- South Korea

- /

- Capital Markets

- /

- KOSE:A016360

Top Asian Dividend Stocks To Watch In May 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a renewed sense of optimism, with indices across the region reflecting this positive sentiment. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those looking to navigate the evolving economic landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.57% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.99% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.54% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.11% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.43% | ★★★★★★ |

Click here to see the full list of 1219 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

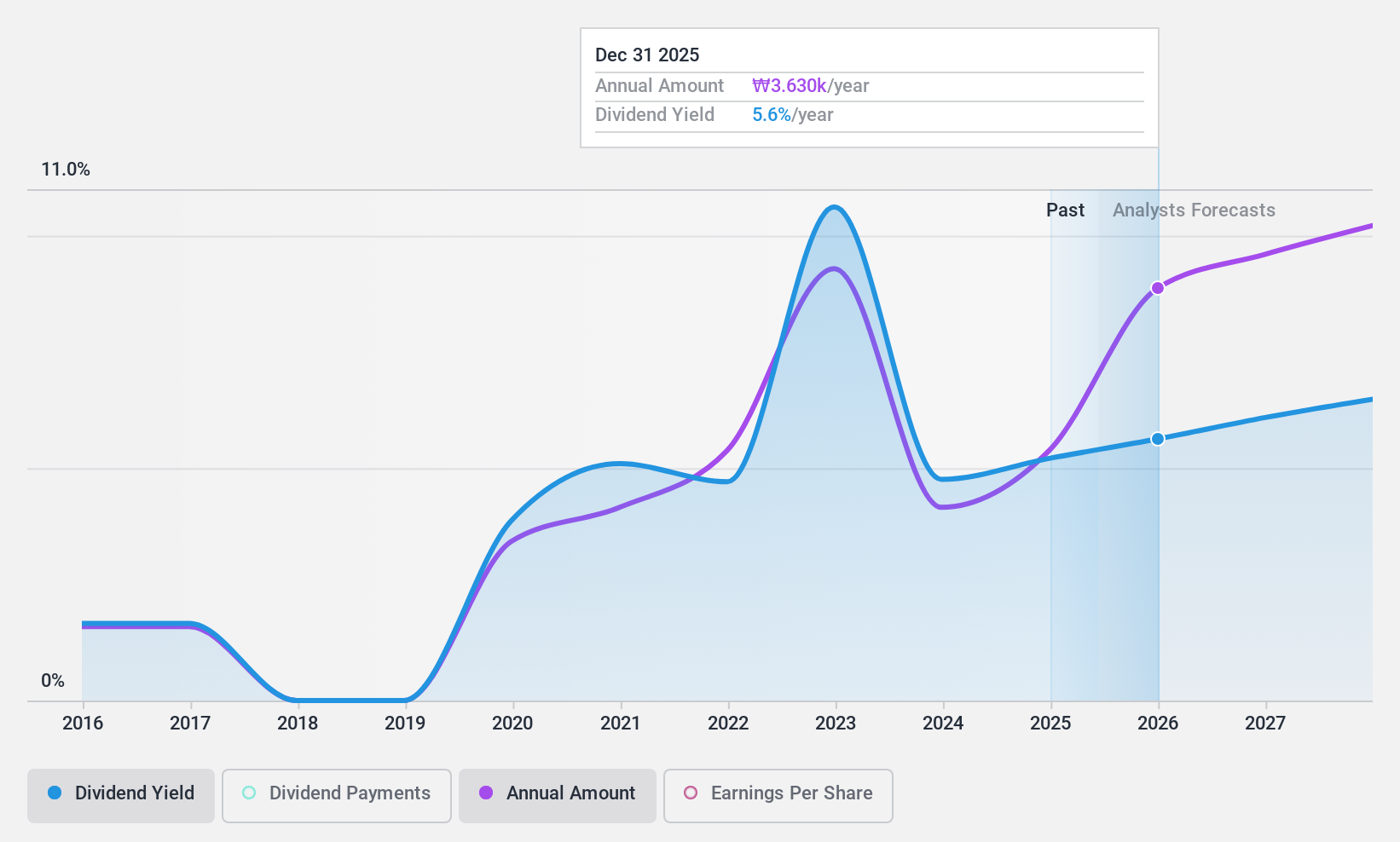

Samsung SecuritiesLtd (KOSE:A016360)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Securities Co., Ltd. is a financial investment company operating in South Korea and internationally, with a market cap of ₩4.66 trillion.

Operations: Samsung Securities Co., Ltd. generates revenue from several segments, including Selling and buying on consignment (₩1.49 trillion), Corporate Finance (₩294.66 billion), Futures brokerage business (₩159.94 billion), S&T (₩171.72 billion), Floor trading (₩72.13 billion), and International Sales (₩18.68 billion).

Dividend Yield: 6.7%

Samsung Securities Ltd. offers a compelling dividend profile with a payout ratio of 34.8%, ensuring dividends are well-covered by earnings and cash flows, with the latter at 24.1%. Despite its top-tier yield of 6.71% in the Korean market, its dividend track record is unstable due to past volatility exceeding annual drops of over 20%. The company trades at good value relative to peers and has shown significant recent earnings growth, though impacted by large one-off items.

- Click here and access our complete dividend analysis report to understand the dynamics of Samsung SecuritiesLtd.

- According our valuation report, there's an indication that Samsung SecuritiesLtd's share price might be on the cheaper side.

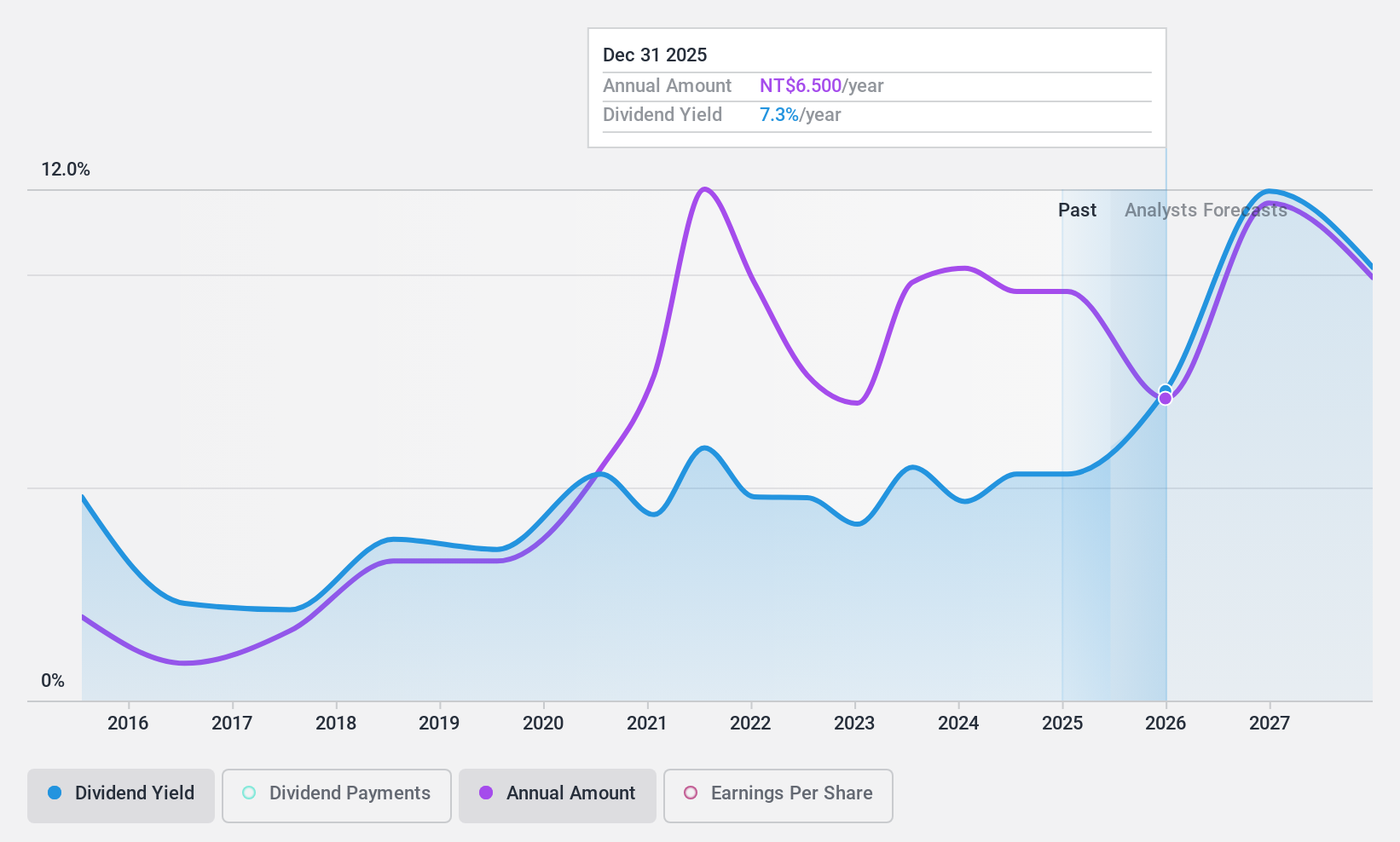

Sino-American Silicon Products (TPEX:5483)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sino-American Silicon Products Inc. focuses on the R&D, design, production, and sale of semiconductor silicon materials and components, rheostats, and optical and communications wafer materials with a market cap of NT$67.87 billion.

Operations: Sino-American Silicon Products Inc.'s revenue is primarily derived from its Semiconductor Business Group, generating NT$67.80 billion, followed by the Automotive Components Division with NT$7.58 billion and the Renewable Energy Division contributing NT$4.69 billion.

Dividend Yield: 5.9%

Sino-American Silicon Products faces challenges for dividend investors due to its volatile and unreliable dividend history, with recent payments not covered by free cash flows. The company's payout ratio of 70.4% suggests dividends are covered by earnings, yet the latest cash dividend decreased to TWD 3.5 per share amid declining net income from TWD 9.84 billion to TWD 5.35 billion in 2024. Trading below estimated fair value offers potential appeal despite these concerns.

- Click here to discover the nuances of Sino-American Silicon Products with our detailed analytical dividend report.

- Our expertly prepared valuation report Sino-American Silicon Products implies its share price may be lower than expected.

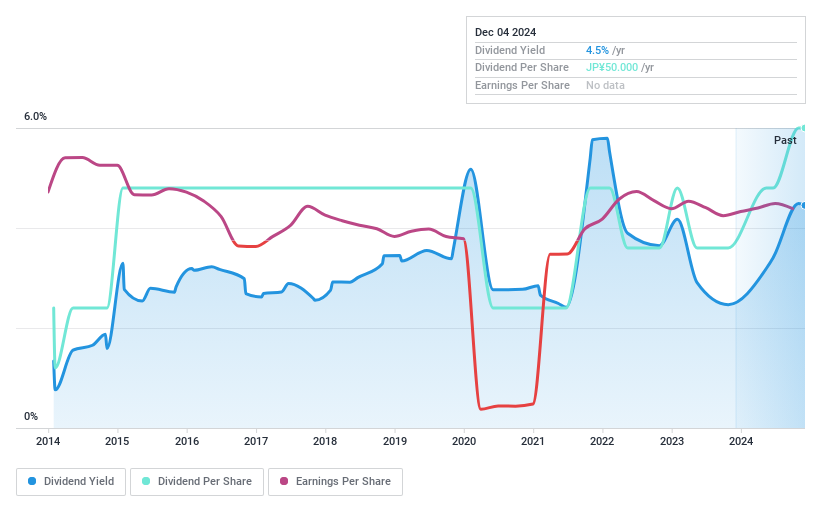

Komori (TSE:6349)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Komori Corporation manufactures, sells, and repairs printing presses across Japan, North America, Europe, and Greater China with a market cap of ¥67.17 billion.

Operations: Komori Corporation generates revenue from its operations in Japan (¥82.17 billion), Europe (¥23.15 billion), Greater China (¥15.17 billion), and North America (¥10.55 billion).

Dividend Yield: 4.3%

Komori Corporation's dividend outlook shows promise with a revised annual forecast of JPY 68 per share, reflecting a commitment to stable shareholder returns. The payout ratio of 29.6% indicates dividends are well-covered by earnings, while the cash payout ratio of 60.8% confirms coverage by cash flows. Despite past volatility in dividend payments, the current yield is among Japan's top quartile at 4.34%. Trading below fair value may enhance its appeal for investors seeking dividends in Asia.

- Click to explore a detailed breakdown of our findings in Komori's dividend report.

- The valuation report we've compiled suggests that Komori's current price could be quite moderate.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1219 Top Asian Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A016360

Samsung SecuritiesLtd

Samsung Securities Co., Ltd. operates as a financial investment company in South Korea and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives