- Japan

- /

- Semiconductors

- /

- TSE:6871

3 Global Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of optimism and caution, with U.S. equity indexes showing modest gains despite weaker-than-expected labor market data fueling speculation of potential interest rate cuts. Amid this backdrop, investors are increasingly on the lookout for stocks that may be undervalued—those trading below their estimated value—offering potential opportunities in a market where economic signals remain mixed.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.99 | CN¥165.09 | 49.7% |

| Takara Bio (TSE:4974) | ¥917.00 | ¥1829.46 | 49.9% |

| Suzhou Zelgen Biopharmaceuticals (SHSE:688266) | CN¥113.00 | CN¥223.99 | 49.6% |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥29.42 | CN¥58.22 | 49.5% |

| SIT (BIT:SIT) | €1.69 | €3.37 | 49.8% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.28 | CN¥28.43 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK62.40 | SEK123.38 | 49.4% |

| Meitu (SEHK:1357) | HK$9.03 | HK$18.01 | 49.9% |

| Kolmar Korea (KOSE:A161890) | ₩78700.00 | ₩155570.53 | 49.4% |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$531.94 | MX$1057.29 | 49.7% |

Let's dive into some prime choices out of the screener.

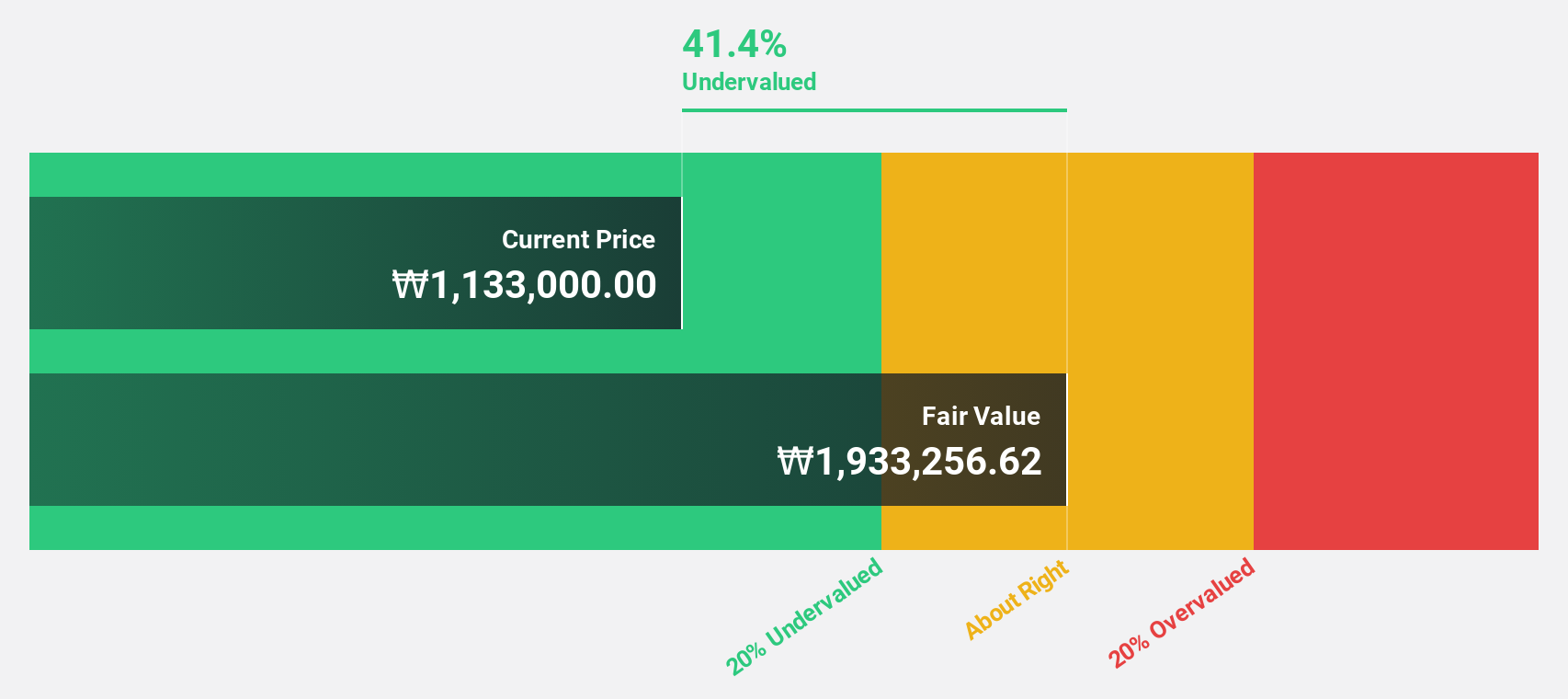

Samyang Foods (KOSE:A003230)

Overview: Samyang Foods Co., Ltd. operates in the food industry both domestically in South Korea and internationally, with a market capitalization of approximately ₩11.55 trillion.

Operations: I'm unable to summarize the company's revenue segments as the specific segment information is not provided in the text.

Estimated Discount To Fair Value: 46%

Samyang Foods is trading at ₩1,624,000, significantly below its estimated fair value of ₩3,006,664.22. With earnings expected to grow 28.6% annually and revenue forecast to increase by 22.9% per year—both surpassing the Korean market average—the company shows potential for substantial growth. Recent product launches in the U.S., like the MEP ramyeon line, may bolster revenue streams further as it taps into consumer demand for innovative flavors and convenience foods.

- Insights from our recent growth report point to a promising forecast for Samyang Foods' business outlook.

- Unlock comprehensive insights into our analysis of Samyang Foods stock in this financial health report.

Range Intelligent Computing Technology Group (SZSE:300442)

Overview: Range Intelligent Computing Technology Group Company Limited offers server hosting services to internet companies and large cloud vendors in China, with a market cap of CN¥84.86 billion.

Operations: The company's revenue segment includes Software and Information Technology Services, generating CN¥4.70 billion.

Estimated Discount To Fair Value: 45.4%

Range Intelligent Computing Technology Group is trading at CNY 53.15, significantly below its estimated fair value of CNY 97.33. Despite a high level of debt, the company shows potential for growth with earnings projected to increase by 32% annually and revenue expected to rise by 29.2% per year, both outpacing the Chinese market averages. Recent dividend affirmations and exploration of a second listing in Hong Kong indicate proactive financial strategies amidst volatile share prices.

- The analysis detailed in our Range Intelligent Computing Technology Group growth report hints at robust future financial performance.

- Navigate through the intricacies of Range Intelligent Computing Technology Group with our comprehensive financial health report here.

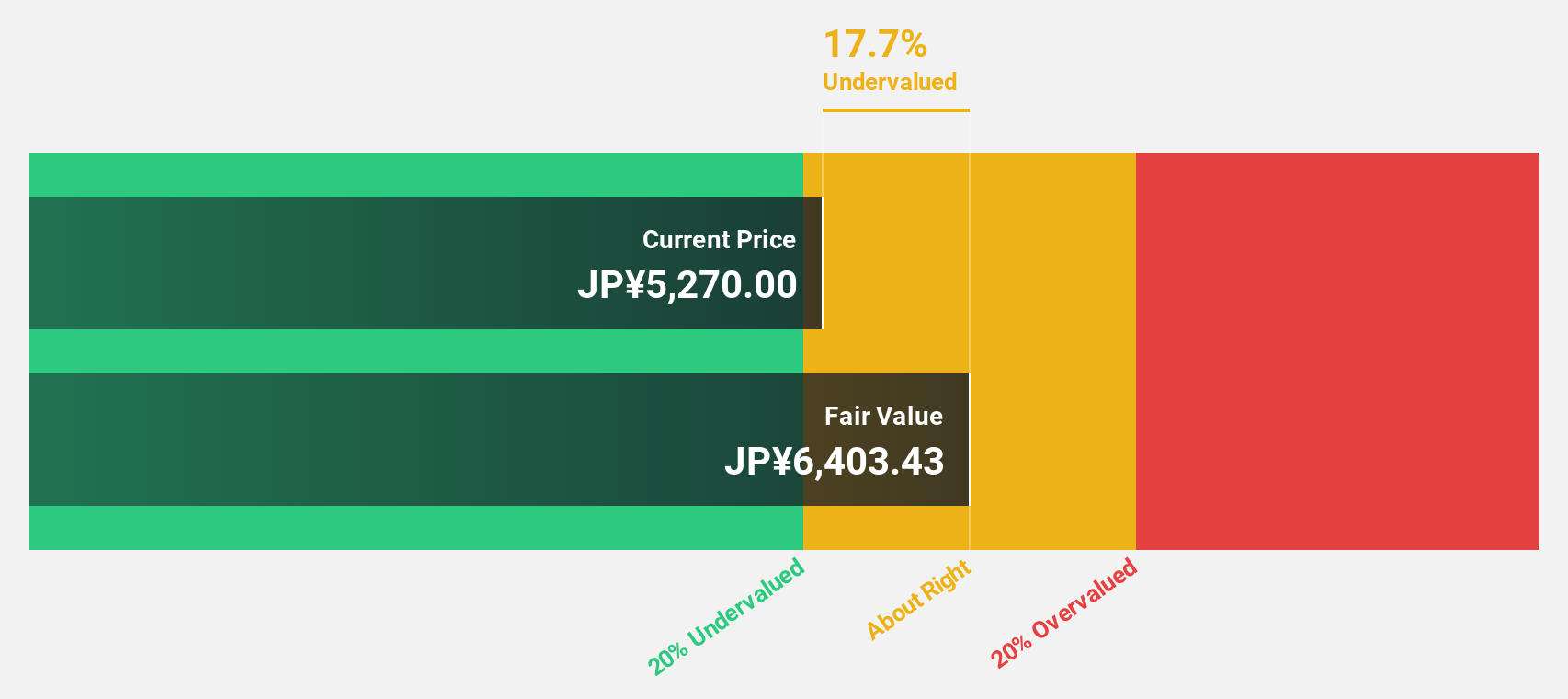

Micronics Japan (TSE:6871)

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells body measuring instruments as well as semiconductor and liquid crystal display inspection equipment globally, with a market cap of ¥182.97 billion.

Operations: The company's revenue is primarily derived from the Probe Card Business, which accounts for ¥60.71 billion, and the TE Business, contributing ¥1.88 billion.

Estimated Discount To Fair Value: 20.9%

Micronics Japan is trading at ¥5,060, below its estimated fair value of ¥6,393.12. Despite recent guidance revisions due to shipment delays from equipment malfunctions, earnings are expected to grow significantly over the next three years. Revenue growth is forecasted at 13.4% per year, surpassing the JP market average. Analysts agree on a potential 20.6% stock price rise while high non-cash earnings and an anticipated increase in dividends reflect robust financial health despite recent volatility.

- Upon reviewing our latest growth report, Micronics Japan's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Micronics Japan.

Summing It All Up

- Embark on your investment journey to our 520 Undervalued Global Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6871

Micronics Japan

Develops, manufactures, and sells body measuring equipment, semiconductor, and liquid crystal display inspection equipment worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives