- Taiwan

- /

- Electrical

- /

- TWSE:3665

Global Market Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating consumer sentiment, global markets have experienced significant volatility, with indices such as the S&P 500 and Nasdaq Composite showing notable gains despite ongoing uncertainties. As investors navigate these turbulent waters, identifying stocks that are potentially undervalued relative to their intrinsic value can offer opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Auras Technology (TPEX:3324) | NT$460.00 | NT$906.08 | 49.2% |

| Nishi-Nippon Financial Holdings (TSE:7189) | ¥1849.00 | ¥3651.86 | 49.4% |

| BMC Medical (SZSE:301367) | CN¥65.98 | CN¥130.28 | 49.4% |

| Alexander Marine (TWSE:8478) | NT$144.50 | NT$283.97 | 49.1% |

| Hyundai Rotem (KOSE:A064350) | ₩106500.00 | ₩209244.10 | 49.1% |

| LITALICO (TSE:7366) | ¥1160.00 | ¥2295.15 | 49.5% |

| Kokusai Electric (TSE:6525) | ¥2114.00 | ¥4176.84 | 49.4% |

| Fodelia Oyj (HLSE:FODELIA) | €7.04 | €13.91 | 49.4% |

| World Fitness Services (TWSE:2762) | NT$80.00 | NT$157.99 | 49.4% |

| Komplett (OB:KOMPL) | NOK11.55 | NOK22.74 | 49.2% |

Here's a peek at a few of the choices from the screener.

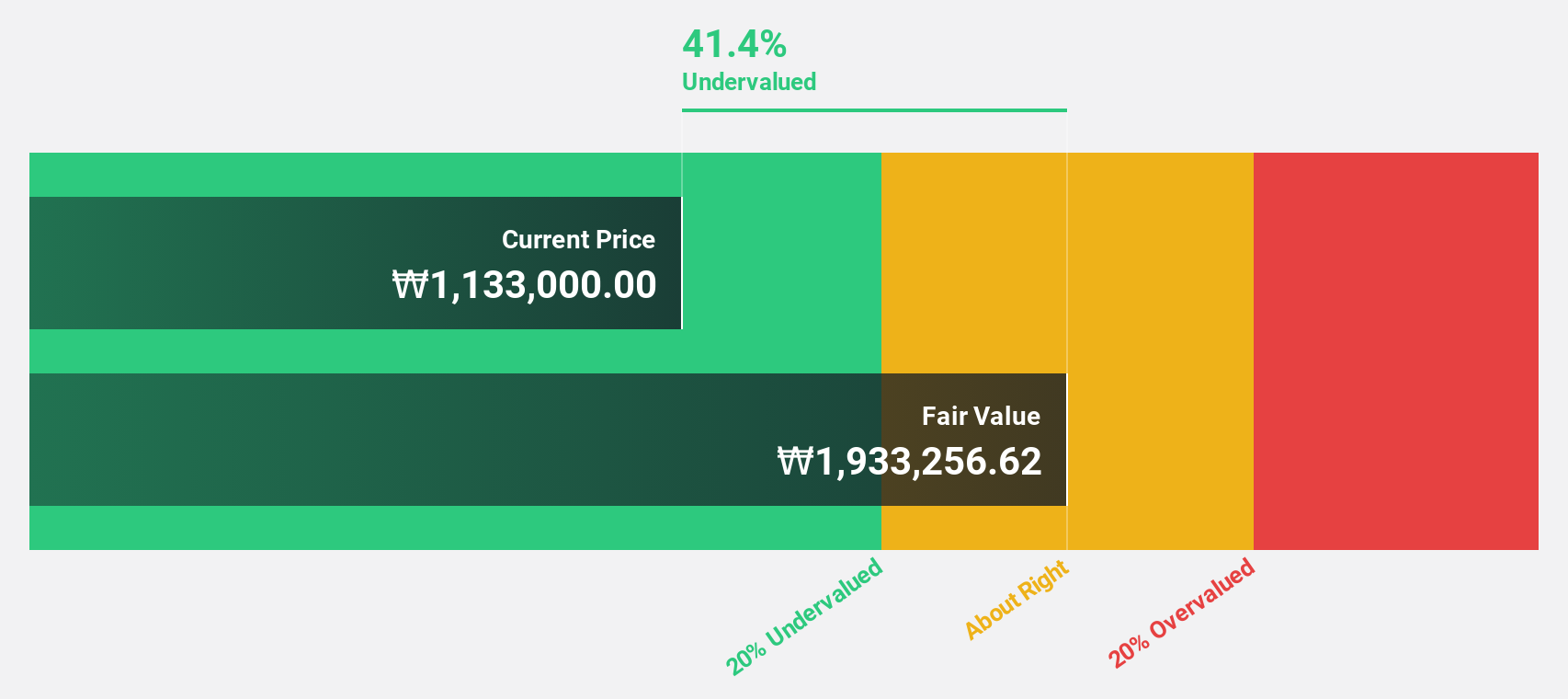

Samyang Foods (KOSE:A003230)

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both domestically in South Korea and internationally, with a market cap of ₩6.88 trillion.

Operations: Revenue Segments (in millions of ₩): Instant noodles: 1,200,000; Snacks: 300,000; Sauces and seasonings: 150,000.

Estimated Discount To Fair Value: 38.9%

Samyang Foods is trading at ₩929,000, significantly below its estimated fair value of ₩1.52 million, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow by 21.05% annually over the next three years, though revenue growth at 18.7% per year lags behind market expectations. The company's high return on equity projection and strong past earnings growth highlight its potential despite slower-than-market earnings growth forecasts.

- Our expertly prepared growth report on Samyang Foods implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Samyang Foods stock in this financial health report.

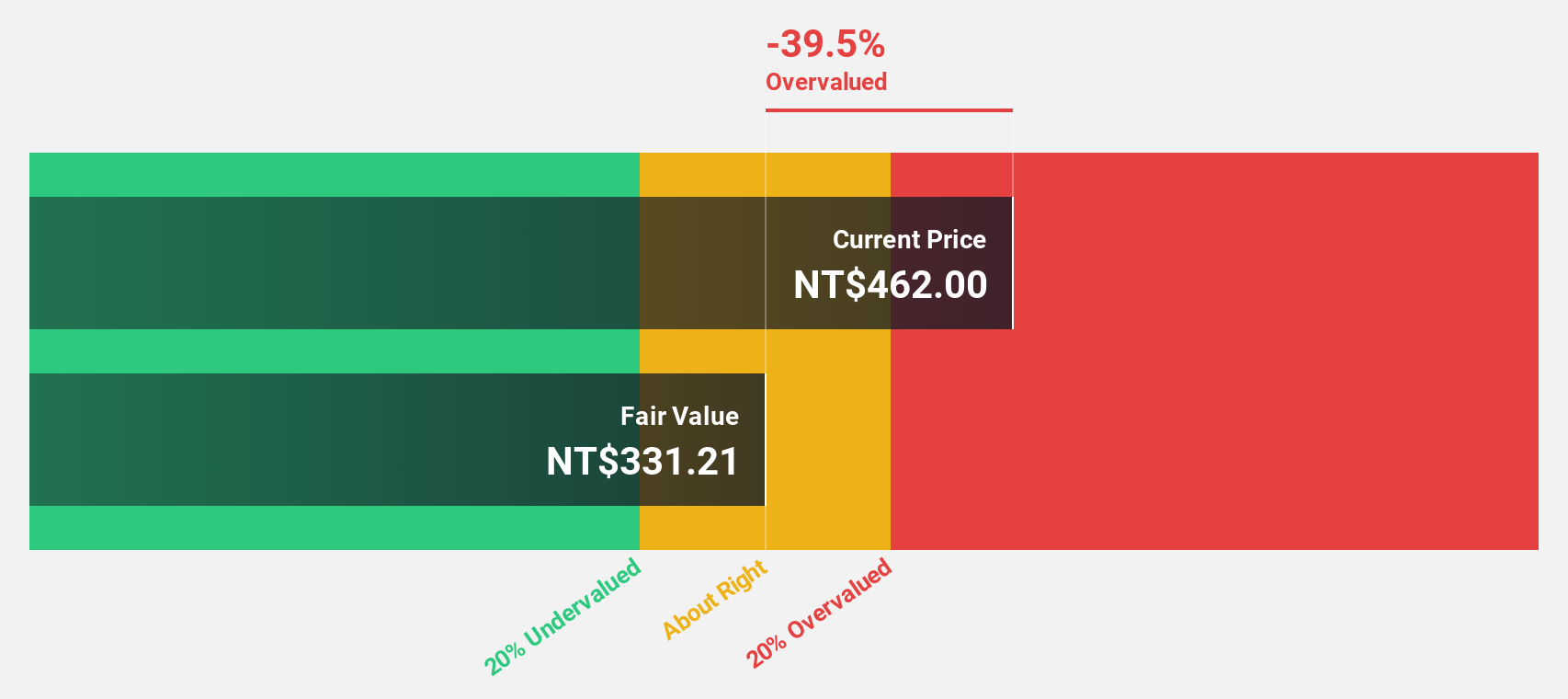

Fortune Electric (TWSE:1519)

Overview: Fortune Electric Co., Ltd. is a company that manufactures, processes, and sells transformers, inverters, power distribution boards, and high-low voltage switches both in Taiwan and internationally with a market cap of NT$120.18 billion.

Operations: The company generates revenue from two main segments: General Contracting, contributing NT$1.39 billion, and Mechanical and Electrical, which accounts for NT$18.81 billion.

Estimated Discount To Fair Value: 18.5%

Fortune Electric is trading at NT$400.5, below its estimated fair value of NT$491.14, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow by 22.86% annually over the next three years, outpacing the Taiwan market's growth rate of 14.9%. Despite a volatile share price and slower revenue growth than the market average, Fortune Electric's high return on equity forecast underlines its investment appeal.

- Our comprehensive growth report raises the possibility that Fortune Electric is poised for substantial financial growth.

- Navigate through the intricacies of Fortune Electric with our comprehensive financial health report here.

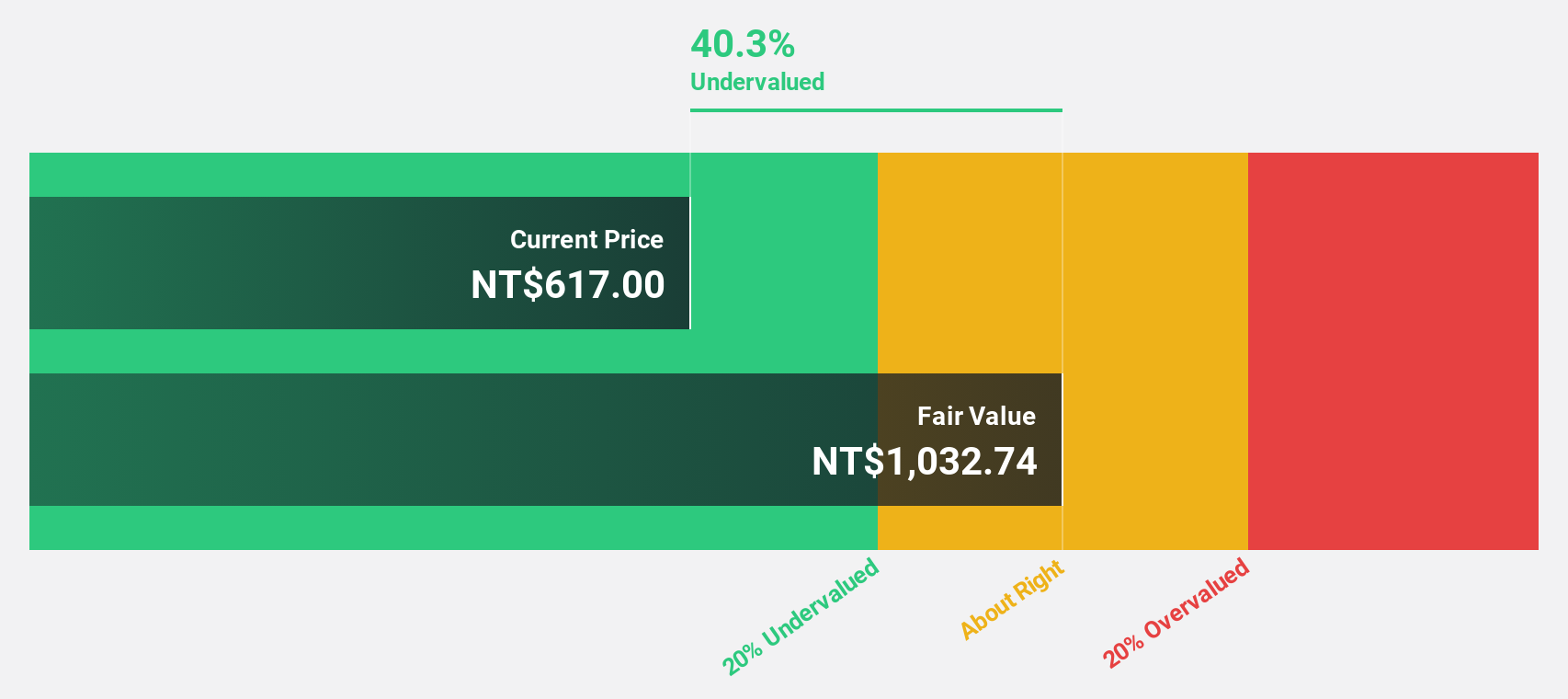

Bizlink Holding (TWSE:3665)

Overview: Bizlink Holding Inc. is engaged in the research, design, development, manufacturing, and sale of interconnect products for cable harnesses across multiple countries including the United States, China, Germany, Malaysia, Taiwan, and Italy with a market cap of NT$95.91 billion.

Operations: The company's revenue is primarily derived from its Computer Transmission Department, which generated NT$57.92 billion, followed by the Industrial Application Department with NT$24.76 billion and the Home Electric Appliance Division contributing NT$9.87 billion.

Estimated Discount To Fair Value: 29.0%

Bizlink Holding is trading at NT$489, significantly below its estimated fair value of NT$688.39, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow 28.2% annually over the next three years, surpassing the Taiwan market's growth rate of 14.9%. Despite recent shareholder dilution and high share price volatility, Bizlink's robust earnings growth and strong sales performance underscore its investment potential.

- According our earnings growth report, there's an indication that Bizlink Holding might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Bizlink Holding.

Taking Advantage

- Gain an insight into the universe of 471 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bizlink Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3665

Bizlink Holding

Researches, designs, develops, manufactures, and sells interconnect products for cable harnesses in the United States, China, Germany, Malaysia, Taiwan, Italy, and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives