- China

- /

- Electrical

- /

- SZSE:301031

Insider-Owned Growth Companies To Watch In January 2025

Reviewed by Simply Wall St

As global markets continue to react to easing inflation and strong earnings reports, major U.S. stock indices have rebounded, with value stocks outperforming growth shares significantly. Amid these market dynamics, companies with high insider ownership often attract attention due to their potential alignment of interests between management and shareholders, making them intriguing candidates for those monitoring growth opportunities in the current economic landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 35.8% | 110.9% |

Let's uncover some gems from our specialized screener.

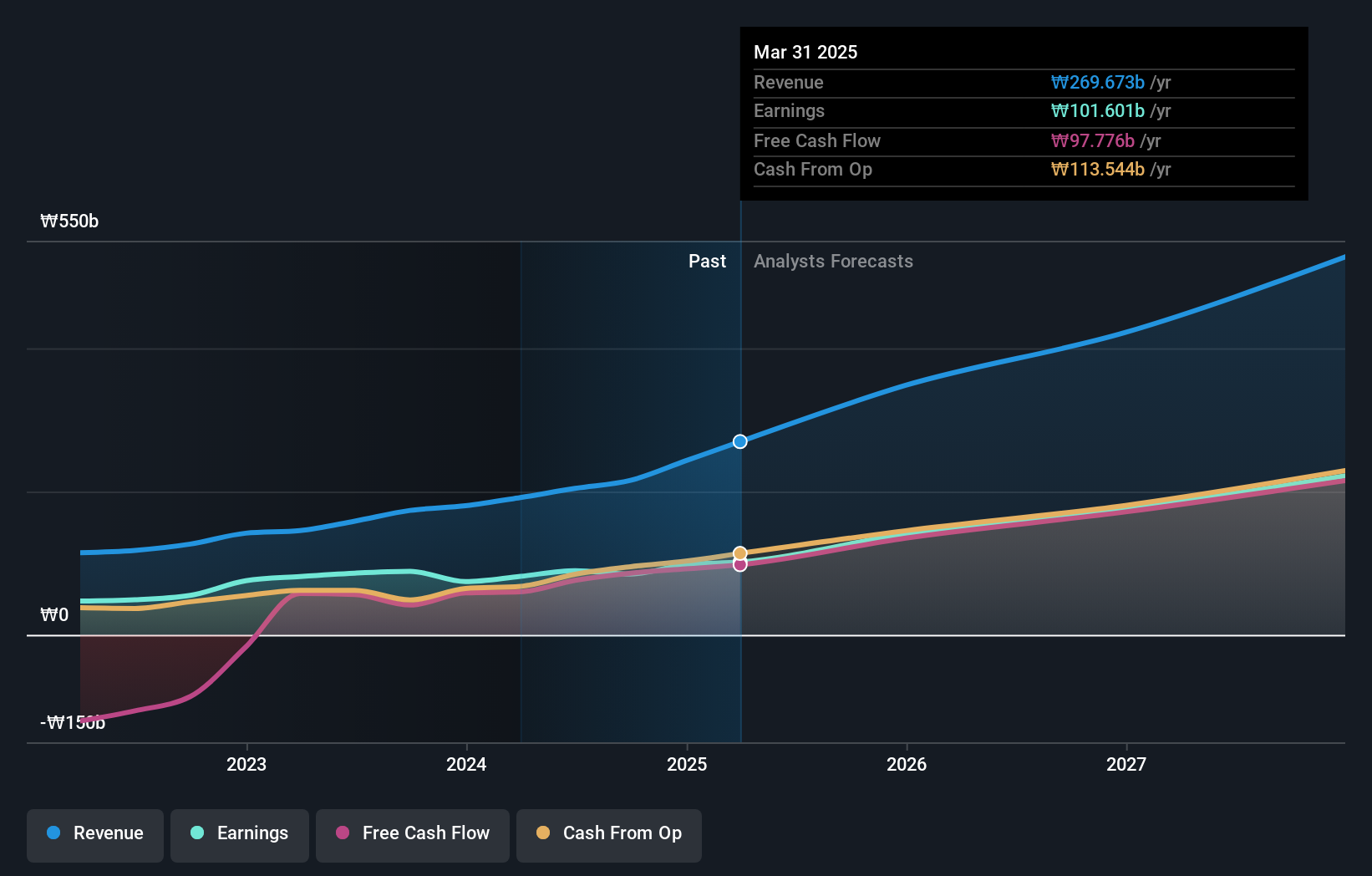

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★★

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.44 billion.

Operations: The company generates revenue of ₩215.54 million from its Surgical & Medical Equipment segment.

Insider Ownership: 13.7%

Return On Equity Forecast: 29% (2027 estimate)

CLASSYS Inc. is poised for robust growth with forecasted revenue and earnings increases of 26.5% and 29.6% per year, respectively, outpacing the Korean market averages. The company recently announced a KRW 25 billion share buyback to enhance shareholder value, potentially stabilizing its stock price. Its strategic partnership with Cartessa Aesthetics marks an entry into the US market, leveraging innovative technology in monopolar radiofrequency devices to address skin treatment needs effectively.

- Click here and access our complete growth analysis report to understand the dynamics of CLASSYS.

- According our valuation report, there's an indication that CLASSYS' share price might be on the cheaper side.

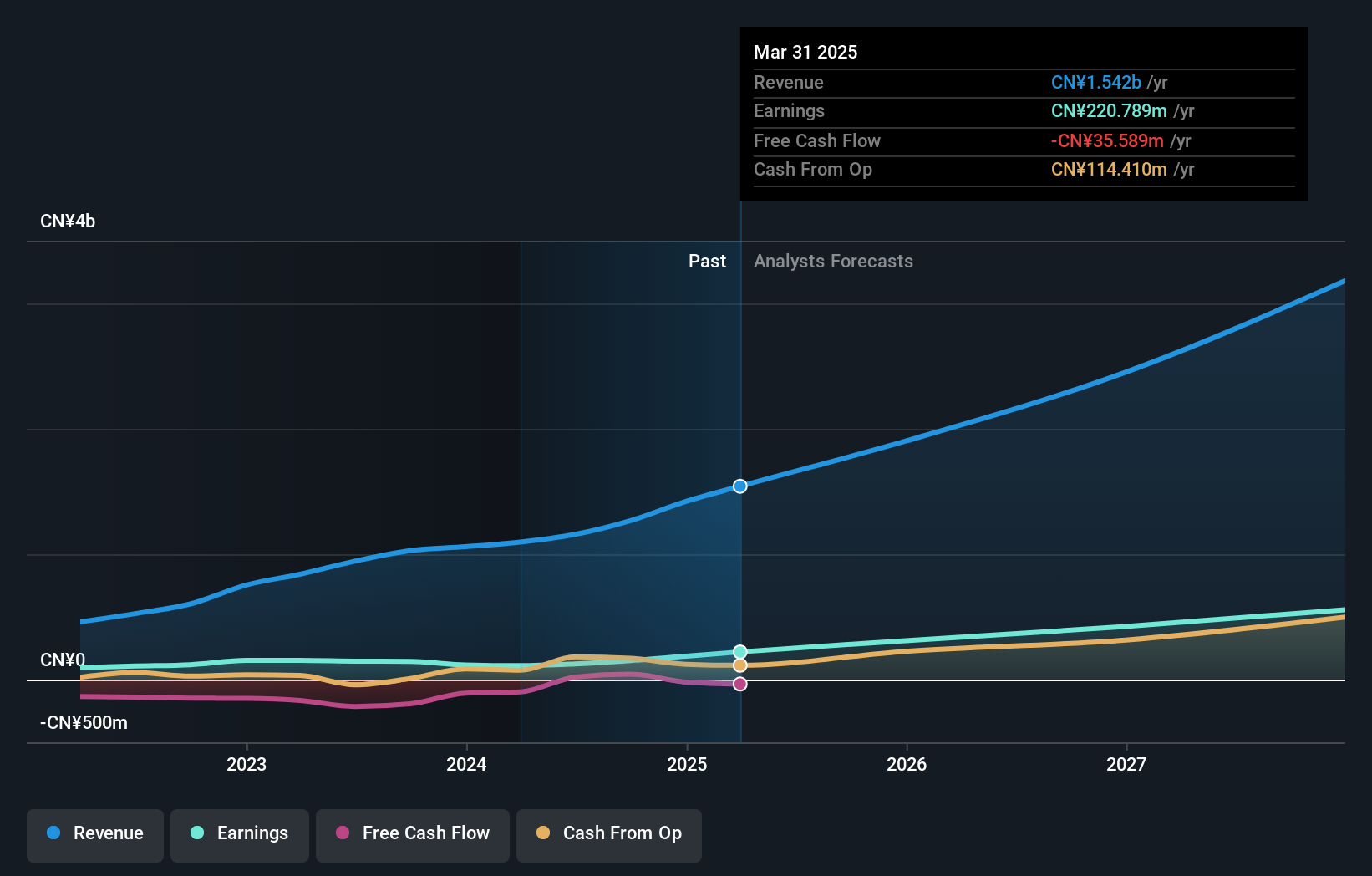

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. specializes in the research, development, production, and sale of circuit protection devices and fuses, with a market cap of CN¥7.22 billion.

Operations: The company generates revenue primarily through the production and sale of circuit protection devices, fuses, and related accessories.

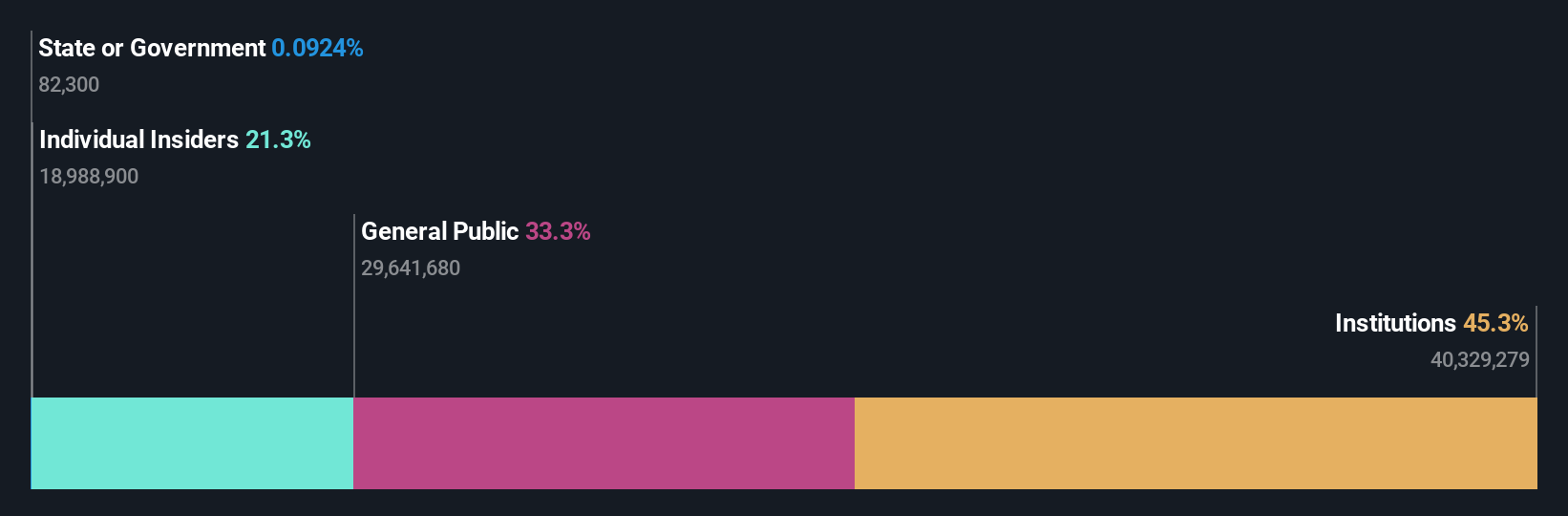

Insider Ownership: 37.2%

Return On Equity Forecast: 24% (2027 estimate)

Xi'an Sinofuse Electric is set for substantial growth, with revenue and earnings expected to increase by 29.4% and 45.5% annually, surpassing the Chinese market averages. Despite no recent insider trading activity, the company shows strong financial performance with net income rising to CNY 119.98 million for nine months ending September 2024 from CNY 85.46 million a year prior. The completed share buyback of CNY 20.14 million could enhance shareholder value further.

- Take a closer look at Xi'an Sinofuse Electric's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Xi'an Sinofuse Electric shares in the market.

Japan Elevator Service HoldingsLtd (TSE:6544)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Elevator Service Holdings Co., Ltd. specializes in providing repair, maintenance, and modernization services for elevators and escalators in Japan, with a market cap of ¥255.77 billion.

Operations: The company's revenue primarily comes from its Maintenance Business, which generated ¥45.59 billion.

Insider Ownership: 22.1%

Return On Equity Forecast: 33% (2027 estimate)

Japan Elevator Service Holdings Ltd. is poised for growth, with earnings projected to increase by 19.1% annually, outpacing the Japanese market average of 8.1%. Recent expansions, such as a new regional head office and additional service locations, aim to bolster customer service capabilities. The company has also undergone executive changes to potentially enhance leadership effectiveness. Analysts agree on a potential stock price increase of 25.3%, reflecting positive sentiment despite no recent insider trading activity.

- Click to explore a detailed breakdown of our findings in Japan Elevator Service HoldingsLtd's earnings growth report.

- The analysis detailed in our Japan Elevator Service HoldingsLtd valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Explore the 1471 names from our Fast Growing Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301031

Xi'an Sinofuse Electric

Engages in the research, development, production, and sale of circuit protection devices, fuses, and related accessories.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives