- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A206640

Risks Still Elevated At These Prices As Boditech Med Inc. (KOSDAQ:206640) Shares Dive 26%

Boditech Med Inc. (KOSDAQ:206640) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

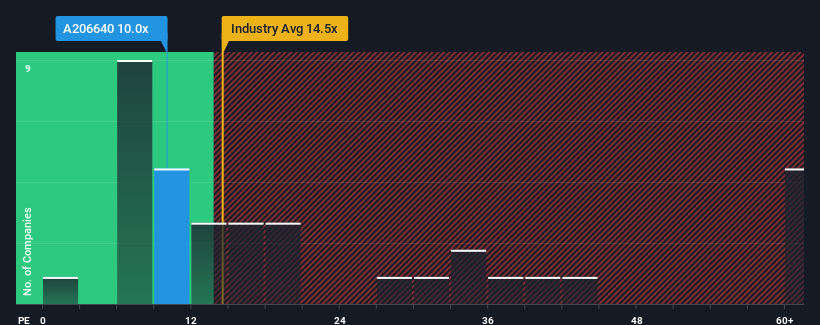

Although its price has dipped substantially, there still wouldn't be many who think Boditech Med's price-to-earnings (or "P/E") ratio of 10x is worth a mention when the median P/E in Korea is similar at about 11x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Boditech Med as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Boditech Med

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Boditech Med's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 36% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 43% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to expand by 16% per annum, which is noticeably more attractive.

With this information, we find it interesting that Boditech Med is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Boditech Med's P/E?

Boditech Med's plummeting stock price has brought its P/E right back to the rest of the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Boditech Med's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Boditech Med.

Of course, you might also be able to find a better stock than Boditech Med. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Boditech Med might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A206640

Boditech Med

Offers instruments and diagnostic reagents in South Korea and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives