- Philippines

- /

- Food and Staples Retail

- /

- PSE:SEVN

MegaStudyEdu Leads These 3 Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets experienced some turbulence, with major indices like the Nasdaq Composite and S&P MidCap 400 hitting record highs before retreating. Amidst this volatility, dividend stocks can offer stability through consistent income streams, which may be appealing to investors seeking refuge from market fluctuations. As such, identifying robust dividend stocks becomes crucial in navigating these uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2033 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

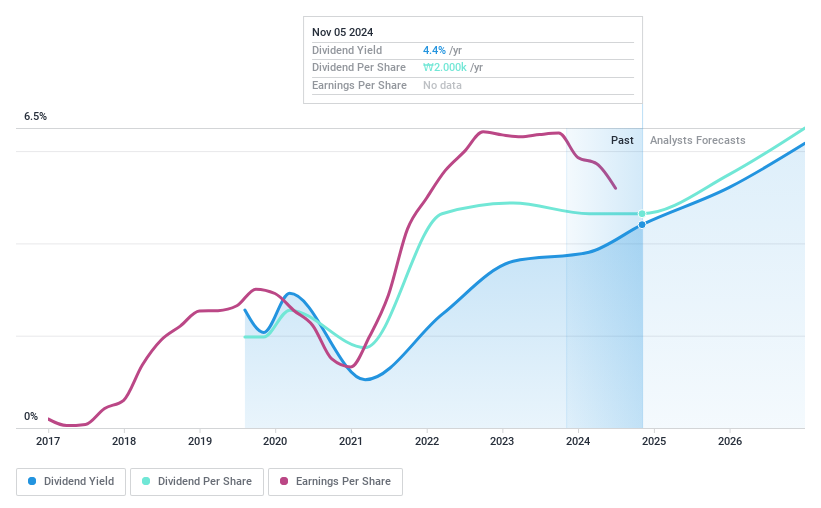

MegaStudyEdu (KOSDAQ:A215200)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MegaStudyEdu Co. Ltd. offers online and offline educational services in South Korea, with a market cap of ₩490.82 billion.

Operations: MegaStudyEdu Co. Ltd.'s revenue segments include High School education at ₩591.27 billion, Elementary and Middle School education at ₩216.85 billion, University education at ₩76.42 billion, and Employment services generating ₩57.27 billion.

Dividend Yield: 4.5%

MegaStudyEdu's dividend yield of 4.46% places it in the top 25% of dividend payers in the KR market, with a low cash payout ratio of 19.9%, indicating strong coverage by cash flows and earnings (payout ratio: 27.8%). However, its dividend history is less than ten years and has been volatile, with significant annual drops over 20%. Recent buybacks totaling KRW 9.99 billion may support future stability but don't guarantee reliability.

- Click to explore a detailed breakdown of our findings in MegaStudyEdu's dividend report.

- The analysis detailed in our MegaStudyEdu valuation report hints at an deflated share price compared to its estimated value.

Philippine Seven (PSE:SEVN)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Philippine Seven Corporation operates convenience stores in the Philippines and has a market cap of ₱119.51 billion.

Operations: Philippine Seven Corporation generates revenue of ₱86.14 billion from its store operations segment.

Dividend Yield: 6.1%

Philippine Seven's dividend yield of 6.08% is below the top tier in the PH market, and its high payout ratio of 196.3% indicates dividends are not covered by earnings, though cash flows cover it at a more reasonable 69.7%. Despite earnings growth of 36.3% last year and recent revenue increases to PHP 23.07 billion, dividends have been volatile over the past decade, with unreliable payments affecting their stability for investors seeking consistent returns.

- Click here to discover the nuances of Philippine Seven with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Philippine Seven is trading beyond its estimated value.

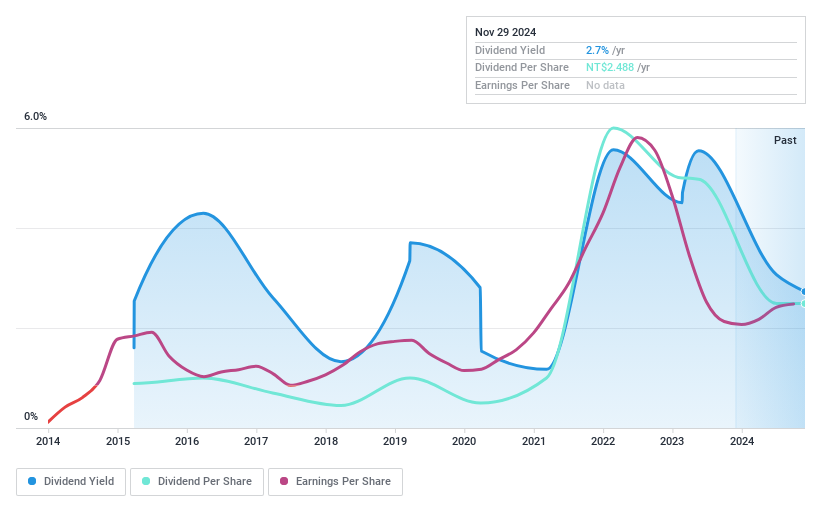

Advanced Power Electronics (TWSE:8261)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Advanced Power Electronics Co., Ltd. supplies metal oxide semiconductor field effect transistors (MOSFET) components across multiple continents, with a market cap of NT$9.85 billion.

Operations: Advanced Power Electronics Co., Ltd. generates revenue of NT$2.80 billion from its Electronic Components & Parts segment.

Dividend Yield: 3%

Advanced Power Electronics' dividend yield of 2.99% is lower than Taiwan's top tier, with a history of volatility and unreliability over the past decade. Despite this, dividends are well covered by earnings and cash flows, with payout ratios at 68.6% and 34.8%, respectively. The company's price-to-earnings ratio of 23.1x offers good value compared to the industry average, though its unstable dividend track record may concern investors seeking consistent returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Advanced Power Electronics.

- Insights from our recent valuation report point to the potential overvaluation of Advanced Power Electronics shares in the market.

Key Takeaways

- Reveal the 2033 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SEVN

Solid track record with excellent balance sheet.