- South Korea

- /

- Food

- /

- KOSE:A003230

Global Market Insights: 3 Stocks Including Türkiye Is Bankasi That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience amid fluctuating economic indicators, such as lower-than-expected U.S. inflation and strengthening business activity in the Eurozone. As investors navigate these complex conditions, identifying undervalued stocks becomes crucial; this involves seeking opportunities where market prices may not fully reflect a company's intrinsic value or growth potential.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ülker Bisküvi Sanayi (IBSE:ULKER) | TRY106.60 | TRY212.90 | 49.9% |

| Robit Oyj (HLSE:ROBIT) | €1.10 | €2.18 | 49.5% |

| Pandora (CPSE:PNDORA) | DKK879.40 | DKK1752.74 | 49.8% |

| Nordisk Bergteknik (OM:NORB B) | SEK11.90 | SEK23.59 | 49.5% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.32 | CN¥26.43 | 49.6% |

| Mo-BRUK (WSE:MBR) | PLN294.00 | PLN585.04 | 49.7% |

| IbidenLtd (TSE:4062) | ¥13580.00 | ¥26774.89 | 49.3% |

| CICT Mobile Communication Technology (SHSE:688387) | CN¥6.75 | CN¥13.37 | 49.5% |

| Bonesupport Holding (OM:BONEX) | SEK224.80 | SEK443.21 | 49.3% |

| Aquafil (BIT:ECNL) | €1.94 | €3.85 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

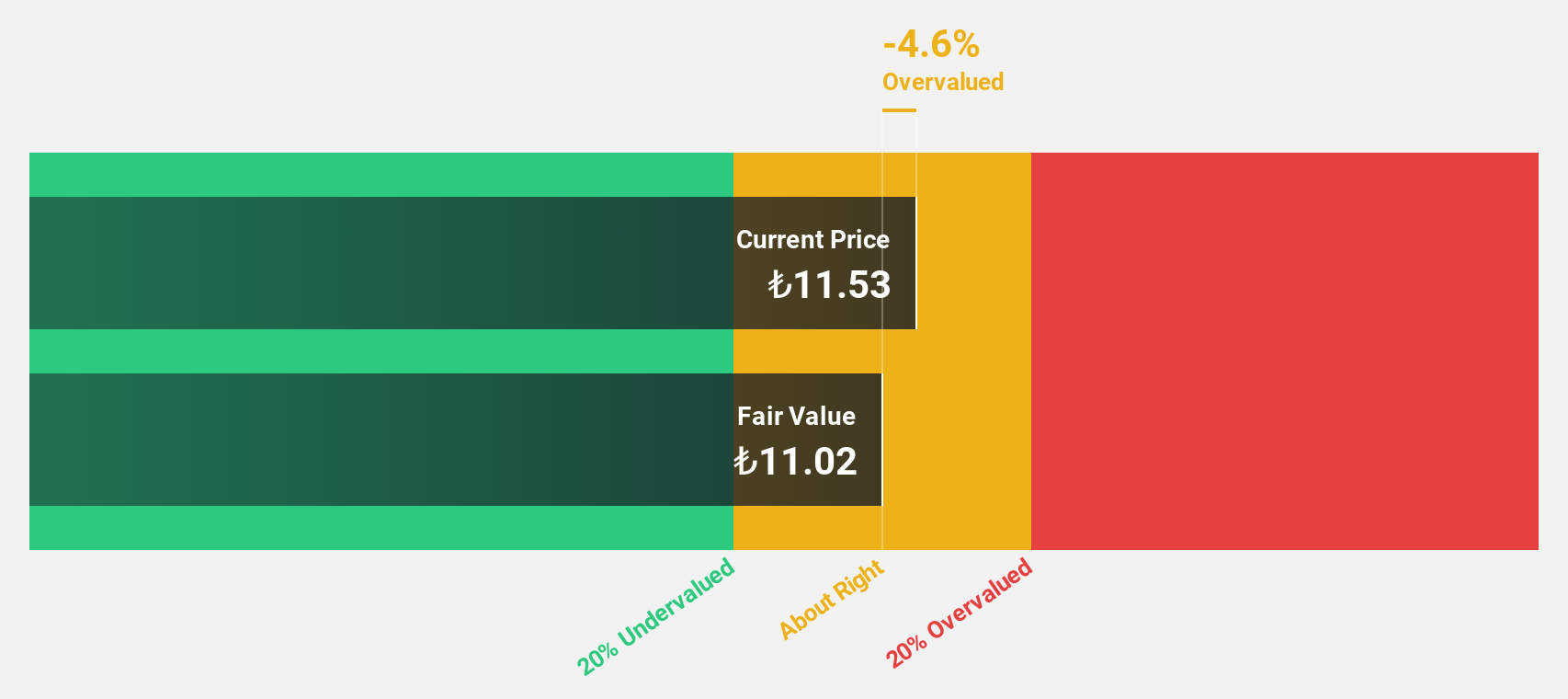

Türkiye Is Bankasi (IBSE:ISCTR)

Overview: Türkiye Is Bankasi A.S. offers a range of banking products and services in Turkey with a market capitalization of TRY364.35 billion.

Operations: The company's revenue is primarily derived from Corporate/Commercial Banking (TRY162.67 billion), Treasury Transactions and Investment Activities (TRY121.32 billion), and Insurance and Reinsurance Activities (TRY73.92 billion).

Estimated Discount To Fair Value: 12.1%

Türkiye Is Bankasi is trading at TRY12.41, below its estimated fair value of TRY14.12, indicating it may be undervalued based on cash flows. Analysts expect revenue and earnings to grow significantly, with revenue forecasted to increase by 24% annually. However, the bank has a high level of bad loans at 2.3%, impacting profit margins which have decreased from 30.6% to 16.4%. Recent earnings show net income growth with TRY30 billion reported for H1 2025.

- Our growth report here indicates Türkiye Is Bankasi may be poised for an improving outlook.

- Get an in-depth perspective on Türkiye Is Bankasi's balance sheet by reading our health report here.

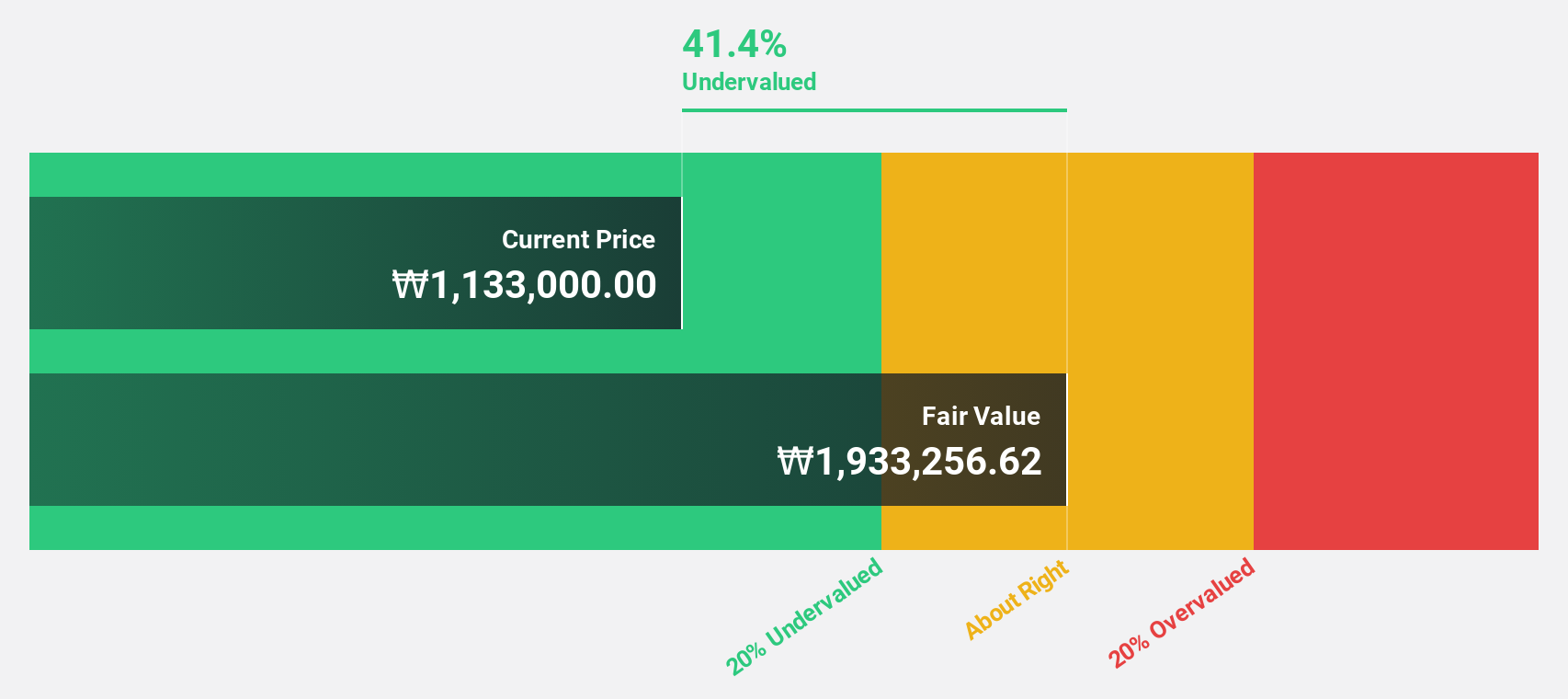

Samyang Foods (KOSE:A003230)

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both in South Korea and internationally, with a market capitalization of approximately ₩9.28 trillion.

Operations: Revenue segments for Samyang Foods Co., Ltd. include domestic and international food operations, contributing to its overall business activities.

Estimated Discount To Fair Value: 42.6%

Samyang Foods is trading at ₩1.33 million, significantly below its estimated fair value of ₩2.31 million, reflecting undervaluation based on cash flows. Earnings grew 54.6% last year and are forecasted to grow 28.71% annually, outpacing the Korean market's growth rate of 27.4%. Recent inclusion in the FTSE All-World Index highlights its increasing global recognition, although high non-cash earnings could affect perceived quality of profits.

- The analysis detailed in our Samyang Foods growth report hints at robust future financial performance.

- Take a closer look at Samyang Foods' balance sheet health here in our report.

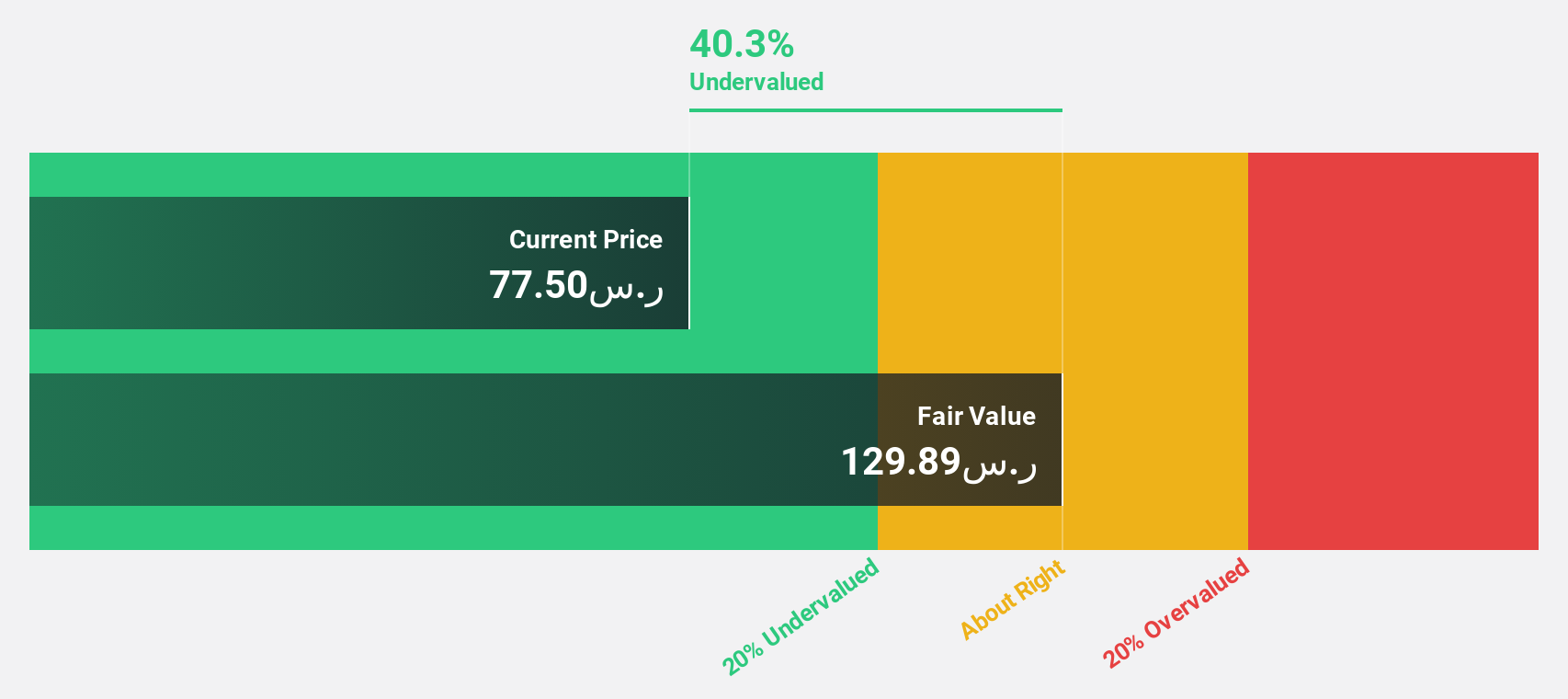

Arabian Drilling (SASE:2381)

Overview: Arabian Drilling Company is a Saudi Arabian firm specializing in onshore and offshore gas and oil rig drilling, with a market cap of SAR7.14 billion.

Operations: The company's revenue primarily comes from its Land Rigs segment, generating SAR2.39 billion, followed by the Off-Shore Rigs segment at SAR1.10 billion.

Estimated Discount To Fair Value: 38%

Arabian Drilling, trading at SAR80.5, is significantly undervalued compared to its fair value of SAR129.89 based on cash flows. Despite lower profit margins this year, earnings are expected to grow 25.23% annually, surpassing the SA market's growth rate of 8%. Recent contract renewals with SLB secured over SAR2.4 billion in backlog, enhancing its industry leadership and financial stability despite challenges in dividend coverage and interest payments from earnings.

- Our comprehensive growth report raises the possibility that Arabian Drilling is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Arabian Drilling.

Make It Happen

- Gain an insight into the universe of 493 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003230

Samyang Foods

Engages in the food business in South Korea and internationally.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives