- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

3 KRX Growth Companies With High Insider Ownership Seeing Up To 64% Revenue Growth

Reviewed by Simply Wall St

The South Korean stock market has been experiencing a modest uptick, with the KOSPI index nearing the 2,600-point mark amid mixed performances from various sectors and cautious global sentiment regarding interest rates. As investors navigate these fluctuating conditions, companies with high insider ownership and significant revenue growth potential stand out as attractive prospects for those seeking resilience and alignment of interests in their investment choices.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| Park Systems (KOSDAQ:A140860) | 33% | 34.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Let's explore several standout options from the results in the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩19.60 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, totaling ₩90.79 billion.

Insider Ownership: 26.6%

Revenue Growth Forecast: 64.2% p.a.

ALTEOGEN, a South Korean company, is experiencing significant growth potential with its revenue forecasted to grow 64.2% annually, outpacing the market's 10.5%. Despite past shareholder dilution, the company is expected to become profitable within three years and achieve a very high return on equity of 66.3%. Currently trading at 71.8% below estimated fair value, ALTEOGEN presents an intriguing opportunity for investors interested in high-growth companies with substantial insider ownership.

- Dive into the specifics of ALTEOGEN here with our thorough growth forecast report.

- Our valuation report here indicates ALTEOGEN may be overvalued.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.72 trillion.

Operations: The company generates revenue from its Surgical & Medical Equipment segment, amounting to ₩204.37 billion.

Insider Ownership: 10.1%

Revenue Growth Forecast: 19.4% p.a.

CLASSYS, a South Korean company, is poised for growth with earnings expected to rise 22.5% annually over the next three years, although slightly below the market's 30.4%. Revenue is projected to grow at 19.4%, outperforming the market's 10.5%. Despite trading at 10.5% below estimated fair value, no significant insider trading activity has been reported recently. CLASSYS actively engages in international investor forums, reflecting its commitment to transparency and global expansion strategies.

- Get an in-depth perspective on CLASSYS' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that CLASSYS is trading beyond its estimated value.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea with a market cap of ₩2.20 trillion.

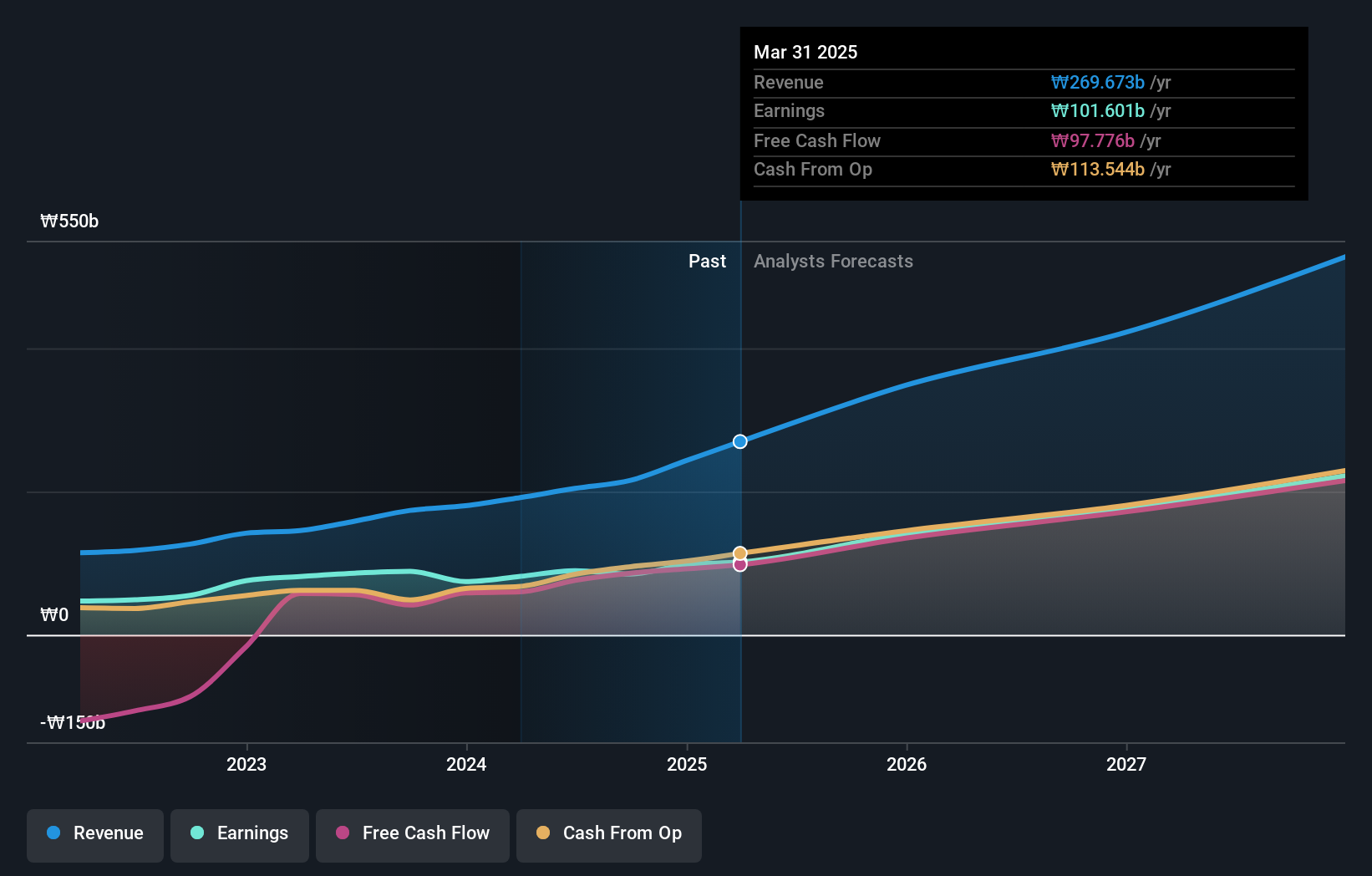

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, which generated ₩296.59 billion.

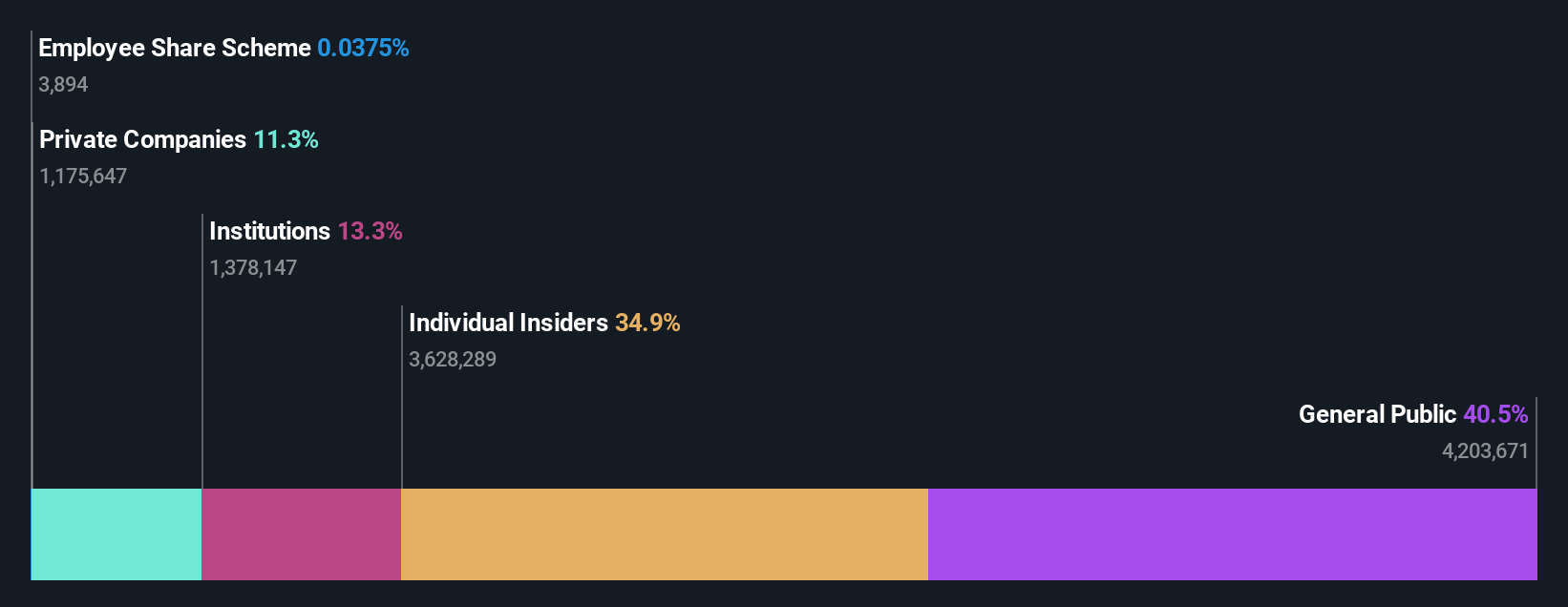

Insider Ownership: 38.9%

Revenue Growth Forecast: 22.3% p.a.

PharmaResearch, a South Korean firm, is experiencing robust growth with earnings up 63.2% last year and forecasted to grow significantly over the next three years. Revenue is expected to rise 22.3% annually, outpacing the market's 10.5%. The company trades at a substantial discount to its estimated fair value and shows strong relative value compared to peers. Recent board-approved private placements are set for completion by December 2024, enhancing capital structure without recent insider trading activity.

- Click to explore a detailed breakdown of our findings in PharmaResearch's earnings growth report.

- Our comprehensive valuation report raises the possibility that PharmaResearch is priced lower than what may be justified by its financials.

Taking Advantage

- Unlock our comprehensive list of 85 Fast Growing KRX Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Flawless balance sheet with high growth potential.