- South Korea

- /

- Food

- /

- KOSDAQ:A222980

Are Mcnulty Korea's (KOSDAQ:222980) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing Mcnulty Korea (KOSDAQ:222980).

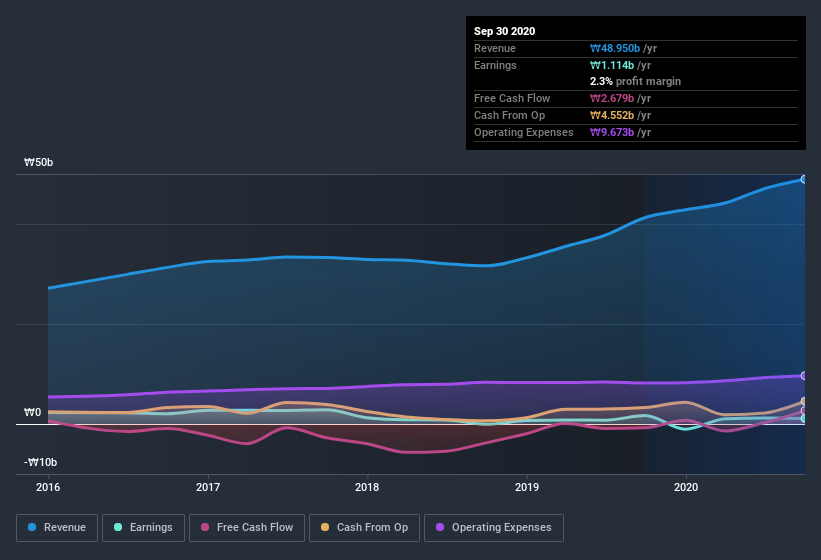

While Mcnulty Korea was able to generate revenue of ₩48.9b in the last twelve months, we think its profit result of ₩1.11b was more important.

View our latest analysis for Mcnulty Korea

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. In this article we'll look at how Mcnulty Korea is impacting shareholders by issuing new shares. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Mcnulty Korea increased the number of shares on issue by 5.7% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Mcnulty Korea's EPS by clicking here.

A Look At The Impact Of Mcnulty Korea's Dilution on Its Earnings Per Share (EPS).

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. Even looking at the last year, profit was still down 32%. Sadly, earnings per share fell further, down a full 35% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Mcnulty Korea's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Mcnulty Korea's Profit Performance

Mcnulty Korea issued shares during the year, and that means its EPS performance lags its net income growth. Therefore, it seems possible to us that Mcnulty Korea's true underlying earnings power is actually less than its statutory profit. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. You'd be interested to know, that we found 4 warning signs for Mcnulty Korea and you'll want to know about them.

Today we've zoomed in on a single data point to better understand the nature of Mcnulty Korea's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Mcnulty Korea, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A222980

Low with imperfect balance sheet.

Market Insights

Community Narratives