Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So, when we ran our eye over ORION's (KRX:271560) trend of ROCE, we liked what we saw.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for ORION, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = ₩389b ÷ (₩2.7t - ₩361b) (Based on the trailing twelve months to September 2020).

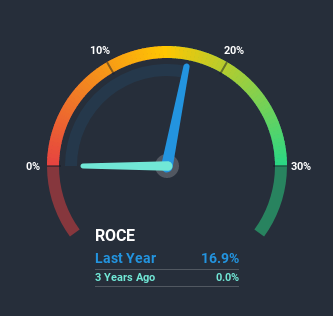

Thus, ORION has an ROCE of 17%. In absolute terms, that's a satisfactory return, but compared to the Food industry average of 6.9% it's much better.

See our latest analysis for ORION

In the above chart we have measured ORION's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for ORION.

What Does the ROCE Trend For ORION Tell Us?

While the current returns on capital are decent, they haven't changed much. Over the past two years, ROCE has remained relatively flat at around 17% and the business has deployed 28% more capital into its operations. 17% is a pretty standard return, and it provides some comfort knowing that ORION has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

The Key Takeaway

The main thing to remember is that ORION has proven its ability to continually reinvest at respectable rates of return. However, over the last three years, the stock has only delivered a 21% return to shareholders who held over that period. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger.

If you're still interested in ORION it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

While ORION isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading ORION or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A271560

ORION

Engages in the manufacture and sale of various confectionery products in South Korea, China, and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.