- South Korea

- /

- Capital Markets

- /

- KOSE:A005940

Discover 3 Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core inflation in the U.S. and strong bank earnings, investors are increasingly looking for stability and income in their portfolios. Dividend stocks can offer such benefits, providing regular income streams while potentially capitalizing on market upswings.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

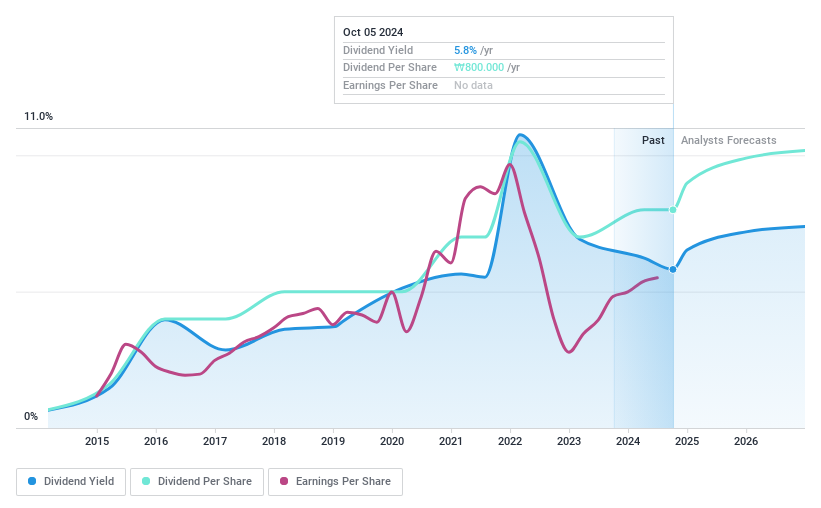

NH Investment & Securities (KOSE:A005940)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NH Investment & Securities Co., Ltd. operates in wealth management, investment banking, trading, and equity sales both in South Korea and internationally, with a market cap of ₩4.88 trillion.

Operations: NH Investment & Securities generates revenue from sales (₩2.84 billion), trading (₩1.83 billion), and investment banking (₩1.00 billion).

Dividend Yield: 5.6%

NH Investment & Securities' dividend yield of 5.63% ranks in the top 25% of the Korean market, yet it is not well covered by free cash flow, raising sustainability concerns. Despite a low payout ratio of 42%, dividends have been volatile over the past decade. Recent earnings growth shows improvement, with net income rising to KRW 153.95 billion for Q3 2024, but non-cash earnings and lack of free cash flow coverage remain challenges for dividend reliability.

- Get an in-depth perspective on NH Investment & Securities' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, NH Investment & Securities' share price might be too pessimistic.

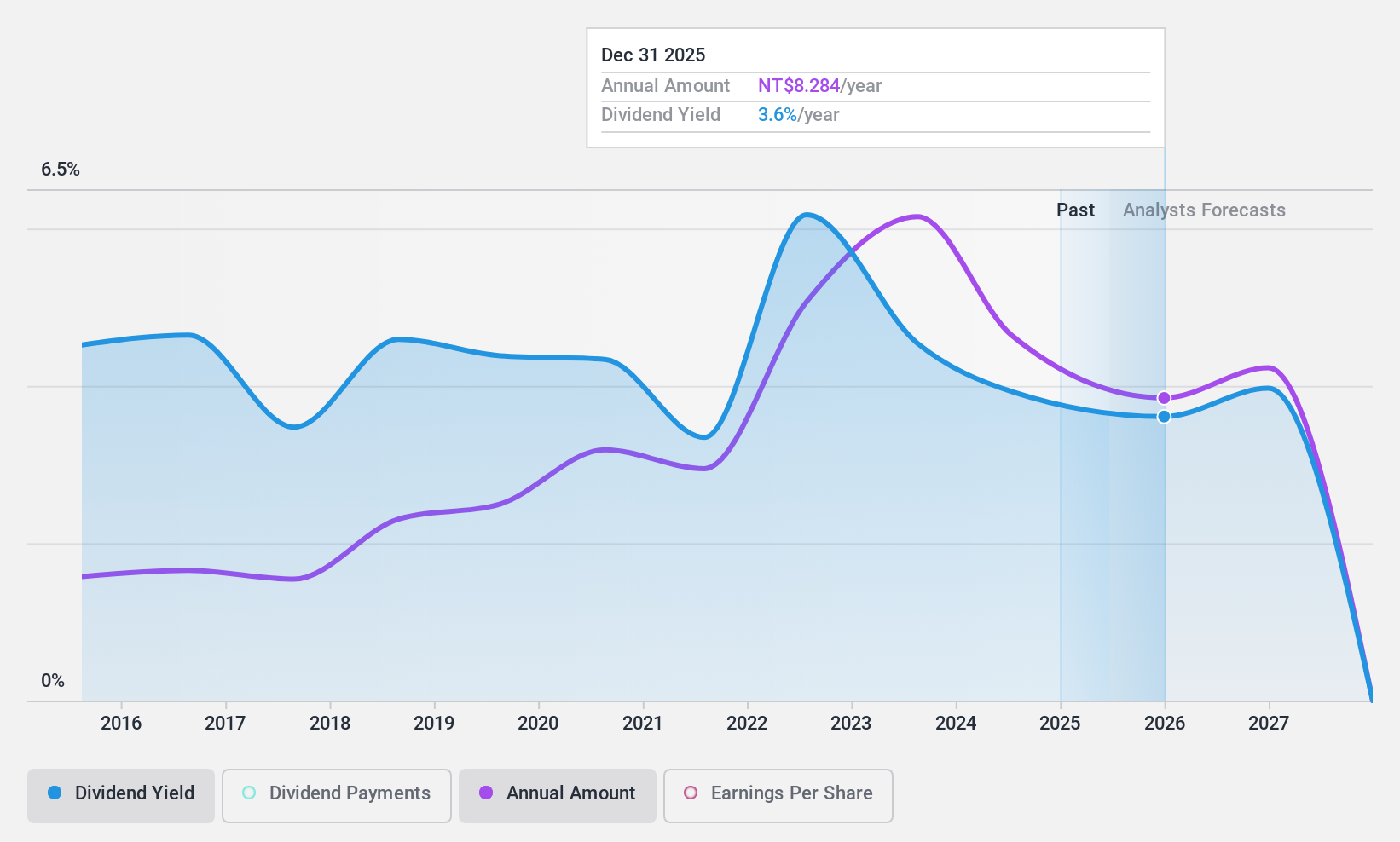

Innodisk (TPEX:5289)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Innodisk Corporation focuses on the research, development, manufacturing, and sales of industrial embedded storage devices across various international markets, with a market cap of NT$19.45 billion.

Operations: Innodisk Corporation generates revenue from the research and development of various industrial memory storage devices amounting to NT$8.82 billion.

Dividend Yield: 4.7%

Innodisk's dividend yield of 4.69% is among the top 25% in Taiwan but isn't supported by free cash flow, questioning its sustainability. The payout ratio stands at 82.3%, indicating coverage by earnings, yet past dividends have been volatile and unreliable over a decade. Recent Q3 results show increased sales to TWD 2.32 billion, though net income declined to TWD 188.62 million from TWD 306.46 million last year, highlighting potential earnings pressure on future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Innodisk.

- Our expertly prepared valuation report Innodisk implies its share price may be lower than expected.

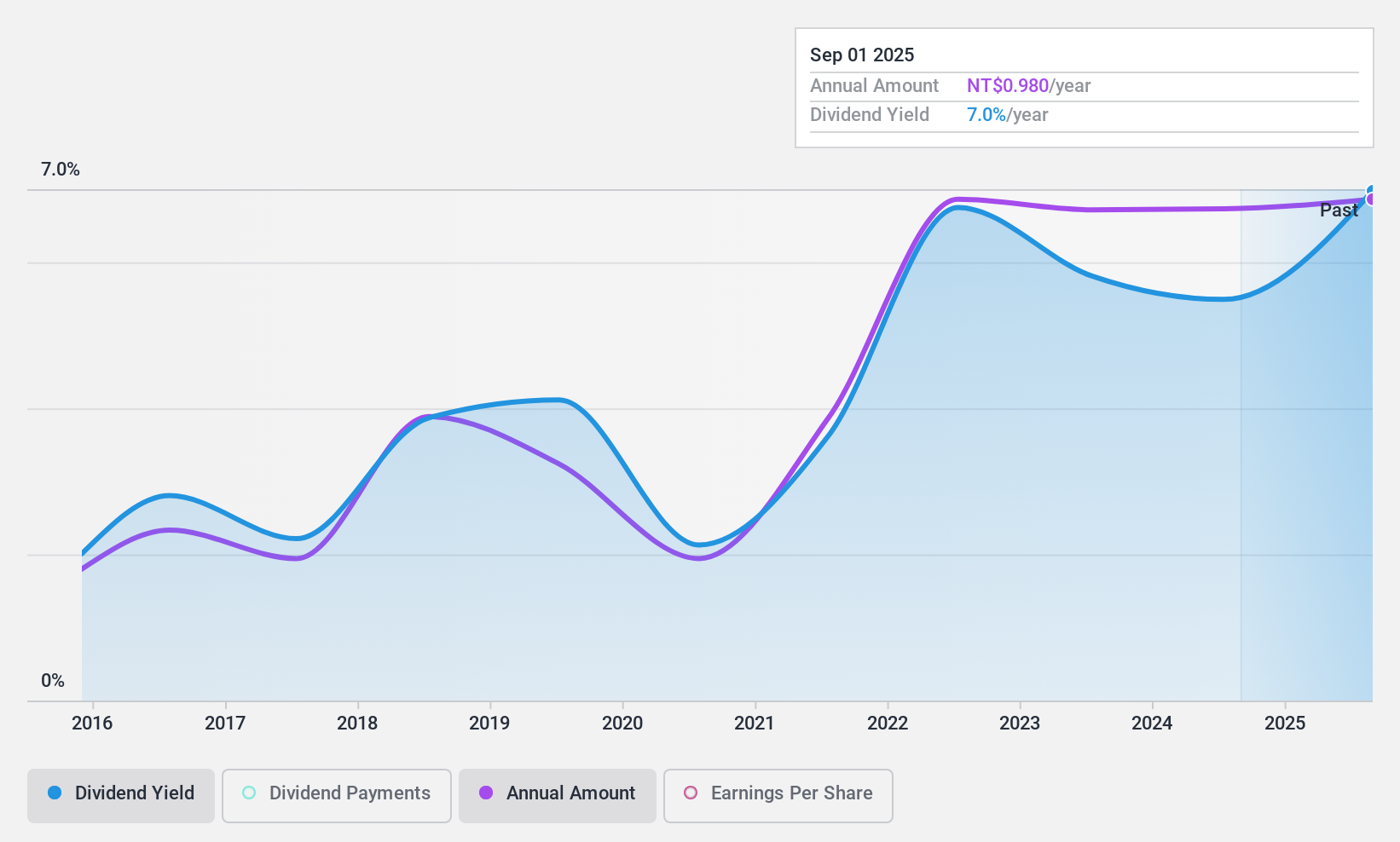

Yem Chio (TWSE:4306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yem Chio Co., Ltd. is involved in the research, design, manufacture, processing, trading, and sale of packaging materials both in Taiwan and internationally, with a market cap of NT$10.97 billion.

Operations: Yem Chio Co., Ltd.'s revenue segments include NT$3.61 billion from the Property Division, NT$0.44 billion from the Special Chemicals Department, NT$13.42 billion from the Tape Manufacturing Department, and NT$1.42 billion from the Packaging Material Path Department (excluding Tape Manufacturing).

Dividend Yield: 5.8%

Yem Chio offers a dividend yield of 5.77%, ranking in the top 25% of Taiwan's market, but it's not backed by free cash flow, raising sustainability concerns. The payout ratio is reasonable at 60.1%, suggesting coverage by earnings despite past volatility and unreliability in dividends over a decade. Earnings grew by 55.5% recently, yet debt isn't well covered by operating cash flow, which could impact future dividend stability and growth prospects.

- Navigate through the intricacies of Yem Chio with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Yem Chio's current price could be quite moderate.

Next Steps

- Delve into our full catalog of 1981 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NH Investment & Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005940

NH Investment & Securities

Engages in the wealth management, investment banking, trading, and equity sales businesses in South Korea and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives