- South Korea

- /

- Oil and Gas

- /

- KOSDAQ:A000440

Subdued Growth No Barrier To Joong Ang Enervis Co., Ltd (KOSDAQ:000440) With Shares Advancing 35%

The Joong Ang Enervis Co., Ltd (KOSDAQ:000440) share price has done very well over the last month, posting an excellent gain of 35%. Looking further back, the 21% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

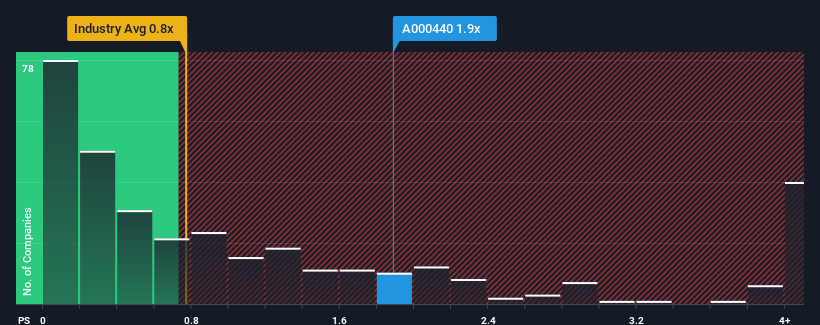

After such a large jump in price, when almost half of the companies in Korea's Oil and Gas industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider Joong Ang Enervis as a stock probably not worth researching with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Joong Ang Enervis

What Does Joong Ang Enervis' P/S Mean For Shareholders?

For example, consider that Joong Ang Enervis' financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Joong Ang Enervis' earnings, revenue and cash flow.How Is Joong Ang Enervis' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Joong Ang Enervis' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 1.1% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that Joong Ang Enervis' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Joong Ang Enervis' P/S?

The large bounce in Joong Ang Enervis' shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Joong Ang Enervis revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 4 warning signs for Joong Ang Enervis (1 is concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A000440

Excellent balance sheet slight.