- South Korea

- /

- Food

- /

- KOSDAQ:A900340

Will Wing Yip Food (China) Holdings Group (KOSDAQ:900340) Multiply In Value Going Forward?

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Wing Yip Food (China) Holdings Group (KOSDAQ:900340) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Wing Yip Food (China) Holdings Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = ₩14b ÷ (₩146b - ₩21b) (Based on the trailing twelve months to September 2020).

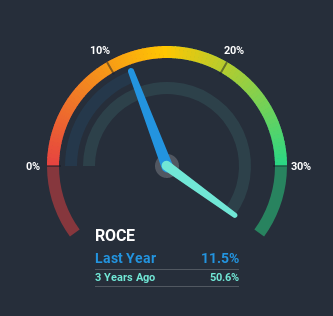

Thus, Wing Yip Food (China) Holdings Group has an ROCE of 12%. In absolute terms, that's a satisfactory return, but compared to the Food industry average of 7.1% it's much better.

View our latest analysis for Wing Yip Food (China) Holdings Group

Above you can see how the current ROCE for Wing Yip Food (China) Holdings Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Wing Yip Food (China) Holdings Group.

What Can We Tell From Wing Yip Food (China) Holdings Group's ROCE Trend?

In terms of Wing Yip Food (China) Holdings Group's historical ROCE movements, the trend isn't fantastic. To be more specific, ROCE has fallen from 51% over the last three years. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. If these investments prove successful, this can bode very well for long term stock performance.

On a side note, Wing Yip Food (China) Holdings Group has done well to pay down its current liabilities to 14% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.The Bottom Line On Wing Yip Food (China) Holdings Group's ROCE

In summary, despite lower returns in the short term, we're encouraged to see that Wing Yip Food (China) Holdings Group is reinvesting for growth and has higher sales as a result. However, despite the promising trends, the stock has fallen 30% over the last year, so there might be an opportunity here for astute investors. So we think it'd be worthwhile to look further into this stock given the trends look encouraging.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 4 warning signs for Wing Yip Food (China) Holdings Group (of which 1 is a bit unpleasant!) that you should know about.

While Wing Yip Food (China) Holdings Group may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Wing Yip Food (China) Holdings Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wing Yip Food Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A900340

Wing Yip Food Holdings Group

Through its subsidiaries, operates as a meat product processing company in the Mainland of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives