- South Korea

- /

- Hospitality

- /

- KOSDAQ:A104620

The Yellow Balloon Tour (KOSDAQ:104620) Share Price Has Gained 57% And Shareholders Are Hoping For More

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Yellow Balloon Tour Co., Ltd. (KOSDAQ:104620) share price is up 57% in the last year, clearly besting the market return of around 35% (not including dividends). So that should have shareholders smiling. We'll need to follow Yellow Balloon Tour for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Yellow Balloon Tour

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Yellow Balloon Tour saw its earnings per share (EPS) drop below zero. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

We are skeptical of the suggestion that the 0.8% dividend yield would entice buyers to the stock. Yellow Balloon Tour's revenue actually dropped 50% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

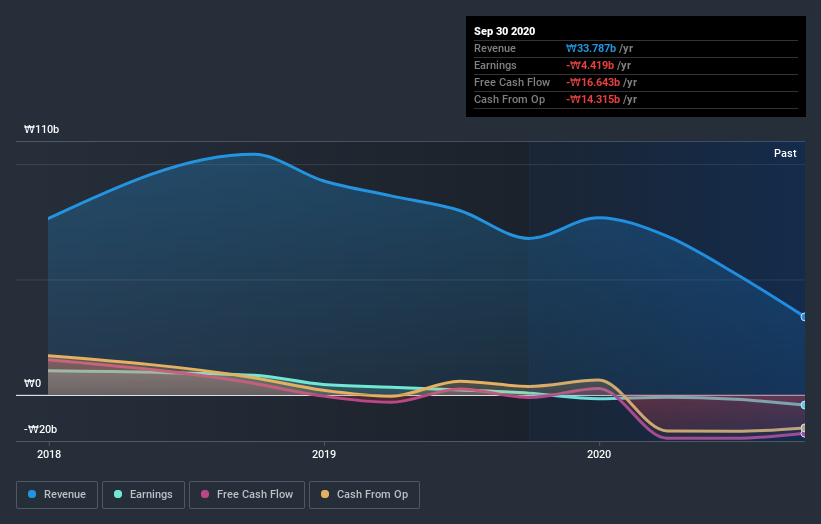

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Yellow Balloon Tour boasts a total shareholder return of 59% for the last year (that includes the dividends) . And the share price momentum remains respectable, with a gain of 44% in the last three months. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Yellow Balloon Tour is showing 3 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

We will like Yellow Balloon Tour better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Yellow Balloon Tour or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A104620

Yellow Balloon Tour

Provides travel services in South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives