- South Korea

- /

- Diversified Financial

- /

- KOSE:A377300

Kakao Pay Corp.'s (KRX:377300) Earnings Haven't Escaped The Attention Of Investors

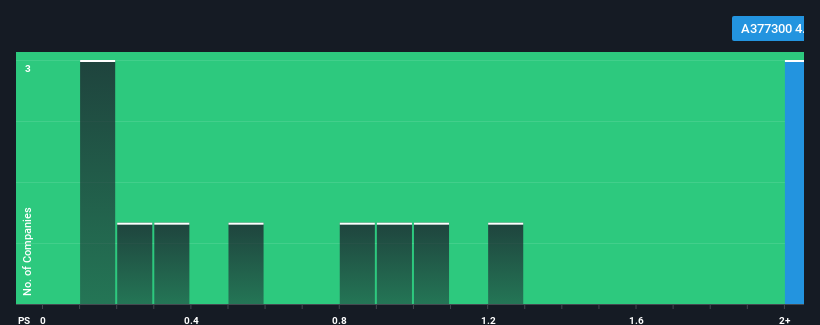

Kakao Pay Corp.'s (KRX:377300) price-to-sales (or "P/S") ratio of 4.8x may look like a poor investment opportunity when you consider close to half the companies in the Diversified Financial industry in Korea have P/S ratios below 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Kakao Pay

What Does Kakao Pay's P/S Mean For Shareholders?

Recent times have been advantageous for Kakao Pay as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kakao Pay.Is There Enough Revenue Growth Forecasted For Kakao Pay?

In order to justify its P/S ratio, Kakao Pay would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The latest three year period has also seen an excellent 78% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 18% during the coming year according to the analysts following the company. That would be an excellent outcome when the industry is expected to decline by 53%.

With this in consideration, we understand why Kakao Pay's P/S is a cut above its industry peers. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we anticipated, our review of Kakao Pay's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

Before you take the next step, you should know about the 2 warning signs for Kakao Pay that we have uncovered.

If you're unsure about the strength of Kakao Pay's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kakao Pay might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A377300

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives