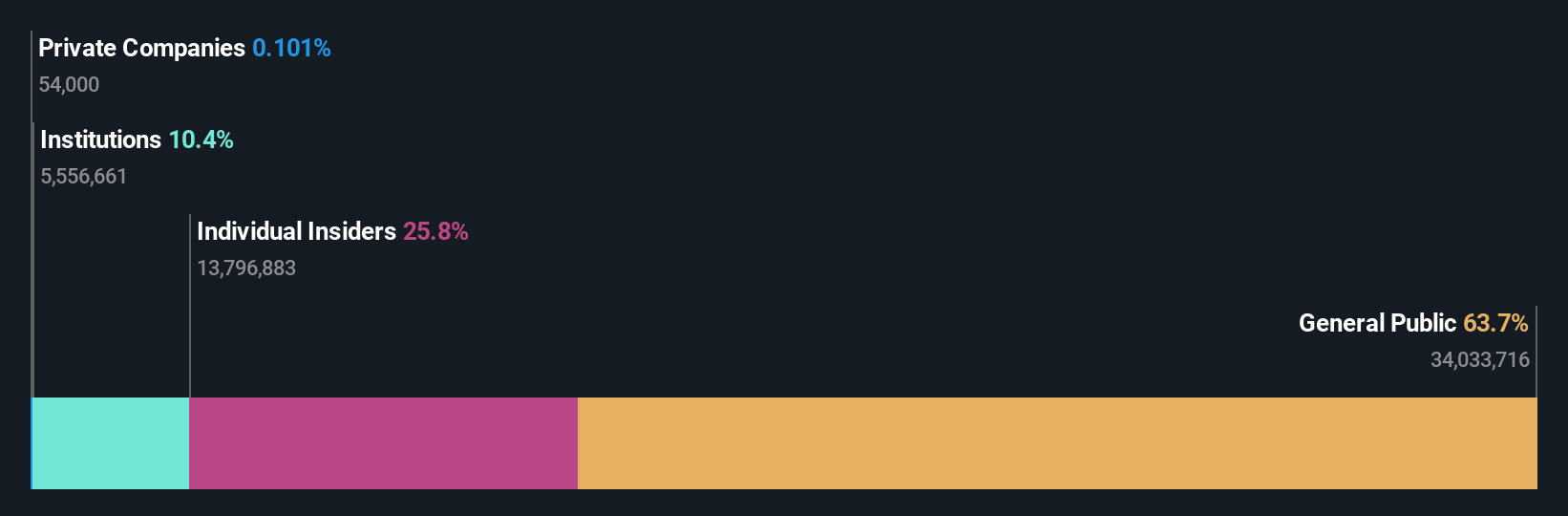

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CLASSYS Inc. specializes in providing medical aesthetics devices globally, with a market capitalization of approximately ₩3.49 billion.

Operations: The firm specializes in the global supply of medical aesthetics devices, achieving a market capitalization of around ₩3.49 billion.

Insider Ownership: 10.1%

CLASSYS, a South Korean company, has shown robust growth with earnings increasing by 25.9% annually over the past five years. It's expected to maintain a strong trajectory with revenue and earnings forecasted to grow at 21.5% and 22.2% per year respectively, outpacing the broader KR market in revenue but slightly trailing in earnings growth. Despite its highly volatile share price recently, CLASSYS has high insider ownership and no significant insider trading reported in the last three months, underscoring stable internal confidence amidst its aggressive presentation schedule across major investment conferences globally.

- Unlock comprehensive insights into our analysis of CLASSYS stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of CLASSYS shares in the market.

Summing It All Up

- Navigate through the entire inventory of 84 Fast Growing KRX Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214150

High growth potential with excellent balance sheet.