- South Korea

- /

- Beverage

- /

- KOSE:A005300

Investors Continue Waiting On Sidelines For Lotte Chilsung Beverage Co., Ltd. (KRX:005300)

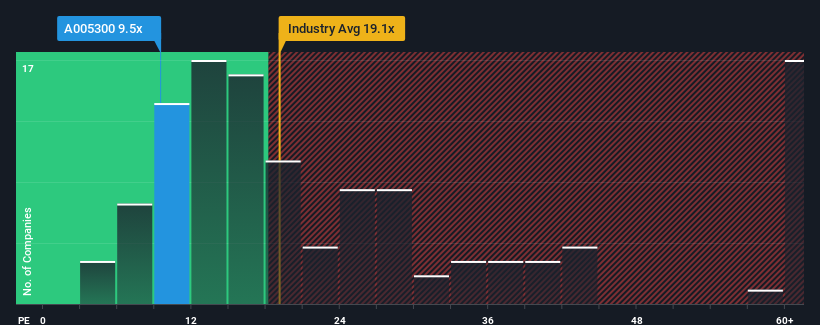

With a median price-to-earnings (or "P/E") ratio of close to 11x in Korea, you could be forgiven for feeling indifferent about Lotte Chilsung Beverage Co., Ltd.'s (KRX:005300) P/E ratio of 9.5x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Lotte Chilsung Beverage certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Lotte Chilsung Beverage

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Lotte Chilsung Beverage's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 9.8%. Pleasingly, EPS has also lifted 512% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the ten analysts watching the company. That's shaping up to be materially higher than the 16% per year growth forecast for the broader market.

In light of this, it's curious that Lotte Chilsung Beverage's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Lotte Chilsung Beverage's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Lotte Chilsung Beverage that you should be aware of.

You might be able to find a better investment than Lotte Chilsung Beverage. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A005300

Lotte Chilsung Beverage

Develops, manufactures, and sells soft drinks, liquor, fruit/vegetable drinks, grain drinks, food, and other beverages in South Korea.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives