- South Korea

- /

- Diversified Financial

- /

- KOSE:A377300

Kakao Pay Corp.'s (KRX:377300) Share Price Is Still Matching Investor Opinion Despite 26% Slump

Kakao Pay Corp. (KRX:377300) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 112%.

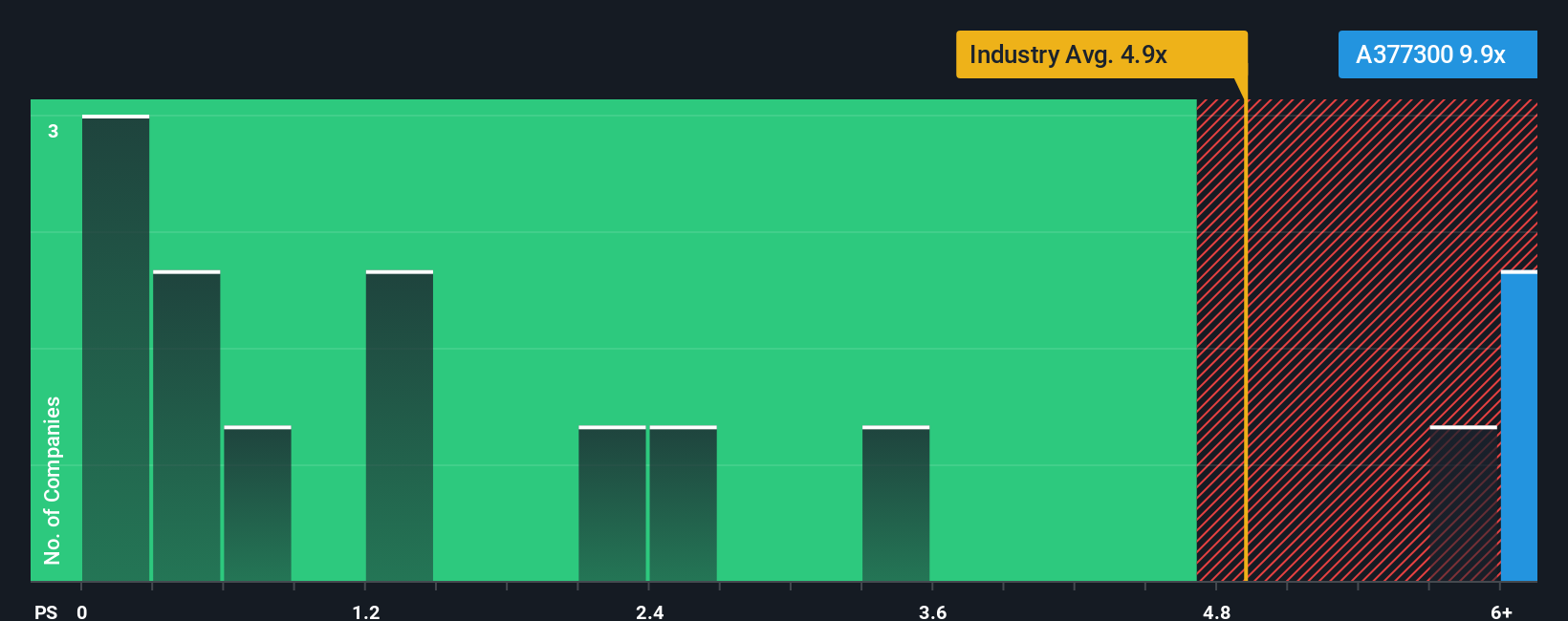

Although its price has dipped substantially, given around half the companies in Korea's Diversified Financial industry have price-to-sales ratios (or "P/S") below 1.4x, you may still consider Kakao Pay as a stock to avoid entirely with its 9.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kakao Pay

How Has Kakao Pay Performed Recently?

With revenue growth that's superior to most other companies of late, Kakao Pay has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Kakao Pay will help you uncover what's on the horizon.How Is Kakao Pay's Revenue Growth Trending?

In order to justify its P/S ratio, Kakao Pay would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. Pleasingly, revenue has also lifted 69% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 21% per year during the coming three years according to the analysts following the company. With the industry only predicted to deliver 11% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Kakao Pay's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Kakao Pay's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Kakao Pay's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - Kakao Pay has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kakao Pay might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A377300

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives