- South Korea

- /

- Food

- /

- KOSDAQ:A103840

Does Wooyang's (KOSDAQ:103840) Share Price Gain of 53% Match Its Business Performance?

Wooyang Co. Ltd (KOSDAQ:103840) shareholders might be concerned after seeing the share price drop 11% in the last week. But that doesn't change the fact that the returns over the last year have been pleasing. To wit, it had solidly beat the market, up 53%.

See our latest analysis for Wooyang

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

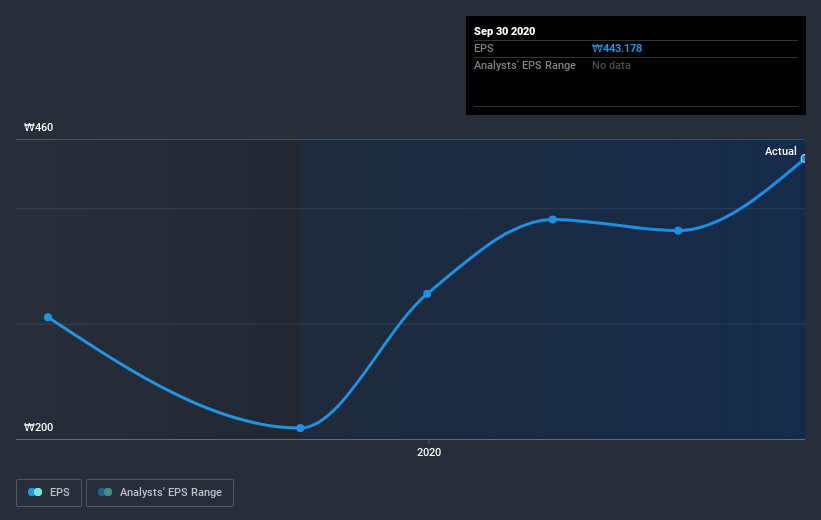

Wooyang was able to grow EPS by 110% in the last twelve months. It's fair to say that the share price gain of 53% did not keep pace with the EPS growth. So it seems like the market has cooled on Wooyang, despite the growth. Interesting.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Wooyang shareholders should be happy with the total gain of 53% over the last twelve months. And the share price momentum remains respectable, with a gain of 18% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Wooyang (2 shouldn't be ignored!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Wooyang, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wooyang might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A103840

Low and overvalued.

Market Insights

Community Narratives