- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In the wake of recent global market fluctuations, investors are navigating a landscape marked by policy uncertainties and shifting economic indicators. Amidst these conditions, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies. Understanding what constitutes a good stock in such an environment involves assessing factors like strong fundamentals, potential for growth despite current volatility, and resilience against broader economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$48.90 | HK$97.69 | 49.9% |

| Wistron (TWSE:3231) | NT$114.00 | NT$227.50 | 49.9% |

| SISB (SET:SISB) | THB31.75 | THB63.41 | 49.9% |

| Shoei (TSE:7839) | ¥2368.00 | ¥4720.11 | 49.8% |

| A.L.A. società per azioni (BIT:ALA) | €24.80 | €49.51 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1474.00 | ¥2940.30 | 49.9% |

| Enento Group Oyj (HLSE:ENENTO) | €18.06 | €36.11 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.87 | 50% |

| Saipem (BIT:SPM) | €2.327 | €4.65 | 50% |

| Credit Clear (ASX:CCR) | A$0.355 | A$0.71 | 50% |

Let's explore several standout options from the results in the screener.

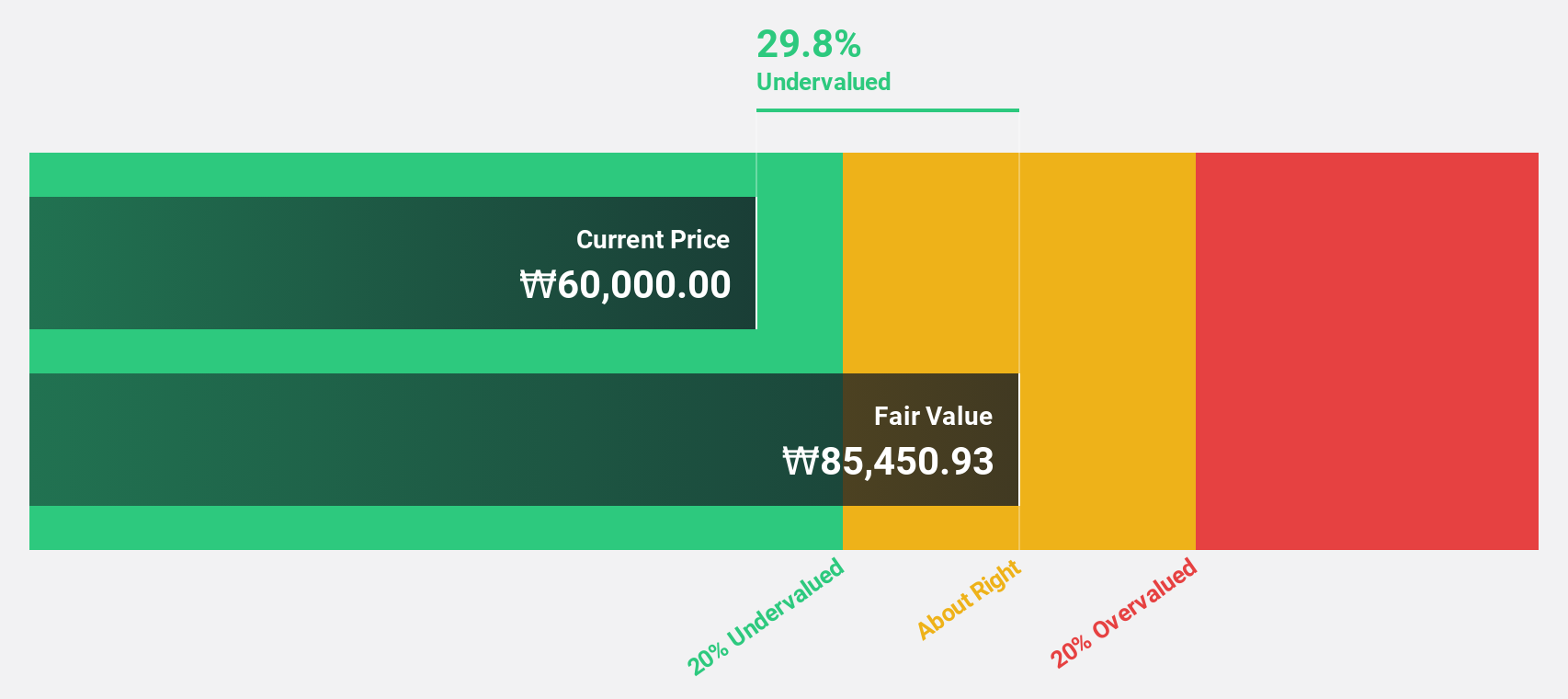

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.17 trillion.

Operations: The company generates revenue of ₩204.37 billion from its Surgical & Medical Equipment segment.

Estimated Discount To Fair Value: 23%

Classys Inc. is trading at 23% below its fair value estimate of ₩62,795.96, presenting a potential opportunity for investors focused on undervalued stocks based on cash flows. The company's earnings and revenue are forecast to grow significantly, with annual growth rates of 24.21% and 24.5%, respectively, outpacing the Korean market's average revenue growth. Despite past shareholder dilution, Classys's recent entry into the US market through Cartessa Aesthetics could bolster future cash flow prospects.

- The analysis detailed in our CLASSYS growth report hints at robust future financial performance.

- Get an in-depth perspective on CLASSYS' balance sheet by reading our health report here.

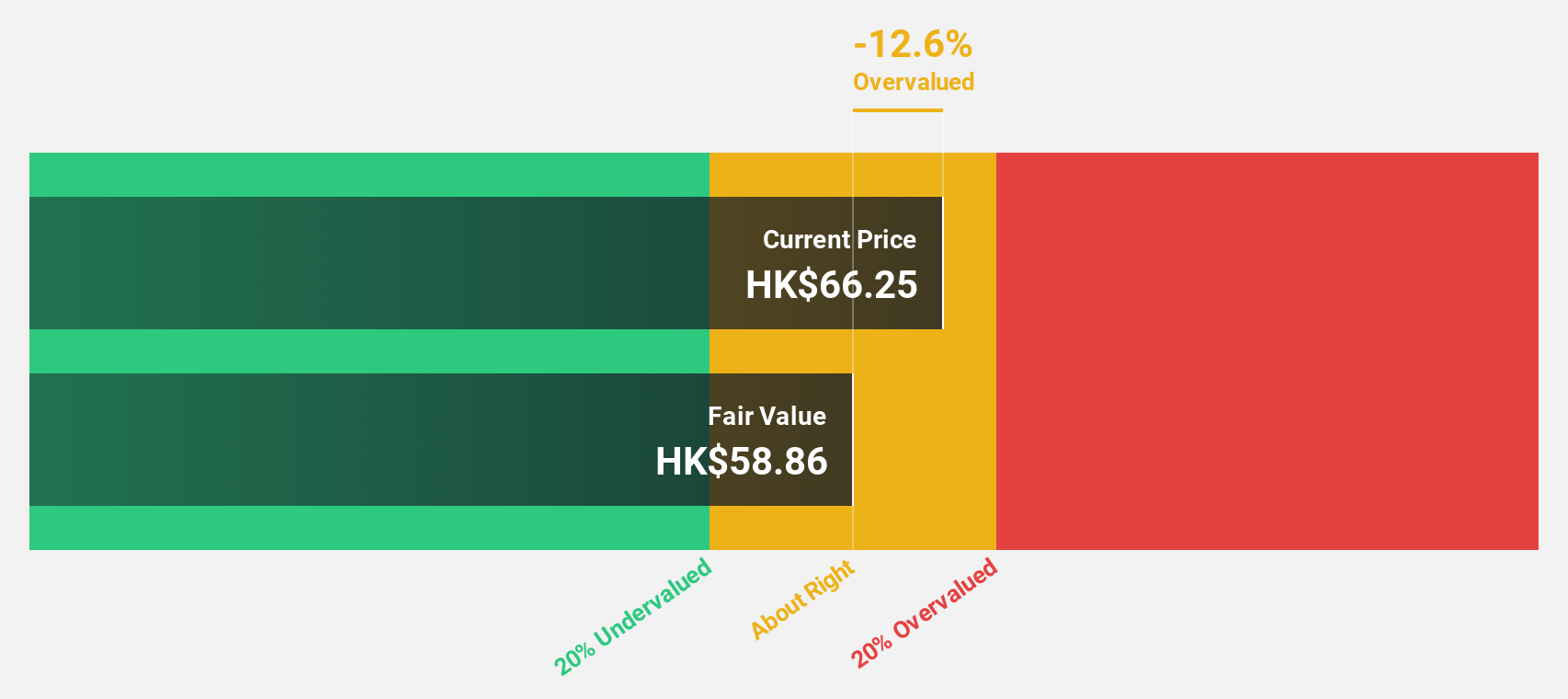

Kuaishou Technology (SEHK:1024)

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$226.50 billion.

Operations: The company generates revenue from its domestic operations amounting to CN¥117.32 billion and overseas activities contributing CN¥3.57 billion.

Estimated Discount To Fair Value: 34.7%

Kuaishou Technology is currently trading at a significant discount, about 34.7% below its estimated fair value of HK$80.44, with its share price at HK$52.55. The company's earnings are projected to grow by 18.7% annually, outpacing the Hong Kong market's average of 11.6%. Recent earnings reports show substantial net income growth from CNY 2,788 million to CNY 11,366 million over nine months, reinforcing its potential as an undervalued stock based on cash flows.

- Our expertly prepared growth report on Kuaishou Technology implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Kuaishou Technology with our comprehensive financial health report here.

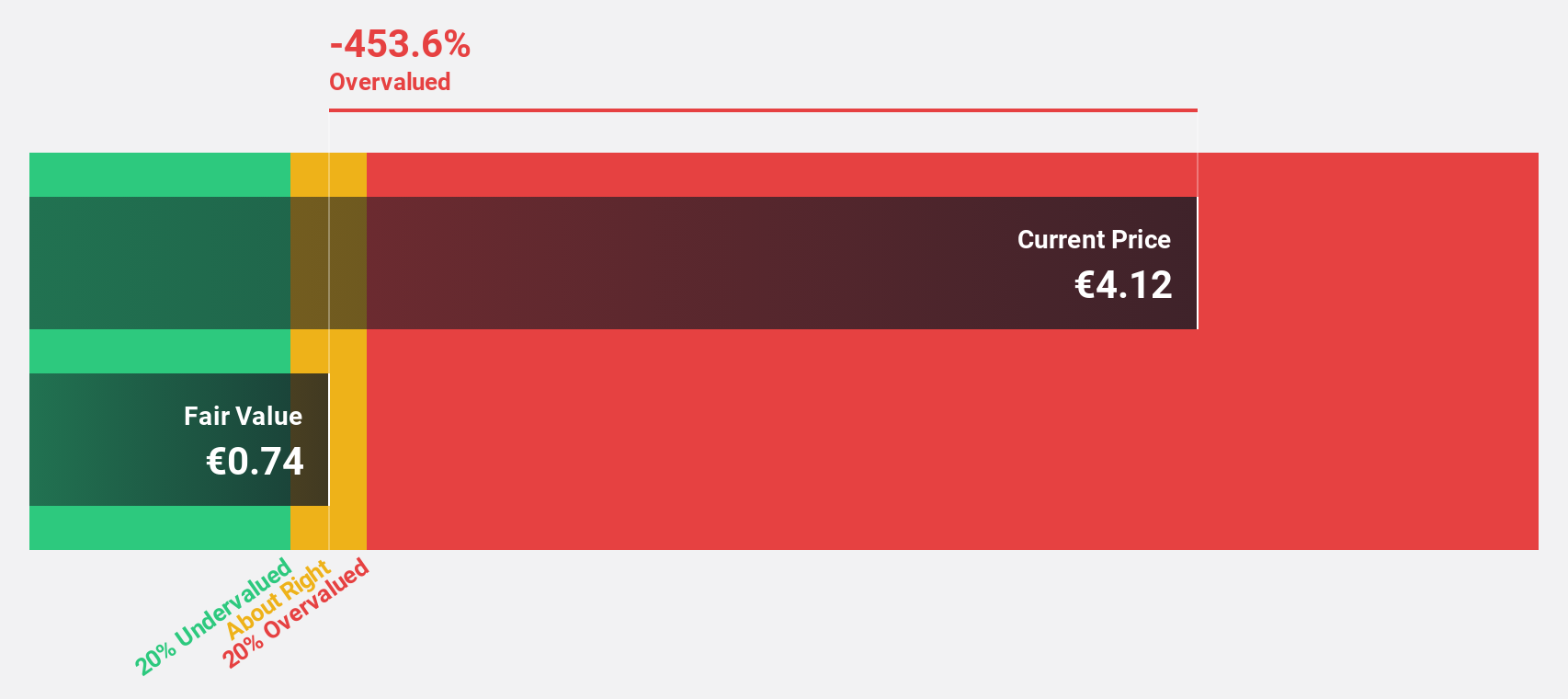

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific; it has a market cap of approximately €4.16 billion.

Operations: The company's revenue segments include Automotive Technologies at €9.73 billion, Vehicle Lifetime Solutions at €2.50 billion, and Bearings & Industrial Solutions at €3.99 billion.

Estimated Discount To Fair Value: 31.9%

Schaeffler is trading at a notable discount, approximately 31.9% below its estimated fair value of €6.46, with a current price of €4.4. Its earnings are forecast to grow significantly at 71.5% annually, surpassing the German market average of 21%. However, profit margins have decreased from last year and interest payments are not well covered by earnings, presenting potential risks despite its undervaluation based on discounted cash flow analysis.

- Upon reviewing our latest growth report, Schaeffler's projected financial performance appears quite optimistic.

- Dive into the specifics of Schaeffler here with our thorough financial health report.

Seize The Opportunity

- Delve into our full catalog of 921 Undervalued Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives