- China

- /

- Electronic Equipment and Components

- /

- SHSE:688522

Global's Top 3 Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape of easing trade tensions and mixed economic signals, U.S. stocks have shown resilience with the S&P 500 and Nasdaq Composite indices posting gains amid better-than-expected earnings reports. In this context, growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management's interests and shareholder value, as these firms often demonstrate strong leadership commitment during uncertain times.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 66.1% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

We'll examine a selection from our screener results.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★★

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩4.36 trillion.

Operations: The company generates revenue from its Surgical & Medical Equipment segment, totaling ₩242.94 billion.

Insider Ownership: 13.7%

CLASSYS Inc. exhibits substantial growth potential with forecasted revenue and earnings growth rates of 22.2% and 24.04% per year, respectively, outpacing the Korean market. Despite recent volatility in its share price, the company's earnings grew by 31.9% over the past year. Notably absent is insider trading activity over the last three months, which can be a critical indicator for investors assessing insider confidence in future performance. Recent presentations at key corporate events highlight CLASSYS's active engagement with investors and analysts, though no shares were repurchased under their buyback program as of March 2025.

- Navigate through the intricacies of CLASSYS with our comprehensive analyst estimates report here.

- The analysis detailed in our CLASSYS valuation report hints at an inflated share price compared to its estimated value.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★★

Overview: Naruida Technology Co., Ltd. specializes in the manufacturing and sale of polarized multifunctional active phased array radars in China, with a market cap of CN¥15.34 billion.

Operations: The company's revenue primarily comes from its Scientific & Technical Instruments segment, generating CN¥371.98 million.

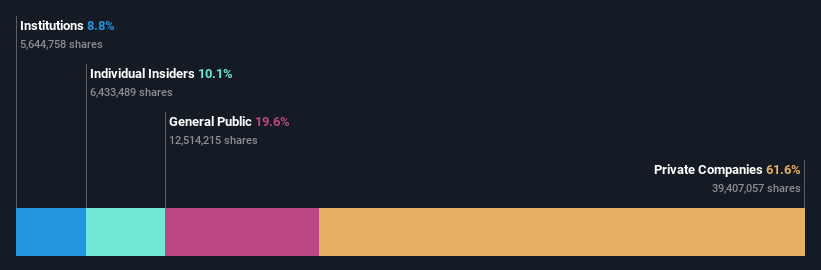

Insider Ownership: 17.8%

Naruida Technology demonstrates significant growth potential, with earnings forecasted to grow 56.7% annually, surpassing the Chinese market average of 23.9%. Recent results show a strong performance, with Q1 sales reaching CNY 58.19 million, up from CNY 31.49 million a year ago, and net income at CNY 21.67 million compared to CNY 4.23 million previously. Despite no recent insider trading activity, the company's high return on equity forecast (20.1%) suggests robust future profitability prospects.

- Click here to discover the nuances of Naruida Technology with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Naruida Technology is priced higher than what may be justified by its financials.

Hwa Create (SZSE:300045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hwa Create Corporation researches, develops, manufactures, and sells satellite navigation as well as radar and communication products and technologies, with a market cap of CN¥12.01 billion.

Operations: Hwa Create generates revenue from its satellite navigation and radar and communication product lines.

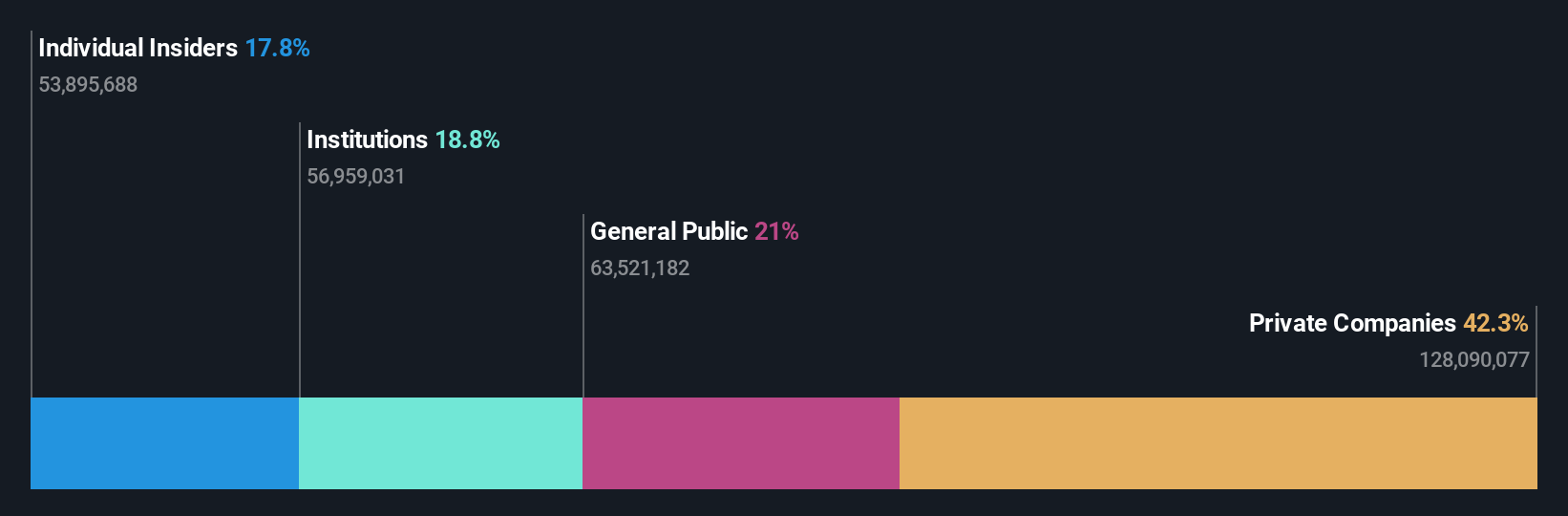

Insider Ownership: 34.4%

Hwa Create's revenue is expected to grow at 27.6% annually, outpacing the Chinese market average of 12.6%, with earnings projected to rise by a very large amount each year. Despite recent losses, including a net loss of CNY 17.37 million in Q1 2025 and CNY 142.96 million for FY 2024, the company aims for profitability within three years. A private placement worth CNY 450 million is underway, potentially enhancing financial stability and growth prospects once approved.

- Click here and access our complete growth analysis report to understand the dynamics of Hwa Create.

- Insights from our recent valuation report point to the potential overvaluation of Hwa Create shares in the market.

Turning Ideas Into Actions

- Discover the full array of 838 Fast Growing Global Companies With High Insider Ownership right here.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Naruida Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688522

Naruida Technology

Manufactures and sells polarized multifunctional active phased array radars in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives