- South Korea

- /

- Food

- /

- KOSDAQ:A189980

Hyung Kuk F&B's (KOSDAQ:189980) Stock Price Has Reduced 71% In The Past Five Years

It is doubtless a positive to see that the Hyung Kuk F&B Co., Ltd. (KOSDAQ:189980) share price has gained some 37% in the last three months. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 71% after a long stretch. Some might say the recent bounce is to be expected after such a bad drop. But it could be that the fall was overdone.

See our latest analysis for Hyung Kuk F&B

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

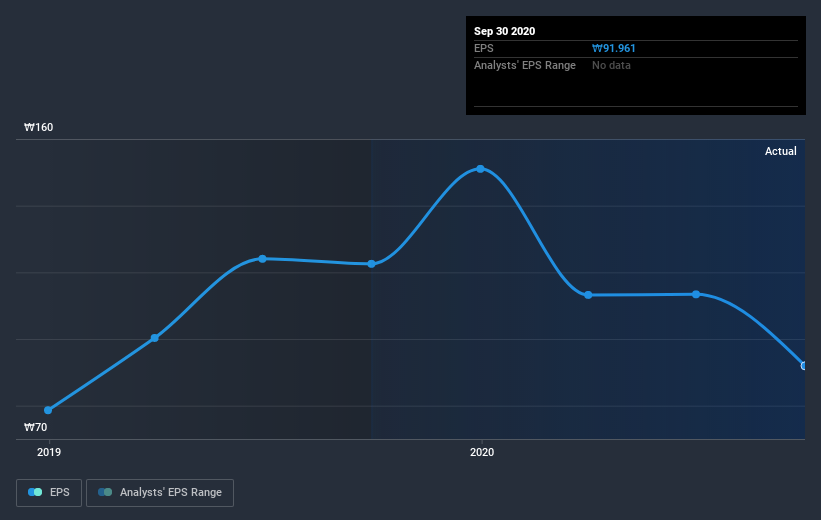

During the five years over which the share price declined, Hyung Kuk F&B's earnings per share (EPS) dropped by 19% each year. Notably, the share price has fallen at 22% per year, fairly close to the change in the EPS. This suggests that market participants have not changed their view of the company all that much. So it's fair to say the share price has been responding to changes in EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Hyung Kuk F&B's key metrics by checking this interactive graph of Hyung Kuk F&B's earnings, revenue and cash flow.

A Different Perspective

Hyung Kuk F&B provided a TSR of 21% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 11% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Hyung Kuk F&B better, we need to consider many other factors. Case in point: We've spotted 6 warning signs for Hyung Kuk F&B you should be aware of, and 1 of them is significant.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Hyung Kuk F&B, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HYUNGKUK F&B might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A189980

HYUNGKUK F&B

Engages in the manufacture and sale of foods and beverages in South Korea.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives