3 Global Stocks Estimated To Be Trading Below Intrinsic Value By Up To 24.8%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, investors are keenly observing opportunities for growth amid uncertainty. With U.S. stocks enjoying gains driven by better-than-expected earnings and Europe seeing an uptick in economic activity, the search for undervalued stocks becomes particularly relevant. In this environment, identifying companies that are trading below their intrinsic value can offer potential benefits, as these stocks may be poised to capitalize on improving market conditions while providing a cushion against volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aidma Holdings (TSE:7373) | ¥1893.00 | ¥3725.60 | 49.2% |

| Lingbao Gold Group (SEHK:3330) | HK$9.11 | HK$18.16 | 49.8% |

| Net Insight (OM:NETI B) | SEK2.81 | SEK5.57 | 49.6% |

| World Fitness Services (TWSE:2762) | NT$82.70 | NT$163.48 | 49.4% |

| dormakaba Holding (SWX:DOKA) | CHF708.00 | CHF1398.90 | 49.4% |

| Etteplan Oyj (HLSE:ETTE) | €10.60 | €20.91 | 49.3% |

| Bloks Group (SEHK:325) | HK$127.80 | HK$255.58 | 50% |

| Obiz (ENXTPA:ALBIZ) | €4.35 | €8.69 | 50% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.87 | HK$1.73 | 49.7% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥56.38 | CN¥111.68 | 49.5% |

Let's uncover some gems from our specialized screener.

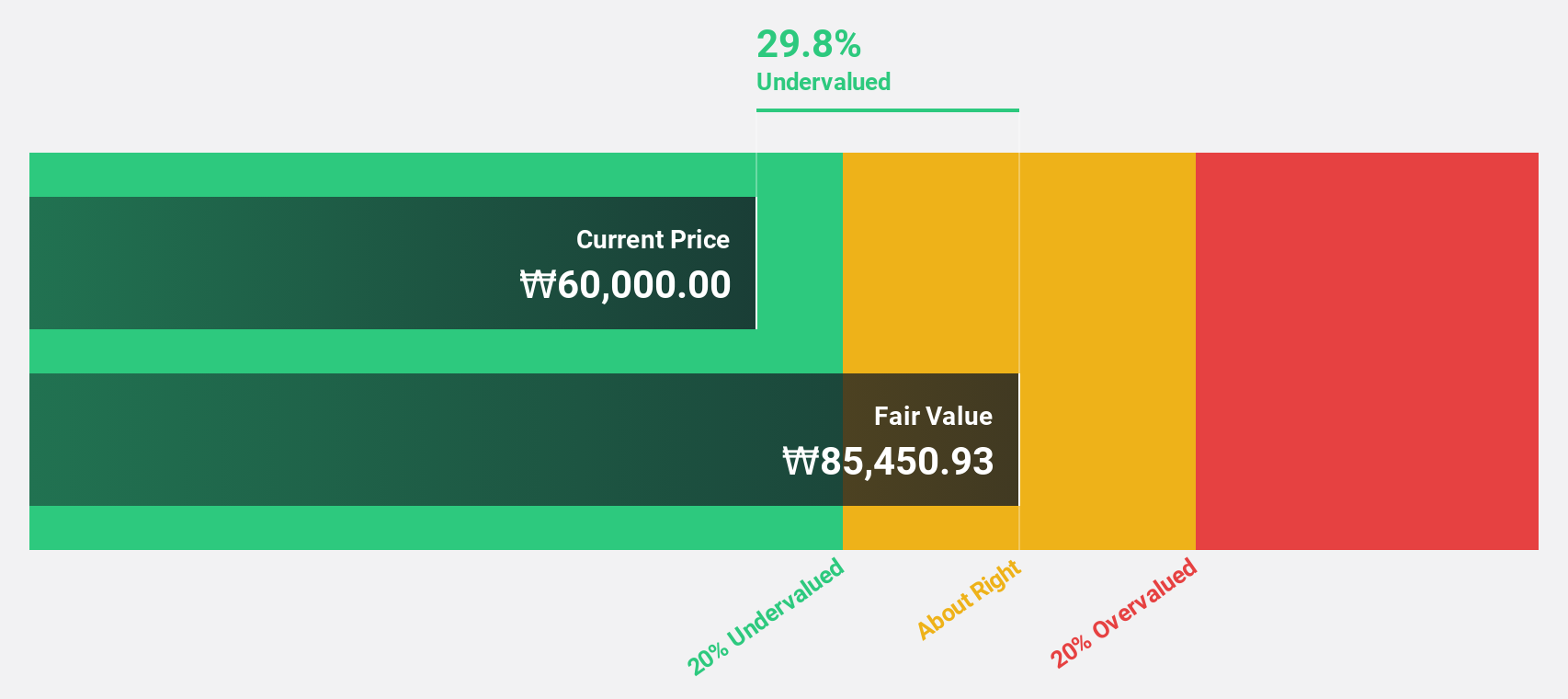

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩4.63 trillion.

Operations: The company generates revenue from its Surgical & Medical Equipment segment, amounting to ₩242.94 billion.

Estimated Discount To Fair Value: 22.2%

CLASSYS Inc. is trading at approximately 22.2% below its estimated fair value of ₩90,789.24, suggesting it may be undervalued based on cash flows. Despite recent high volatility in its share price, the company's revenue and earnings are forecasted to grow significantly faster than the market, with expected annual growth rates of 22.2% and 24%, respectively. Recent financial results show a substantial increase in both sales and net income compared to the previous year.

- The analysis detailed in our CLASSYS growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of CLASSYS stock in this financial health report.

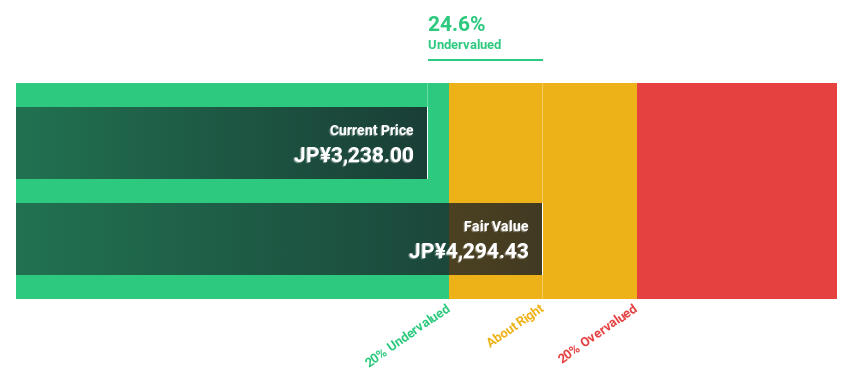

Ajinomoto (TSE:2802)

Overview: Ajinomoto Co., Inc. operates in the seasonings and foods, frozen foods, and healthcare sectors both in Japan and internationally, with a market cap of ¥2.99 trillion.

Operations: Ajinomoto's revenue is derived from its operations in seasonings and foods, frozen foods, and healthcare sectors across Japan and international markets.

Estimated Discount To Fair Value: 24.8%

Ajinomoto is trading 24.8% below its fair value estimate of ¥4294.42, highlighting potential undervaluation based on cash flows. While revenue growth is forecast at 4.6% annually, earnings are expected to grow significantly by 20.6%, outpacing the broader Japanese market's average growth rate of 7.4%. The recent announcement of a share repurchase program worth ¥100 billion aims to enhance shareholder returns and improve capital efficiency by cancelling repurchased shares.

- In light of our recent growth report, it seems possible that Ajinomoto's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Ajinomoto.

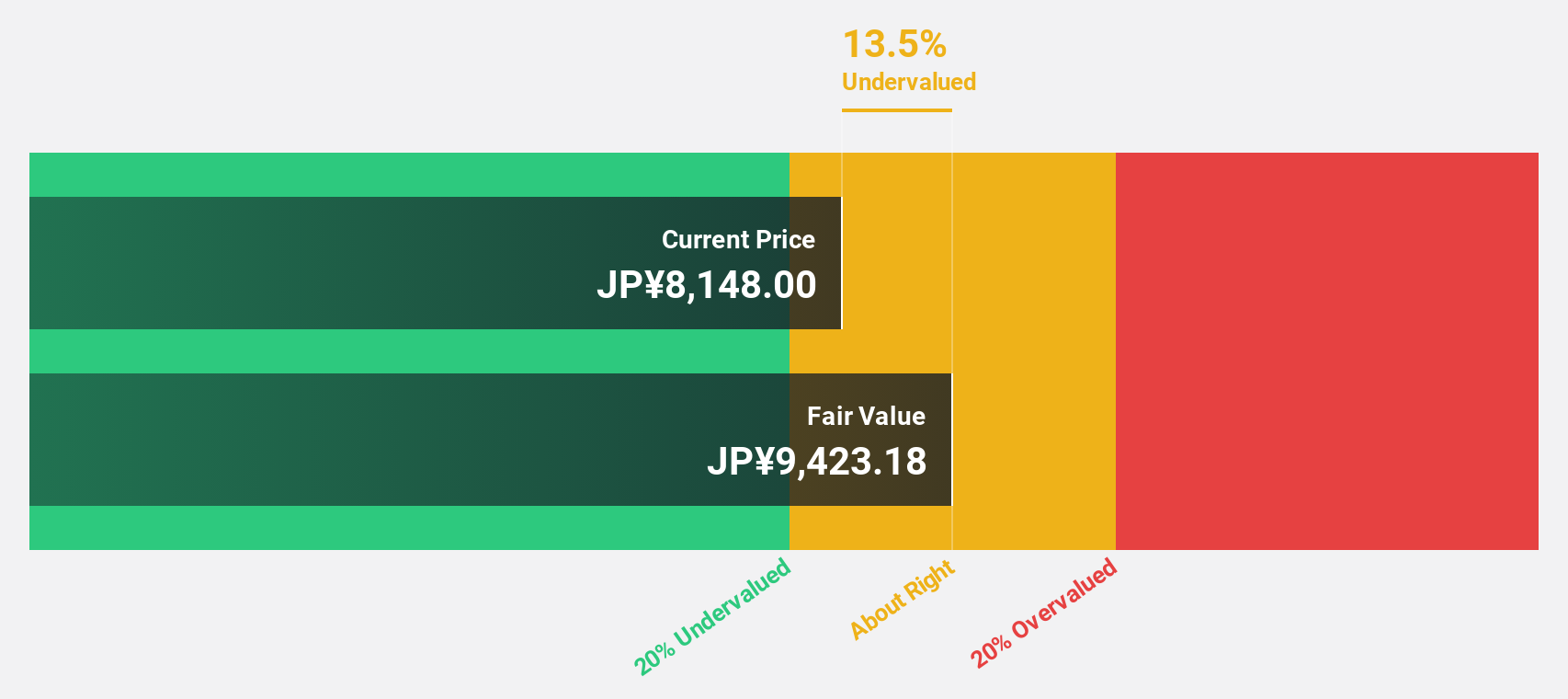

Zensho Holdings (TSE:7550)

Overview: Zensho Holdings Co., Ltd. operates food service chain restaurants both in Japan and internationally, with a market cap of ¥1.38 billion.

Operations: The company's revenue segments include Restaurants at ¥0.15 billion, Global Sukiya at ¥0.29 billion, Global Fast Food at ¥0.31 billion, Global Hamasushi at ¥0.23 billion, Retail at ¥0.08 billion, and Corporate and Support operations contributing ¥0.40 billion.

Estimated Discount To Fair Value: 23%

Zensho Holdings is trading 23% below its fair value estimate of ¥11,577.42, indicating potential undervaluation based on cash flows. Despite a high debt level, the company has shown strong earnings growth of 88.2% over the past year and is forecast to grow earnings by 18.1% annually, surpassing the Japanese market's average growth rate of 7.4%. Revenue is expected to increase at 6.9% per year, higher than the market's pace of 4.2%.

- According our earnings growth report, there's an indication that Zensho Holdings might be ready to expand.

- Navigate through the intricacies of Zensho Holdings with our comprehensive financial health report here.

Key Takeaways

- Click here to access our complete index of 453 Undervalued Global Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ajinomoto, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2802

Ajinomoto

Engages in the seasonings and foods, frozen foods, and healthcare and other businesses in Japan and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives