- South Korea

- /

- Hospitality

- /

- KOSE:A035250

Top 3 KRX Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

Over the past 7 days, the South Korean market has risen by 1.6%, contributing to a robust 12% climb over the last year, with earnings forecasted to grow by 30% annually. In this promising environment, selecting dividend stocks that offer consistent payouts and potential for capital appreciation can be an effective strategy for investors seeking steady income and growth opportunities.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.95% | ★★★★★★ |

| Shinhan Financial Group (KOSE:A055550) | 3.85% | ★★★★★☆ |

| Kangwon Land (KOSE:A035250) | 5.25% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.54% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.31% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.51% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.56% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.62% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.00% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.50% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top KRX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Samhwa Paints Industrial (KOSE:A000390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samhwa Paints Industrial Co., Ltd. manufactures and sells various paints in South Korea and internationally, with a market cap of ₩174.10 billion.

Operations: Samhwa Paints Industrial Co., Ltd.'s revenue primarily comes from its Paints and Chemicals segment, contributing ₩657.78 billion, followed by the IT segment with ₩8.73 billion.

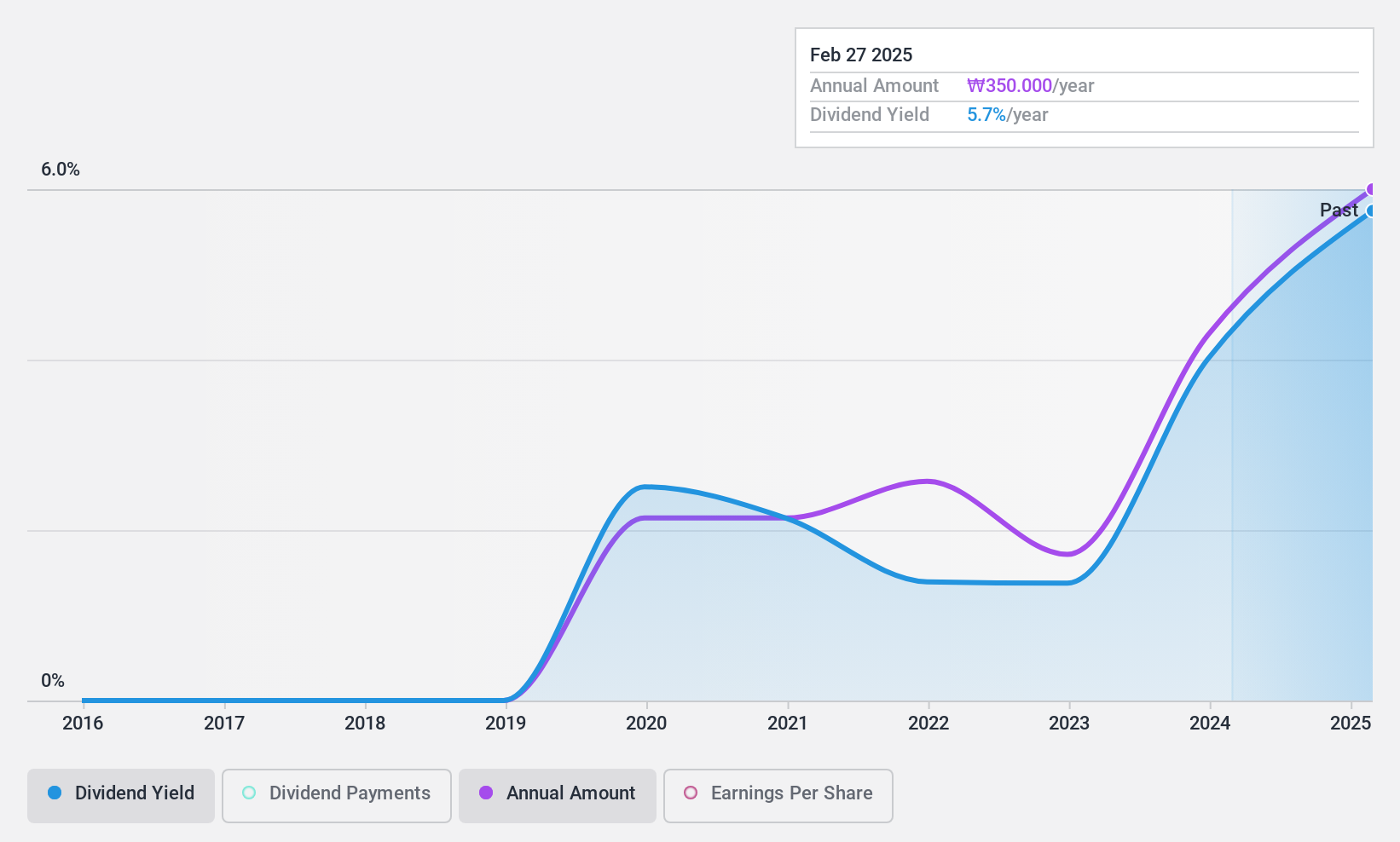

Dividend Yield: 5.4%

Samhwa Paints Industrial's dividend yield of 5.42% ranks in the top 25% of South Korea's market, supported by a low payout ratio of 47.5% and cash payout ratio of 29.9%, indicating strong coverage by earnings and cash flows. However, its dividend history is less than a decade old with volatility and unreliability noted over the past five years. The company's price-to-earnings ratio at 8.8x suggests attractive valuation compared to the broader market average of 11.1x.

- Dive into the specifics of Samhwa Paints Industrial here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Samhwa Paints Industrial is trading beyond its estimated value.

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai G.F. Holdings Co., Ltd. operates in the rental and investment sectors, with a market capitalization of approximately ₩702.35 billion.

Operations: Hyundai G.F. Holdings Co., Ltd. focuses on rental and investment activities.

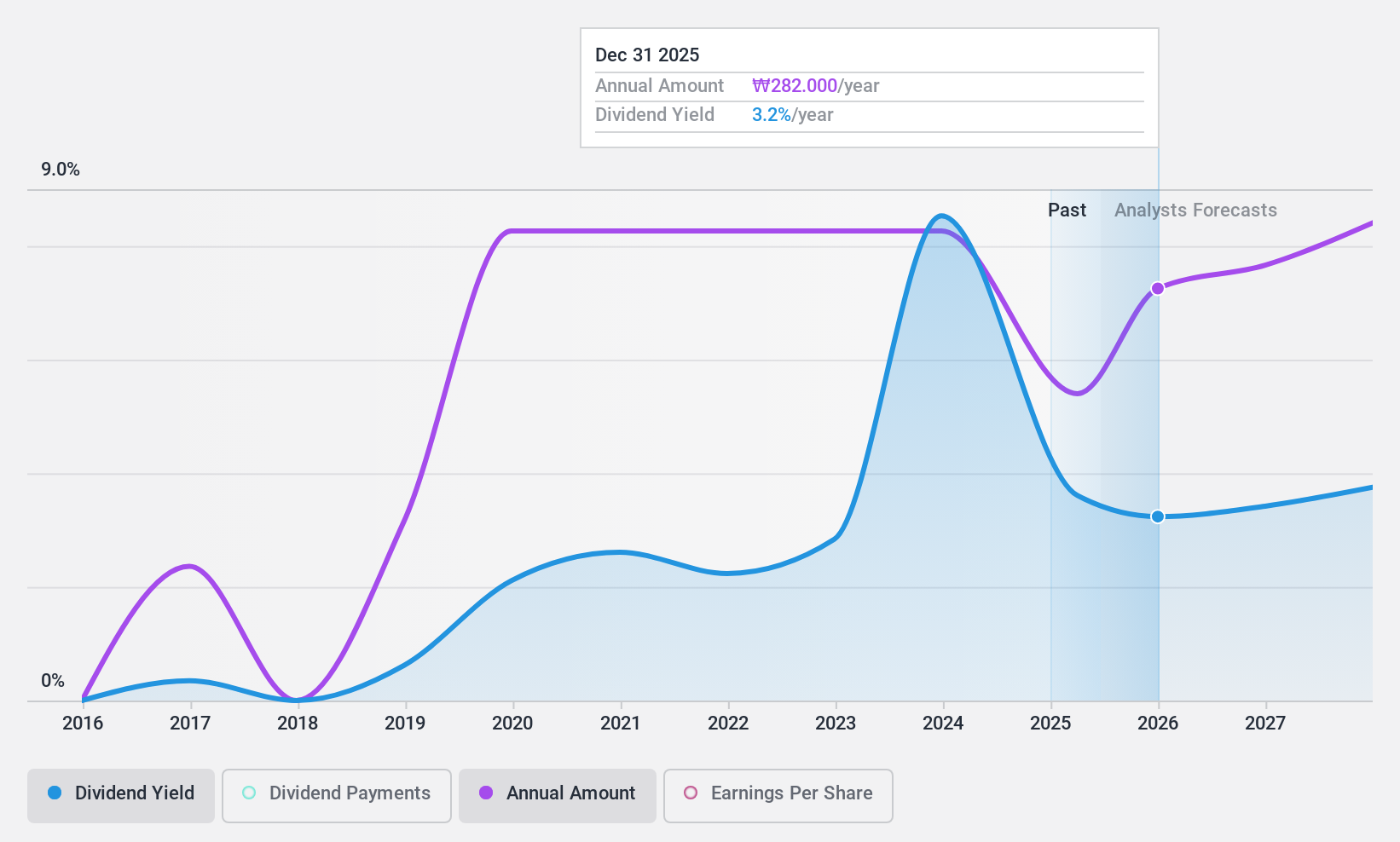

Dividend Yield: 4.4%

Hyundai G.F. Holdings offers a dividend yield of 4.44%, placing it among the top 25% of dividend payers in South Korea, with robust coverage by earnings and cash flows, evidenced by low payout ratios of 1.8% and 27.2%, respectively. However, its dividend history is under a decade with noted volatility and unreliability over nine years, despite recent increases in payments. The stock trades significantly below its estimated fair value, suggesting potential undervaluation opportunities for investors.

- Click to explore a detailed breakdown of our findings in Hyundai G.F. Holdings' dividend report.

- The analysis detailed in our Hyundai G.F. Holdings valuation report hints at an deflated share price compared to its estimated value.

Kangwon Land (KOSE:A035250)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kangwon Land, Inc. operates in the casino, tourist hotel, and ski resorts sectors in South Korea with a market cap of ₩3.59 trillion.

Operations: Kangwon Land, Inc.'s revenue primarily comes from its Casinos & Resorts segment, totaling ₩1.41 trillion.

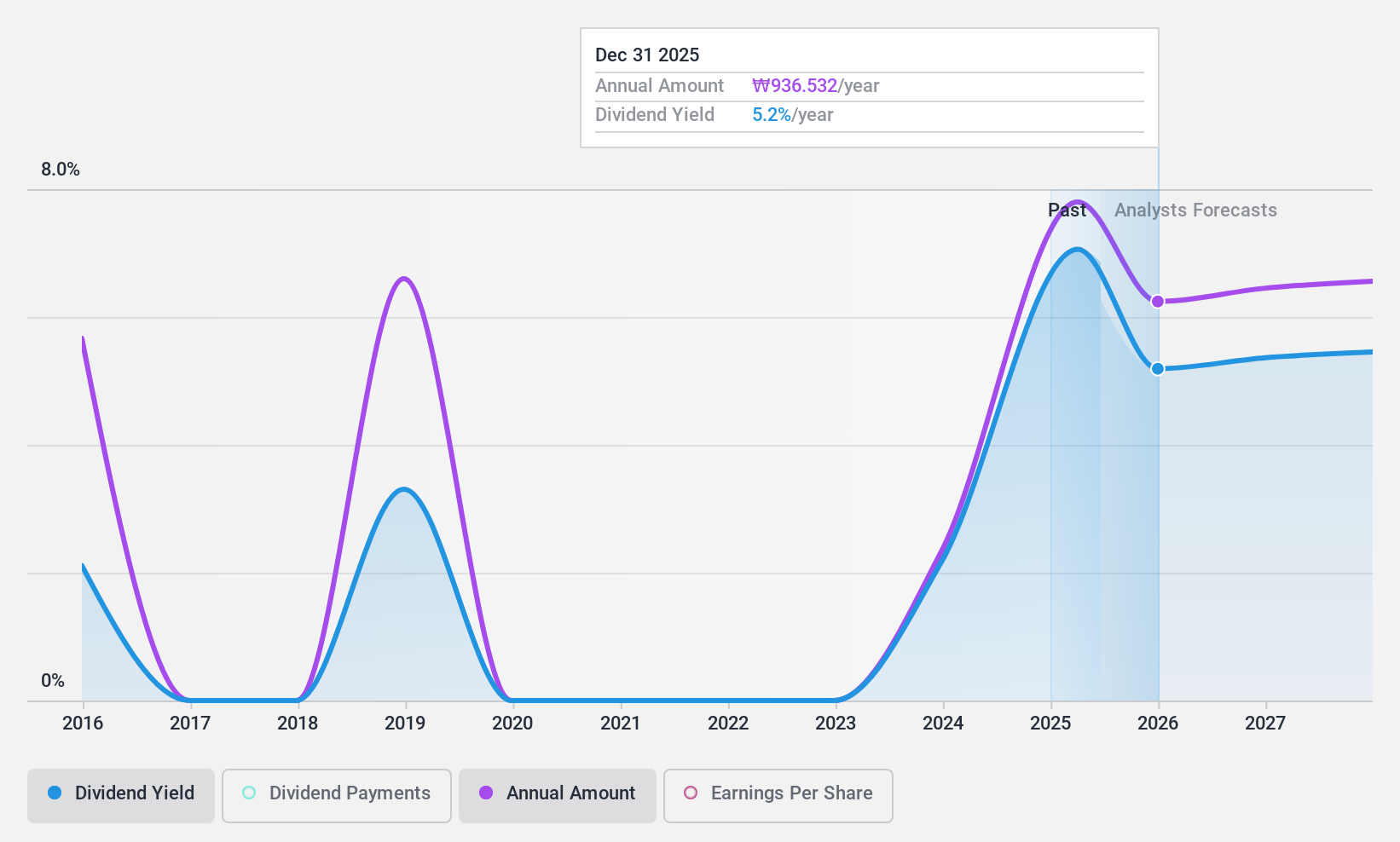

Dividend Yield: 5.3%

Kangwon Land's dividend yield of 5.25% ranks it in the top 25% among South Korean dividend stocks, with a payout ratio of 46.9%, indicating solid earnings coverage, though cash flow coverage is higher at 77.6%. Despite recent earnings growth and a share buyback plan to enhance shareholder value, its dividends have been volatile over the past decade, lacking stability and reliability. The stock trades at an attractive valuation with a P/E ratio below the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Kangwon Land.

- Our expertly prepared valuation report Kangwon Land implies its share price may be lower than expected.

Turning Ideas Into Actions

- Reveal the 75 hidden gems among our Top KRX Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kangwon Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A035250

Kangwon Land

Engages in the casino, tourist hotel, and ski resorts businesses in South Korea.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives