- South Korea

- /

- Consumer Services

- /

- KOSDAQ:A096240

Returns On Capital At CHUNGDAHM Learning (KOSDAQ:096240) Have Stalled

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, the ROCE of CHUNGDAHM Learning (KOSDAQ:096240) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for CHUNGDAHM Learning:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = ₩17b ÷ (₩210b - ₩77b) (Based on the trailing twelve months to December 2020).

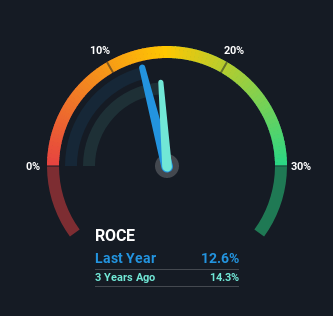

Therefore, CHUNGDAHM Learning has an ROCE of 13%. On its own, that's a standard return, however it's much better than the 10% generated by the Consumer Services industry.

Check out our latest analysis for CHUNGDAHM Learning

In the above chart we have measured CHUNGDAHM Learning's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Can We Tell From CHUNGDAHM Learning's ROCE Trend?

While the returns on capital are good, they haven't moved much. The company has employed 113% more capital in the last five years, and the returns on that capital have remained stable at 13%. 13% is a pretty standard return, and it provides some comfort knowing that CHUNGDAHM Learning has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

On a side note, CHUNGDAHM Learning has done well to reduce current liabilities to 37% of total assets over the last five years. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

The Key Takeaway

In the end, CHUNGDAHM Learning has proven its ability to adequately reinvest capital at good rates of return. And the stock has done incredibly well with a 129% return over the last five years, so long term investors are no doubt ecstatic with that result. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

On a final note, we've found 3 warning signs for CHUNGDAHM Learning that we think you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A096240

Creverse

Engages in the education business in South Korea and internationally.

Good value with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026