- China

- /

- Food and Staples Retail

- /

- SHSE:603233

Asian Dividend Stocks Yielding Up To 4.4% For Your Portfolio

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by U.S.-China trade tensions and domestic economic challenges, investors are increasingly looking towards stable income sources like dividend stocks. In this environment, selecting stocks with consistent dividend yields can provide a buffer against volatility while contributing to long-term portfolio growth.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.26% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.04% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| Daicel (TSE:4202) | 4.40% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.53% | ★★★★★★ |

Click here to see the full list of 1061 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

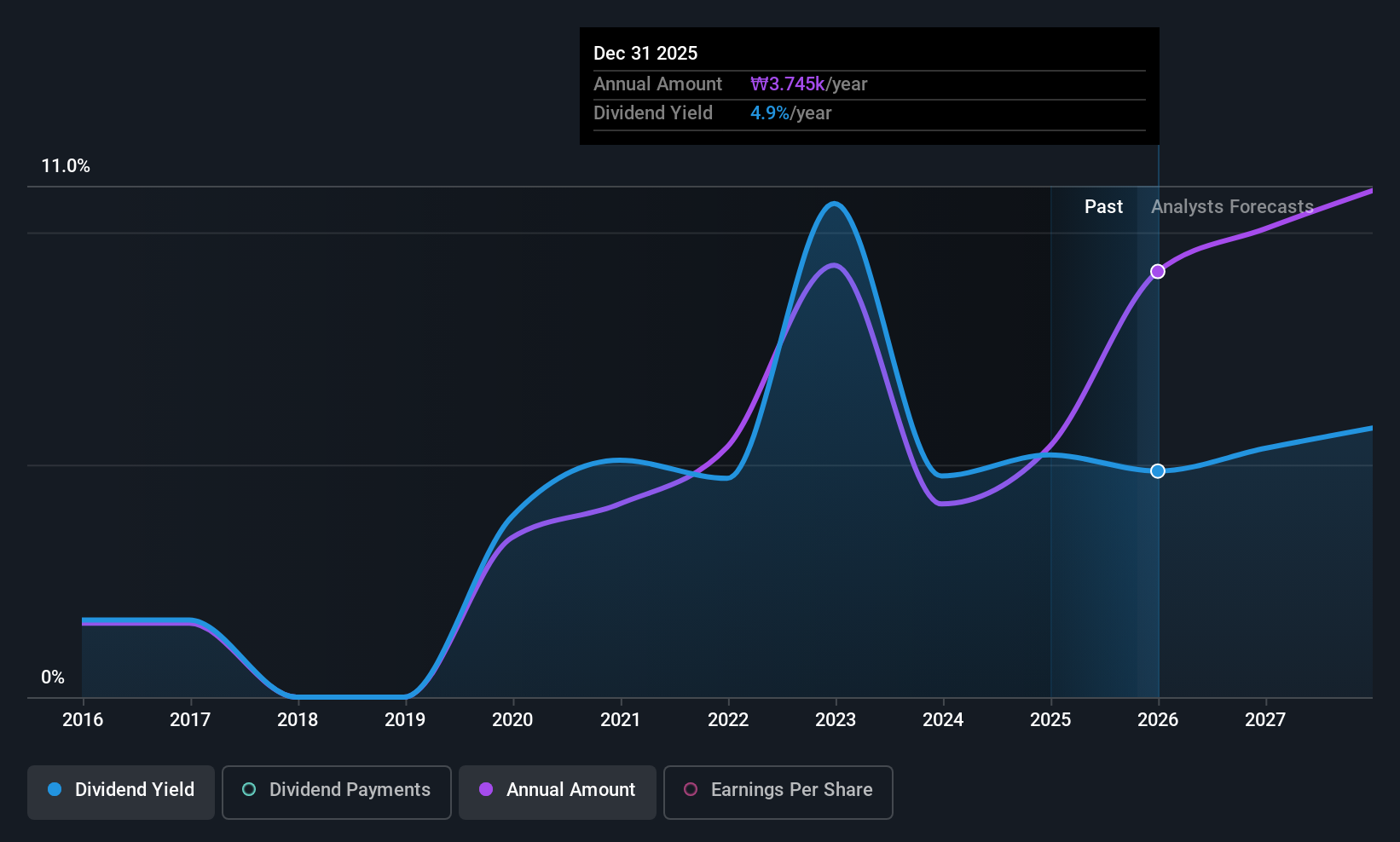

Samsung SecuritiesLtd (KOSE:A016360)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samsung Securities Co., Ltd. is a financial investment company operating in South Korea and internationally, with a market cap of ₩6.64 trillion.

Operations: Samsung Securities Co., Ltd. generates revenue from several segments, including Above Consignment Sale (₩1.57 trillion), Corporate Finance (₩296.71 billion), Operating During the Gift Period (₩161.79 billion), S&T (₩126.84 billion), Self-Trading (₩34.17 billion), and Overseas Sales (₩19.41 billion).

Dividend Yield: 4.5%

Samsung Securities Ltd. offers a dividend yield of 4.46%, placing it in the top 25% of payers in the Korean market, although its dividends have been volatile and not well covered by free cash flows, with a high cash payout ratio of 200.9%. Despite this, earnings are adequately covering dividends with a low payout ratio of 35.9%. Recent strategic partnerships and conference presentations highlight efforts to expand global reach and innovate financial solutions.

- Dive into the specifics of Samsung SecuritiesLtd here with our thorough dividend report.

- Our valuation report unveils the possibility Samsung SecuritiesLtd's shares may be trading at a discount.

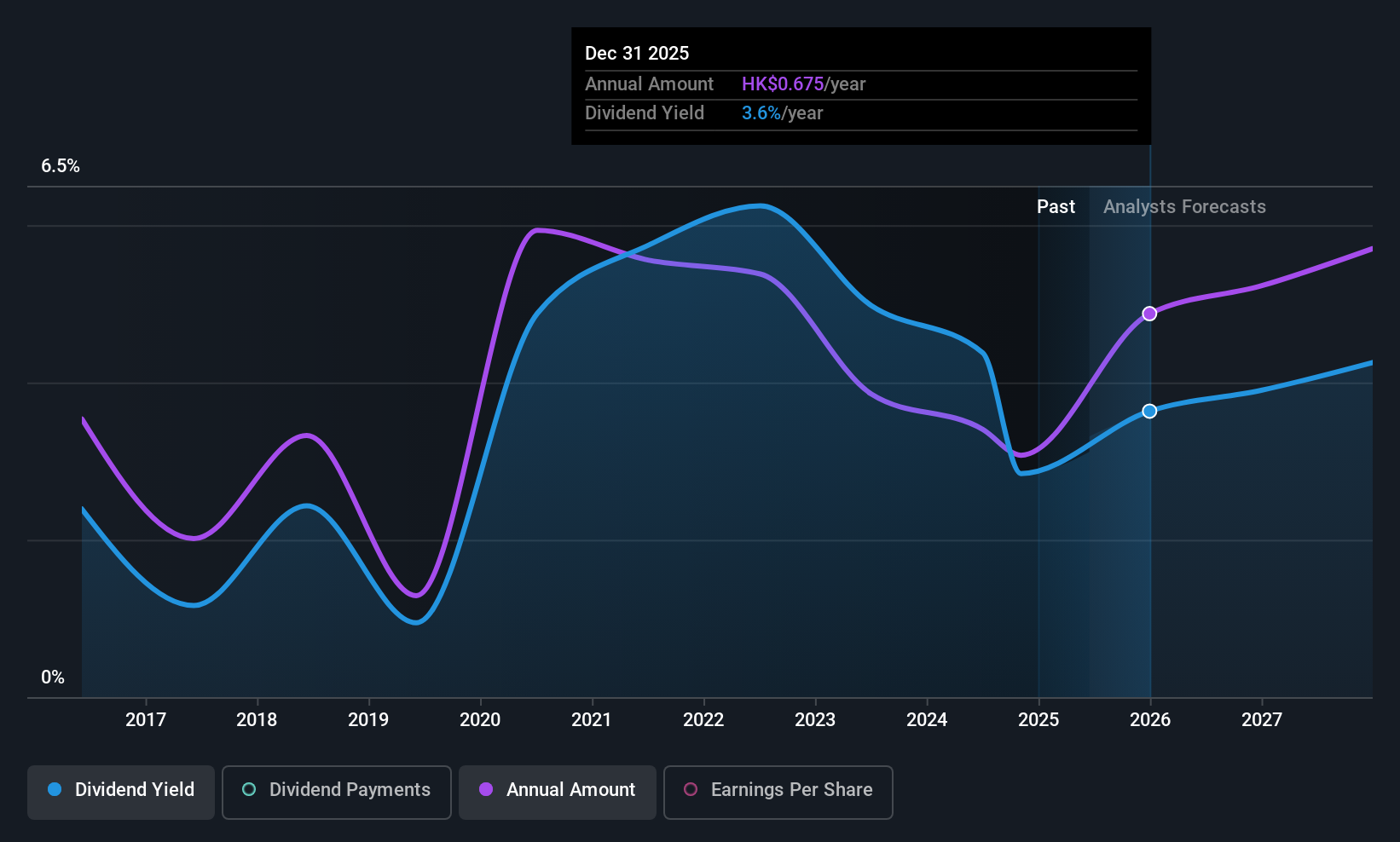

China Life Insurance (SEHK:2628)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Life Insurance Company Limited, along with its subsidiaries, operates as a life insurance provider in the People’s Republic of China with a market cap of approximately HK$1.10 trillion.

Operations: China Life Insurance Company Limited generates revenue through its life insurance business (CN¥220.27 billion), health insurance (CN¥60.02 billion), and accident insurance (CN¥13.79 billion).

Dividend Yield: 3%

China Life Insurance's dividend yield of 3.01% is below the top tier in Hong Kong, yet its dividends are well covered by earnings and cash flows with low payout ratios of 17.7% and 4.6%, respectively. Despite a history of volatile dividends, recent increases suggest potential stability improvements. The company's strategic focus on asset-liability interaction and diversification has led to significant profit growth, enhancing its ability to sustain dividend payments amidst market recovery efforts and investment optimization strategies.

- Delve into the full analysis dividend report here for a deeper understanding of China Life Insurance.

- The analysis detailed in our China Life Insurance valuation report hints at an deflated share price compared to its estimated value.

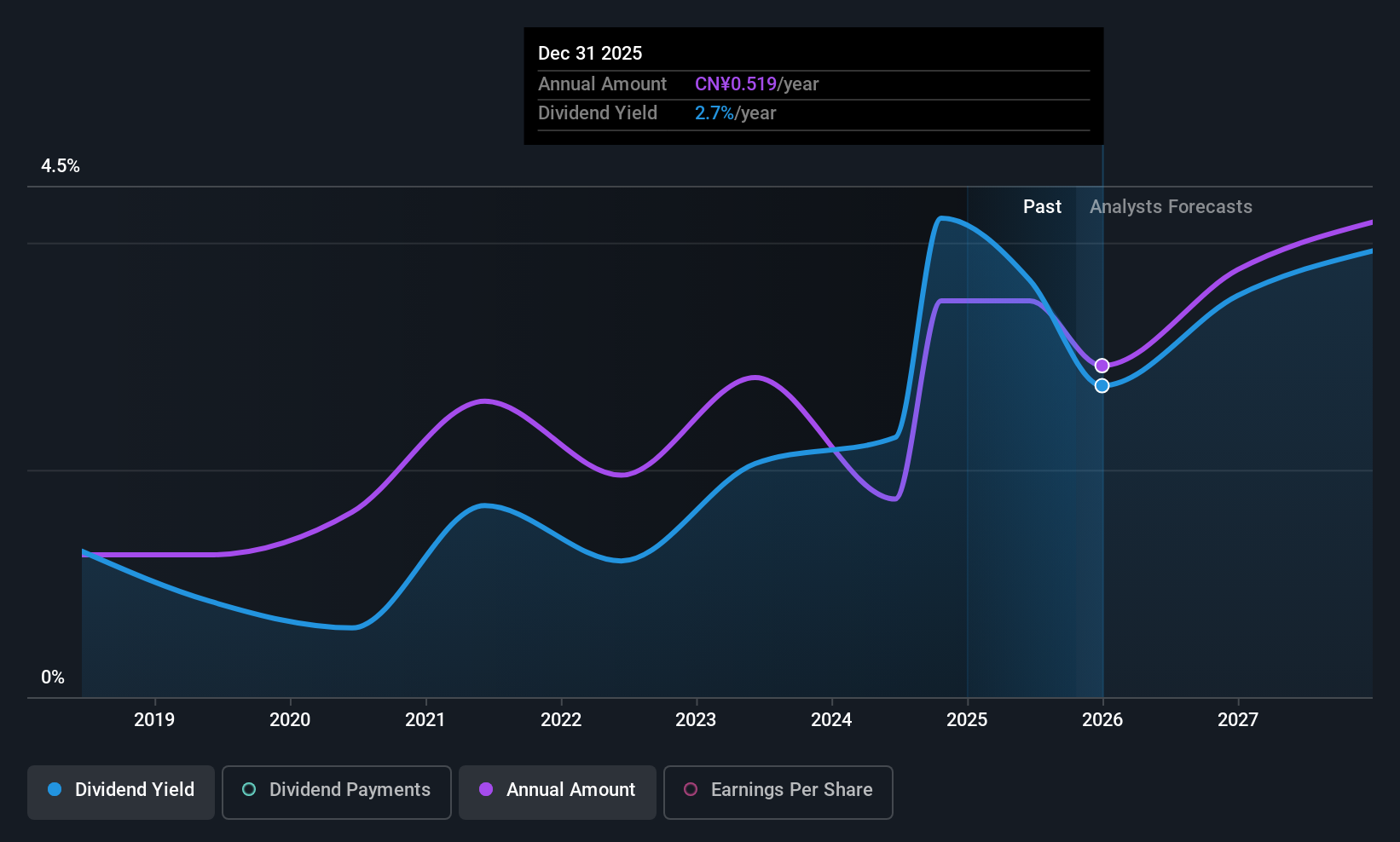

DaShenLin Pharmaceutical Group (SHSE:603233)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DaShenLin Pharmaceutical Group Co., Ltd. is involved in the manufacturing, distribution, and retailing of pharmaceutical products in China, with a market cap of approximately CN¥19.93 billion.

Operations: DaShenLin Pharmaceutical Group generates revenue primarily from its retail segment, which accounts for CN¥21.84 billion, and its franchise and distribution segment, contributing CN¥4.10 billion.

Dividend Yield: 3.7%

DaShenLin Pharmaceutical Group's dividend yield of 3.7% ranks in the top 25% of CN market dividend payers, supported by a reasonable payout ratio of 69.8% and a low cash payout ratio of 20.2%. Despite only seven years of payments and some volatility, recent earnings growth and strong cash flow coverage suggest potential for stability. The company's H1 2025 results showed increased net income to CNY 798.17 million, indicating robust financial performance that may support future dividends.

- Take a closer look at DaShenLin Pharmaceutical Group's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that DaShenLin Pharmaceutical Group is priced lower than what may be justified by its financials.

Where To Now?

- Discover the full array of 1061 Top Asian Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603233

DaShenLin Pharmaceutical Group

Manufactures, distributes, and retails pharmaceutical products in China.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives