- South Korea

- /

- Food

- /

- KOSDAQ:A218150

Some Shareholders Feeling Restless Over Milae Bioresources Co., Ltd.'s (KOSDAQ:218150) P/S Ratio

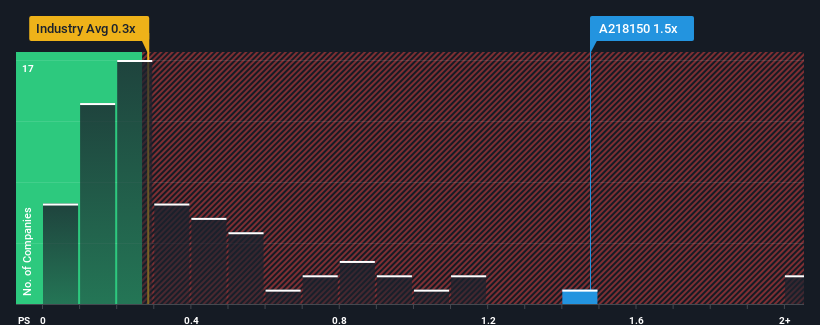

When you see that almost half of the companies in the Food industry in Korea have price-to-sales ratios (or "P/S") below 0.3x, Milae Bioresources Co., Ltd. (KOSDAQ:218150) looks to be giving off some sell signals with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Milae Bioresources

What Does Milae Bioresources' P/S Mean For Shareholders?

For example, consider that Milae Bioresources' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Milae Bioresources' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Milae Bioresources?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Milae Bioresources' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 29% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 8.8% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that Milae Bioresources' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't expect to see Milae Bioresources trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Milae Bioresources has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

If you're unsure about the strength of Milae Bioresources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A218150

Adequate balance sheet very low.

Market Insights

Community Narratives