- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A064850

FnGuide Inc.'s (KOSDAQ:064850) Shares Bounce 31% But Its Business Still Trails The Market

FnGuide Inc. (KOSDAQ:064850) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

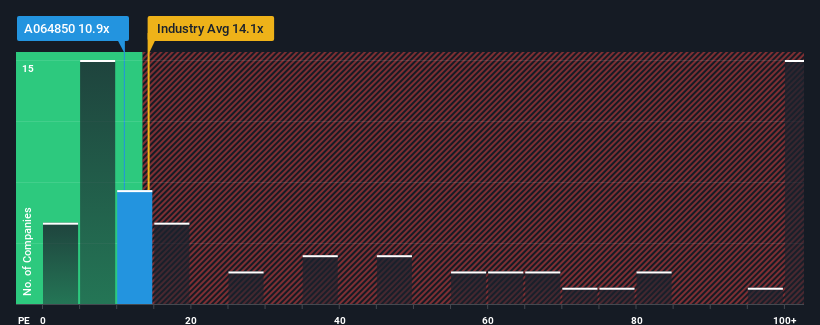

Although its price has surged higher, FnGuide may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.9x, since almost half of all companies in Korea have P/E ratios greater than 13x and even P/E's higher than 27x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We'd have to say that with no tangible growth over the last year, FnGuide's earnings have been unimpressive. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for FnGuide

How Is FnGuide's Growth Trending?

In order to justify its P/E ratio, FnGuide would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period has seen an excellent 48% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 28% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why FnGuide is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Despite FnGuide's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of FnGuide revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for FnGuide you should be aware of.

If these risks are making you reconsider your opinion on FnGuide, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A064850

FnGuide

Engages in development and provision of programs related to securities investment information and financial information.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives