- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A206640

Did Business Growth Power Boditech Med's (KOSDAQ:206640) Share Price Gain of 193%?

Boditech Med Inc. (KOSDAQ:206640) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But that doesn't change the fact that the returns over the last year have been very strong. During that period, the share price soared a full 193%. So it is important to view the recent reduction in price through that lense. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Boditech Med

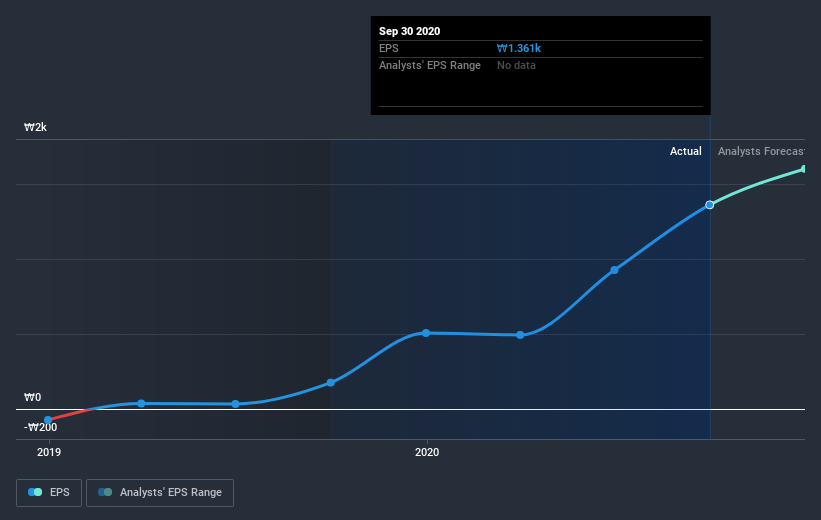

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Boditech Med boasted truly magnificent EPS growth in the last year. While that particular rate of growth is unlikely to be sustained for long, it is still remarkable. We are not surprised the share price is up. We're real advocates of letting inflection points like this guide our research as stock pickers.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Boditech Med has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Boditech Med's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Boditech Med shareholders have received a total shareholder return of 195% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.1% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Boditech Med you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Boditech Med, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Boditech Med might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A206640

Boditech Med

Offers instruments and diagnostic reagents in South Korea and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives