- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A293580

Shareholders Should Be Pleased With NAU IB Capital's (KOSDAQ:293580) Price

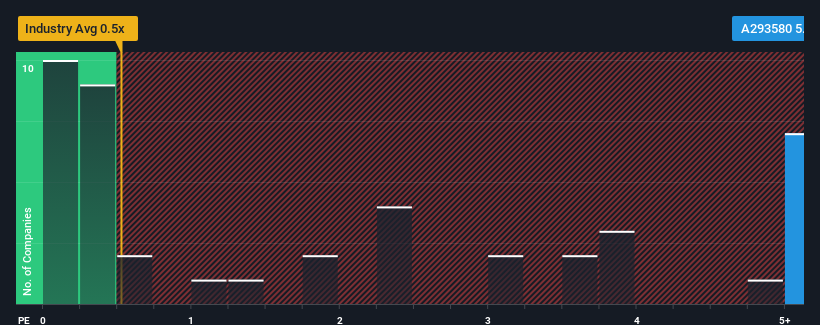

When close to half the companies in the Capital Markets industry in Korea have price-to-sales ratios (or "P/S") below 0.5x, you may consider NAU IB Capital (KOSDAQ:293580) as a stock to avoid entirely with its 5.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for NAU IB Capital

How NAU IB Capital Has Been Performing

NAU IB Capital has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on NAU IB Capital's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For NAU IB Capital?

In order to justify its P/S ratio, NAU IB Capital would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 71% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 53% shows it's a great look while it lasts.

In light of this, it's understandable that NAU IB Capital's P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As detailed previously, the strength of NAU IB Capital's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

Before you settle on your opinion, we've discovered 4 warning signs for NAU IB Capital that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NAU IB Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A293580

NAU IB Capital

Operates as a technology business finance company in South Korea.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives