- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A036120

Why Investors Shouldn't Be Surprised By SCI Information Service Inc.'s (KOSDAQ:036120) P/S

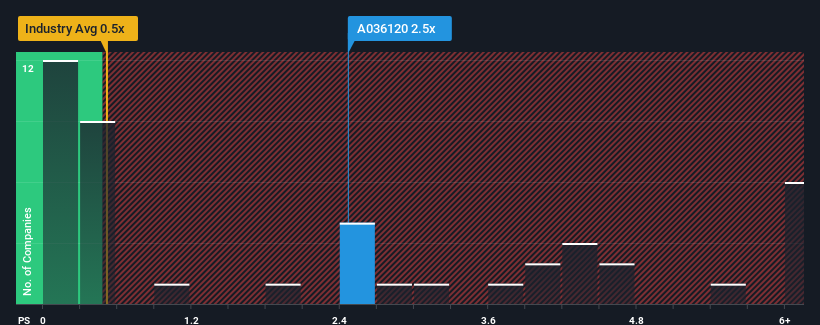

When you see that almost half of the companies in the Capital Markets industry in Korea have price-to-sales ratios (or "P/S") below 0.5x, SCI Information Service Inc. (KOSDAQ:036120) looks to be giving off some sell signals with its 2.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for SCI Information Service

What Does SCI Information Service's Recent Performance Look Like?

For example, consider that SCI Information Service's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SCI Information Service's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For SCI Information Service?

There's an inherent assumption that a company should outperform the industry for P/S ratios like SCI Information Service's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 54% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

With this in consideration, it's no surprise that SCI Information Service's P/S exceeds that of its industry peers. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From SCI Information Service's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of SCI Information Service revealed its narrower three-year contraction in revenue is contributing to its higher than industry P/S, given the industry is set to shrink even more. At this stage investors feel the potential for outperformance relative to the industry justifies a premium on the P/S ratio. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its outlook remains more positive than the rest of its peers.

You should always think about risks. Case in point, we've spotted 5 warning signs for SCI Information Service you should be aware of, and 3 of them shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A036120

Seoul Information Service

Provides credit information services in South Korea.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026