- South Korea

- /

- Healthcare Services

- /

- KOSDAQ:A032940

Market Might Still Lack Some Conviction On Wonik Corporation (KOSDAQ:032940) Even After 35% Share Price Boost

Wonik Corporation (KOSDAQ:032940) shareholders have had their patience rewarded with a 35% share price jump in the last month. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

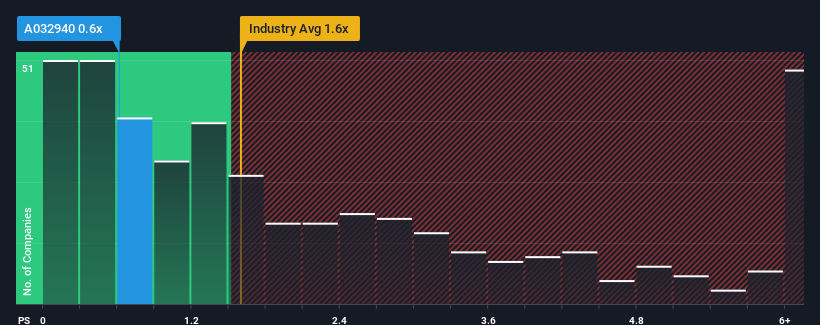

Even after such a large jump in price, Wonik may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Healthcare industry in Korea have P/S ratios greater than 1.5x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Wonik

What Does Wonik's Recent Performance Look Like?

Revenue has risen firmly for Wonik recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Wonik will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Wonik, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Wonik's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.5% last year. Pleasingly, revenue has also lifted 54% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 16% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Wonik is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does Wonik's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Wonik's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Wonik currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

You need to take note of risks, for example - Wonik has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wonik might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A032940

Wonik

Engages in the semiconductor, trade and distribution, finance, cosmetics, IT and electronic parts, robots, and leisure businesses in South Korea.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success