- South Korea

- /

- Beverage

- /

- KOSE:A005300

If You Had Bought Lotte Chilsung BeverageLtd (KRX:005300) Shares Five Years Ago You'd Have A Total Return Of Negative 4.3%

Lotte Chilsung Beverage Co.,Ltd. (KRX:005300) shareholders should be happy to see the share price up 26% in the last month. But if you look at the last five years the returns have not been good. In fact, the share price is down 49%, which falls well short of the return you could get by buying an index fund.

See our latest analysis for Lotte Chilsung BeverageLtd

Because Lotte Chilsung BeverageLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Lotte Chilsung BeverageLtd grew its revenue at 0.9% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 8% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

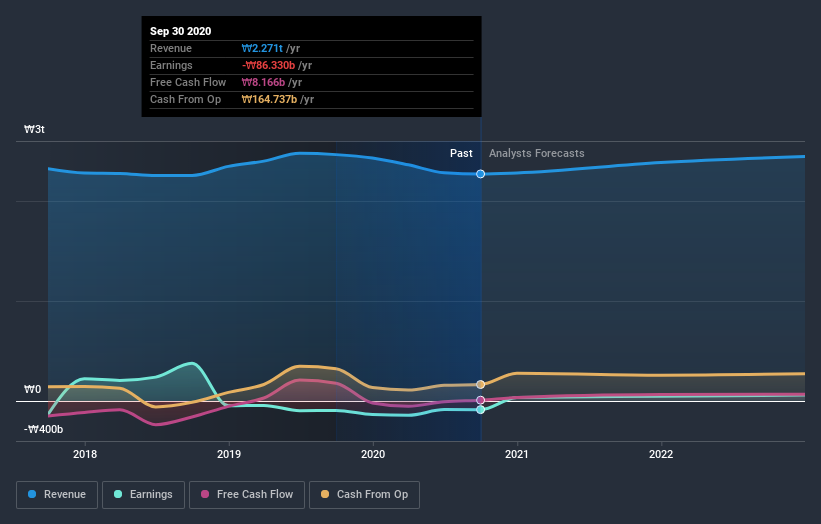

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Lotte Chilsung BeverageLtd is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Lotte Chilsung BeverageLtd will earn in the future (free analyst consensus estimates)

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Lotte Chilsung BeverageLtd's TSR for the last 5 years was -4.3%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Lotte Chilsung BeverageLtd shareholders are down 18% for the year (even including dividends), but the market itself is up 34%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Lotte Chilsung BeverageLtd (of which 1 is a bit concerning!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Lotte Chilsung BeverageLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A005300

Lotte Chilsung Beverage

Manufactures and sells soft drinks, liquor, fruit/vegetable drinks, grain drinks, and food and other beverages in Korea, the Philippines, Pakistan, the United States, Japan, China, Myanmar, Singapore, and Russia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives