- South Korea

- /

- Consumer Services

- /

- KOSDAQ:A068930

Is Digital Daesung Co., Ltd. (KOSDAQ:068930) A Smart Pick For Income Investors?

Dividend paying stocks like Digital Daesung Co., Ltd. (KOSDAQ:068930) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

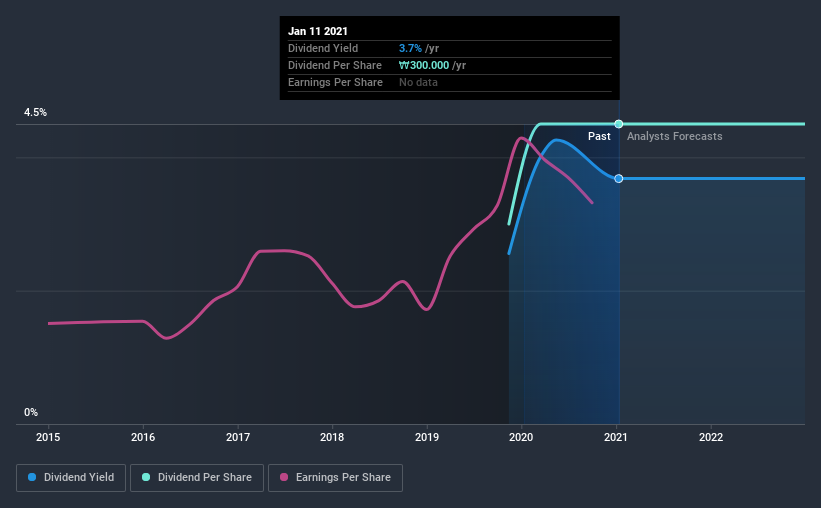

Some readers mightn't know much about Digital Daesung's 3.7% dividend, as it has only been paying distributions for a year or so. During the year, the company also conducted a buyback equivalent to around 0.8% of its market capitalisation. There are a few simple ways to reduce the risks of buying Digital Daesung for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 51% of Digital Daesung's profits were paid out as dividends in the last 12 months. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Digital Daesung paid out 65% of its free cash flow last year, which is acceptable, but is starting to limit the amount of earnings that can be reinvested into the business. It's positive to see that Digital Daesung's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note Digital Daesung's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Digital Daesung's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. This works out to be a compound annual growth rate (CAGR) of approximately 50% a year over that time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. It's good to see Digital Daesung has been growing its earnings per share at 17% a year over the past five years. Digital Daesung's earnings per share have grown rapidly in recent years, although more than half of its profits are being paid out as dividends, which makes us wonder if the company has a limited number of reinvestment opportunities in its business.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we think Digital Daesung is paying out an acceptable percentage of its cashflow and profit. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. Ultimately, Digital Daesung comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Digital Daesung that investors need to be conscious of moving forward.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Digital Daesung or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A068930

Digital Daesung

Provides online and offline educational services in South Korea and internationally.

Solid track record, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion