- China

- /

- Trade Distributors

- /

- SHSE:600822

Discovering Undiscovered Gems in Global Markets This July 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by new tariffs and mixed economic signals, the tech-heavy Nasdaq Composite has demonstrated resilience, while small-cap stocks have shown little differentiation in performance compared to their larger counterparts. In this environment, identifying promising opportunities requires a keen eye for companies that can thrive despite external pressures and leverage growth potential effectively.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| TOT BIOPHARM International | 54.00% | 61.14% | 50.47% | ★★★★★☆ |

| Forth Smart Service | 51.94% | -6.63% | -7.91% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Woori Technology Investment (KOSDAQ:A041190)

Simply Wall St Value Rating: ★★★★★★

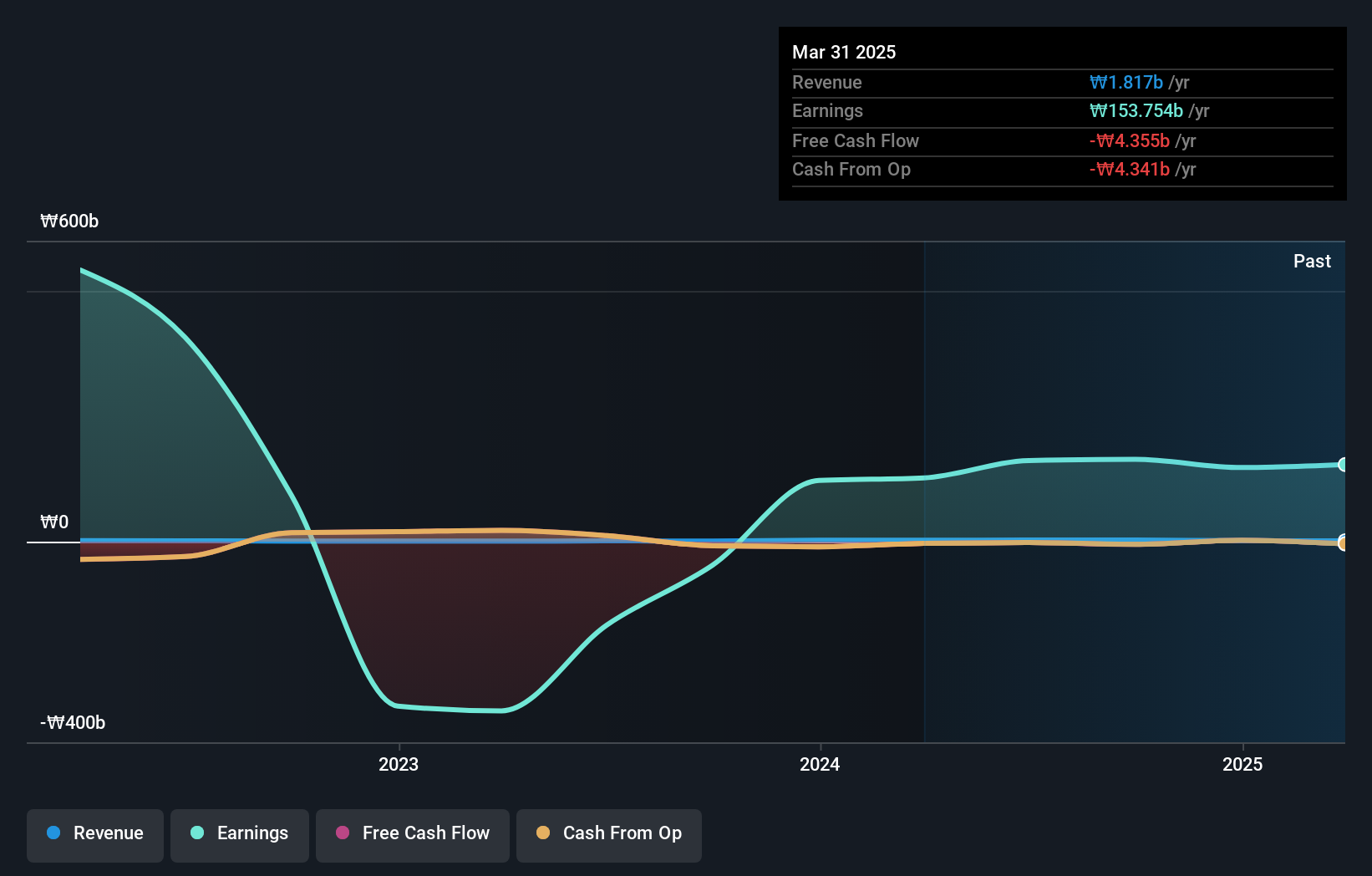

Overview: Woori Technology Investment Co., Ltd. is a venture capital firm that focuses on venture funds, mezzanine funds, project funds, and investments in small and medium-sized companies, with a market cap of approximately ₩929 billion.

Operations: The primary revenue stream for Woori Technology Investment comes from its financial services, generating approximately ₩1.82 billion. The company has a market cap of around ₩929 billion.

Woori Technology Investment, with a market presence that might not be on everyone's radar, is trading at 55% below its estimated fair value, suggesting potential undervaluation. Despite being debt-free for the past five years, its earnings growth of 21% over the last year slightly lags behind the industry average of 22%. The company showcases high-quality past earnings but faces challenges with declining earnings by 3.8% annually over five years and volatile share prices recently. Its revenue remains modest at ₩2 billion (US$1.54 million), highlighting room for expansion in this niche segment.

Shanghai Material Trading (SHSE:600822)

Simply Wall St Value Rating: ★★★★☆☆

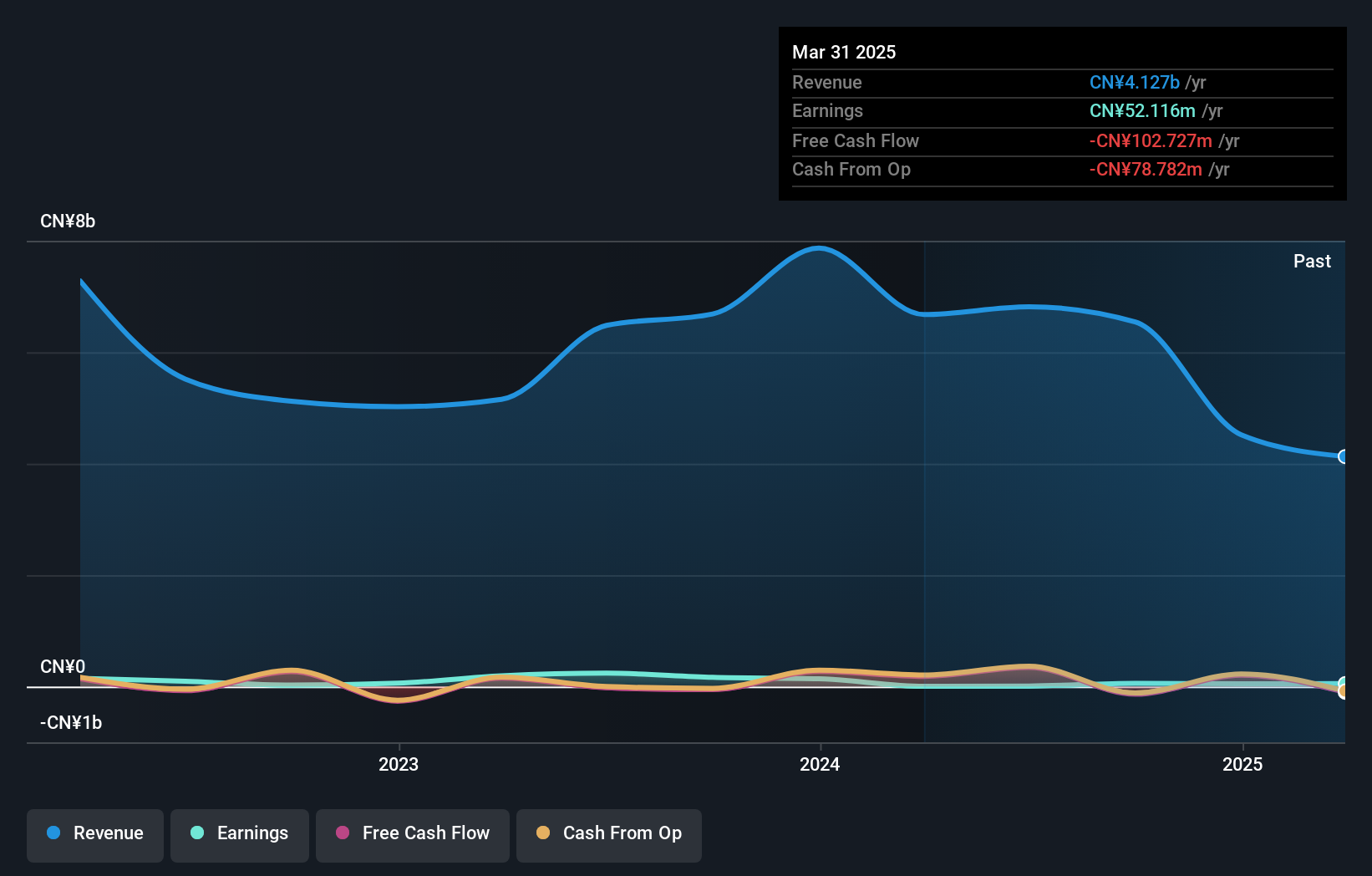

Overview: Shanghai Material Trading Co., Ltd. operates in the wholesale and retail sectors, focusing on production materials for the automobile and chemical industries both domestically in China and internationally, with a market cap of CN¥4.63 billion.

Operations: Shanghai Material Trading generates revenue primarily from the wholesale and retail of production materials for the automobile and chemical industries. The company has a market capitalization of CN¥4.63 billion, indicating its substantial presence in both domestic and international markets.

Shanghai Material Trading has shown notable earnings growth, with a staggering 898% increase over the past year, outpacing its industry peers. Despite this impressive figure, the company's sales have seen a dip, from CNY 7.87 billion to CNY 4.52 billion in the last financial year. The debt situation appears favorable as well; their debt-to-equity ratio has significantly improved from 31.7% to just 3.6% over five years, indicating better financial management and reduced leverage risks. Net income for Q1 was CNY 6.74 million compared to CNY 5.16 million previously, reflecting some resilience amid revenue challenges.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Material Trading.

Learn about Shanghai Material Trading's historical performance.

YOUNGY (SZSE:002192)

Simply Wall St Value Rating: ★★★★★★

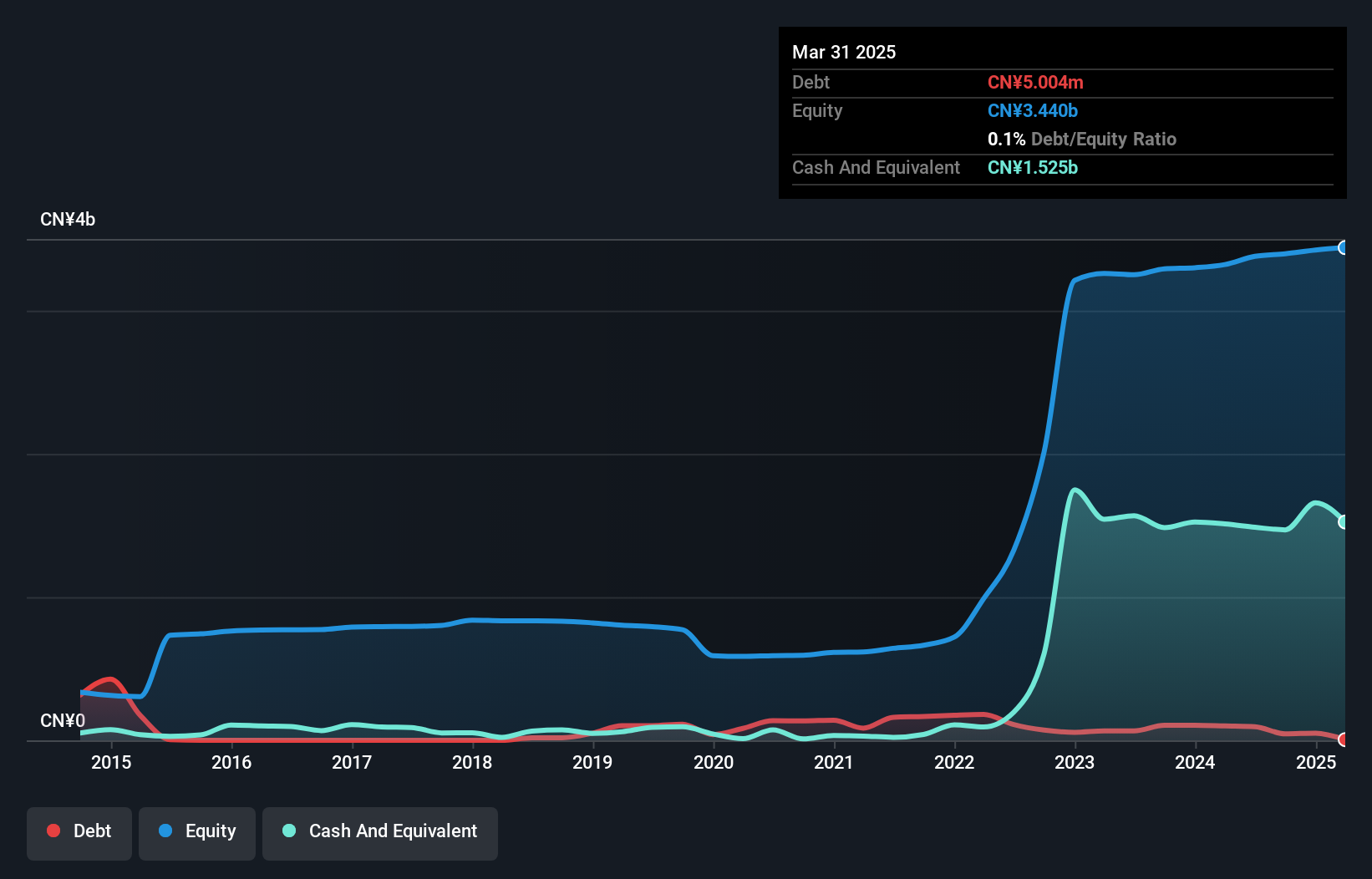

Overview: YOUNGY Co., Ltd. operates in the lithium energy industry with a market cap of CN¥8.17 billion.

Operations: Revenue streams for SZSE:002192 primarily derive from its activities in the lithium energy sector. The company's financial performance is highlighted by a net profit margin of 12.5%, reflecting its profitability after accounting for all expenses.

Youngy, a smaller player in the market, has shown some financial resilience despite recent challenges. Over the past five years, its debt-to-equity ratio impressively decreased from 14.2% to just 0.1%, indicating strong financial management. While it boasts high-quality earnings and more cash than total debt, its recent performance saw a dip with net income for Q1 2025 at CNY 20 million compared to CNY 28 million last year. Despite sales increasing to CNY 95 million from CNY 82 million year-over-year, Youngy's earnings growth was negative at -40.2%, contrasting with industry trends of -4.1%.

- Click to explore a detailed breakdown of our findings in YOUNGY's health report.

Gain insights into YOUNGY's past trends and performance with our Past report.

Turning Ideas Into Actions

- Reveal the 3155 hidden gems among our Global Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600822

Shanghai Material Trading

Engages in the wholesale and retail of production materials for automobile and chemicals in China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives