- South Korea

- /

- Capital Markets

- /

- KOSE:A005940

What Makes NH Investment & Securities Co., Ltd. (KRX:005940) A Great Dividend Stock?

Could NH Investment & Securities Co., Ltd. (KRX:005940) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

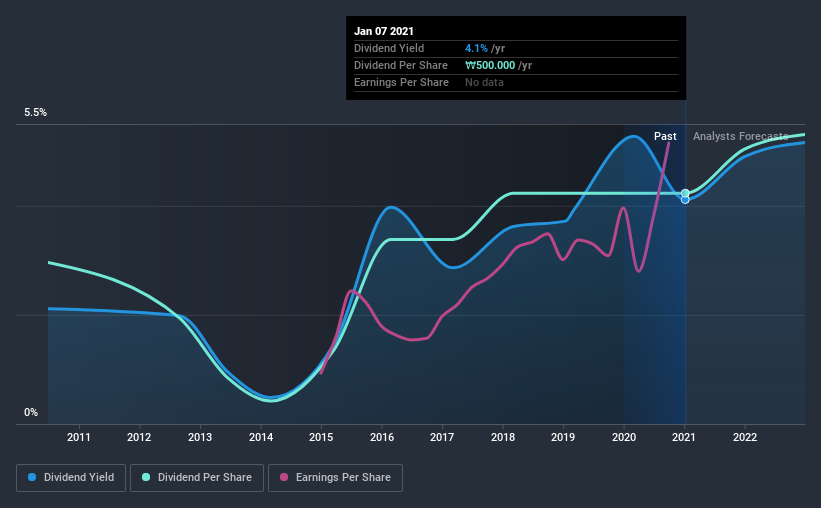

With NH Investment & Securities yielding 4.1% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. We'd guess that plenty of investors have purchased it for the income. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on NH Investment & Securities!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 24% of NH Investment & Securities' profits were paid out as dividends in the last 12 months. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

Remember, you can always get a snapshot of NH Investment & Securities' latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. NH Investment & Securities has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut on at least one occasion historically. During the past 10-year period, the first annual payment was ₩350 in 2011, compared to ₩500 last year. This works out to be a compound annual growth rate (CAGR) of approximately 3.6% a year over that time. NH Investment & Securities' dividend payments have fluctuated, so it hasn't grown 3.6% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's good to see NH Investment & Securities has been growing its earnings per share at 18% a year over the past five years. Rapid earnings growth and a low payout ratio suggests this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that NH Investment & Securities has a low and conservative payout ratio. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. NH Investment & Securities has a number of positive attributes, but falls short of our ideal dividend company. It may be worth a look at the right price, though.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 4 warning signs for NH Investment & Securities (of which 2 are potentially serious!) you should know about.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you decide to trade NH Investment & Securities, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade NH Investment & Securities, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NH Investment & Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A005940

NH Investment & Securities

Engages in the wealth management, investment banking, trading, and equity sales businesses in South Korea and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives