- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A058110

We Wouldn't Rely On MEKICS' (KOSDAQ:058110) Statutory Earnings As A Guide

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding MEKICS (KOSDAQ:058110).

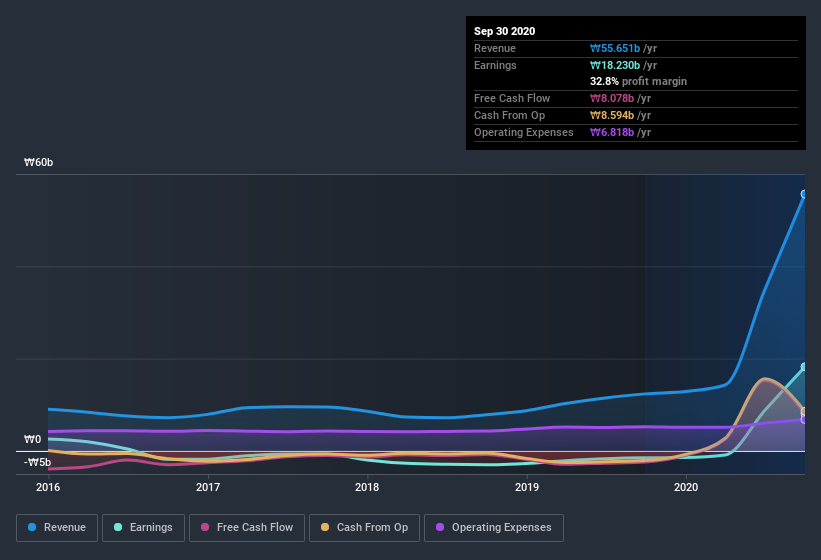

It's good to see that over the last twelve months MEKICS made a profit of ₩18.2b on revenue of ₩55.7b. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

View our latest analysis for MEKICS

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. As a result, we'll today take a look at how dilution and cashflow shape our understanding of MEKICS' earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At MEKICS' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

MEKICS has an accrual ratio of 0.38 for the year to September 2020. Ergo, its free cash flow is significantly weaker than its profit. As a general rule, that bodes poorly for future profitability. To wit, it produced free cash flow of ₩8.1b during the period, falling well short of its reported profit of ₩18.2b. Notably, MEKICS had negative free cash flow last year, so the ₩8.1b it produced this year was a welcome improvement. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, MEKICS issued 30% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out MEKICS' historical EPS growth by clicking on this link.

A Look At The Impact Of MEKICS' Dilution on Its Earnings Per Share (EPS).

Three years ago, MEKICS lost money. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

If MEKICS' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On MEKICS' Profit Performance

In conclusion, MEKICS has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). For the reasons mentioned above, we think that a perfunctory glance at MEKICS' statutory profits might make it look better than it really is on an underlying level. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. To that end, you should learn about the 2 warning signs we've spotted with MEKICS (including 1 which is a bit concerning).

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade MEKICS, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A058110

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.