- South Korea

- /

- Software

- /

- KOSE:A039570

Top 3 KRX Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

Over the past year, the South Korean market has seen a growth of 7.2%, despite remaining flat in the last 7 days. With earnings forecasted to grow by 29% annually, investors might consider dividend stocks as a potentially stable component in their portfolios given these market conditions.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.35% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.40% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.44% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.10% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.42% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.39% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.84% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.11% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.76% | ★★★★★☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 5.89% | ★★★★☆☆ |

Click here to see the full list of 71 stocks from our Top KRX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Multicampus (KOSDAQ:A067280)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multicampus Corporation focuses on providing educational services for the HRD system mainly in South Korea, with a market capitalization of approximately ₩192.62 billion.

Operations: Multicampus Corporation generates its revenue primarily through its educational business, totaling approximately ₩0.36 billion.

Dividend Yield: 4.9%

Multicampus, a South Korean company, offers a dividend yield of 4.92%, ranking in the top 25% of local dividend payers. With a Price-To-Earnings ratio at 6x, below the market average of 12.6x, its valuation appears competitive. The dividends are well-supported by both earnings and cash flows with payout ratios at 29.5% and 16.8%, respectively. Despite this strong coverage, the firm's dividend history is relatively short at just five years, marking an area for caution among investors seeking long-term stability in payouts.

- Take a closer look at Multicampus' potential here in our dividend report.

- Our valuation report here indicates Multicampus may be overvalued.

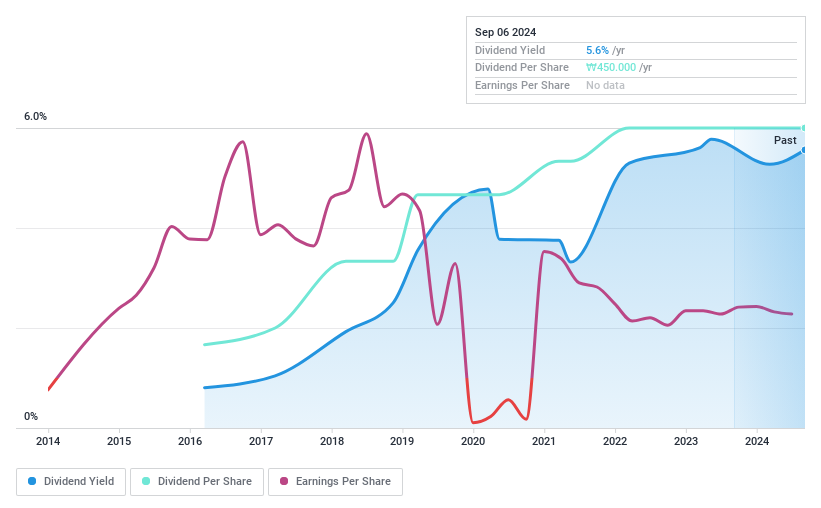

S-1 (KOSE:A012750)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S-1 Corporation specializes in providing safety and security services both domestically in South Korea and on an international scale, with a market capitalization of approximately ₩1.98 trillion.

Operations: S-1 Corporation generates its revenue primarily through the provision of safety and security services across South Korea and various international markets.

Dividend Yield: 4.6%

S-1 Corporation, with a dividend yield of 4.6%, stands above the South Korean market average of 3.54%. The dividends are backed by a payout ratio of 50.1% and a cash payout ratio of 43.4%, indicating solid earnings and cash flow support despite its short dividend history under ten years. Trading at significant undervaluation, analysts predict potential stock price growth of 25.3%. However, recent financials show a dip in net income and EPS year-over-year, suggesting possible concerns ahead for sustaining growth and dividends.

- Dive into the specifics of S-1 here with our thorough dividend report.

- Our valuation report here indicates S-1 may be undervalued.

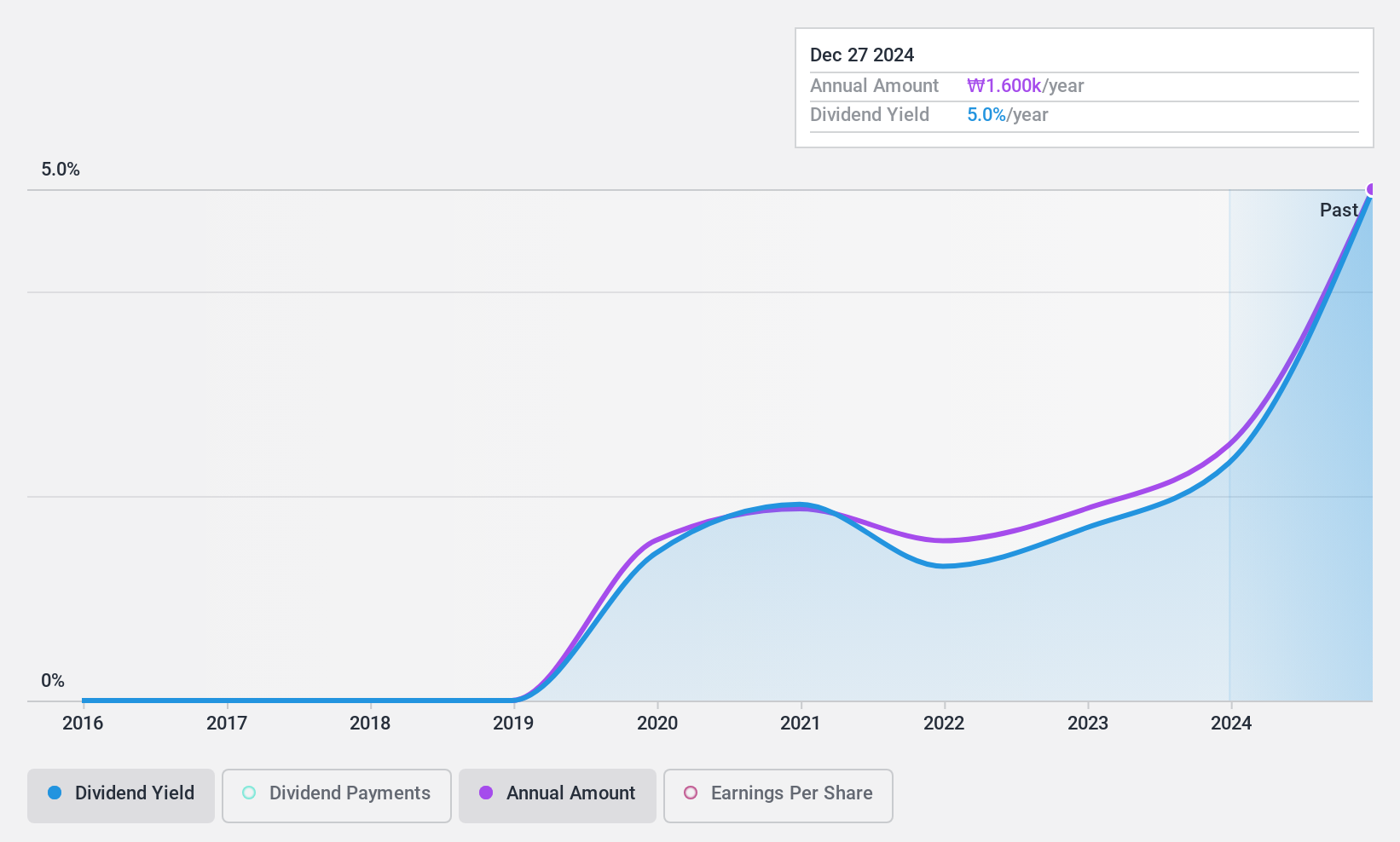

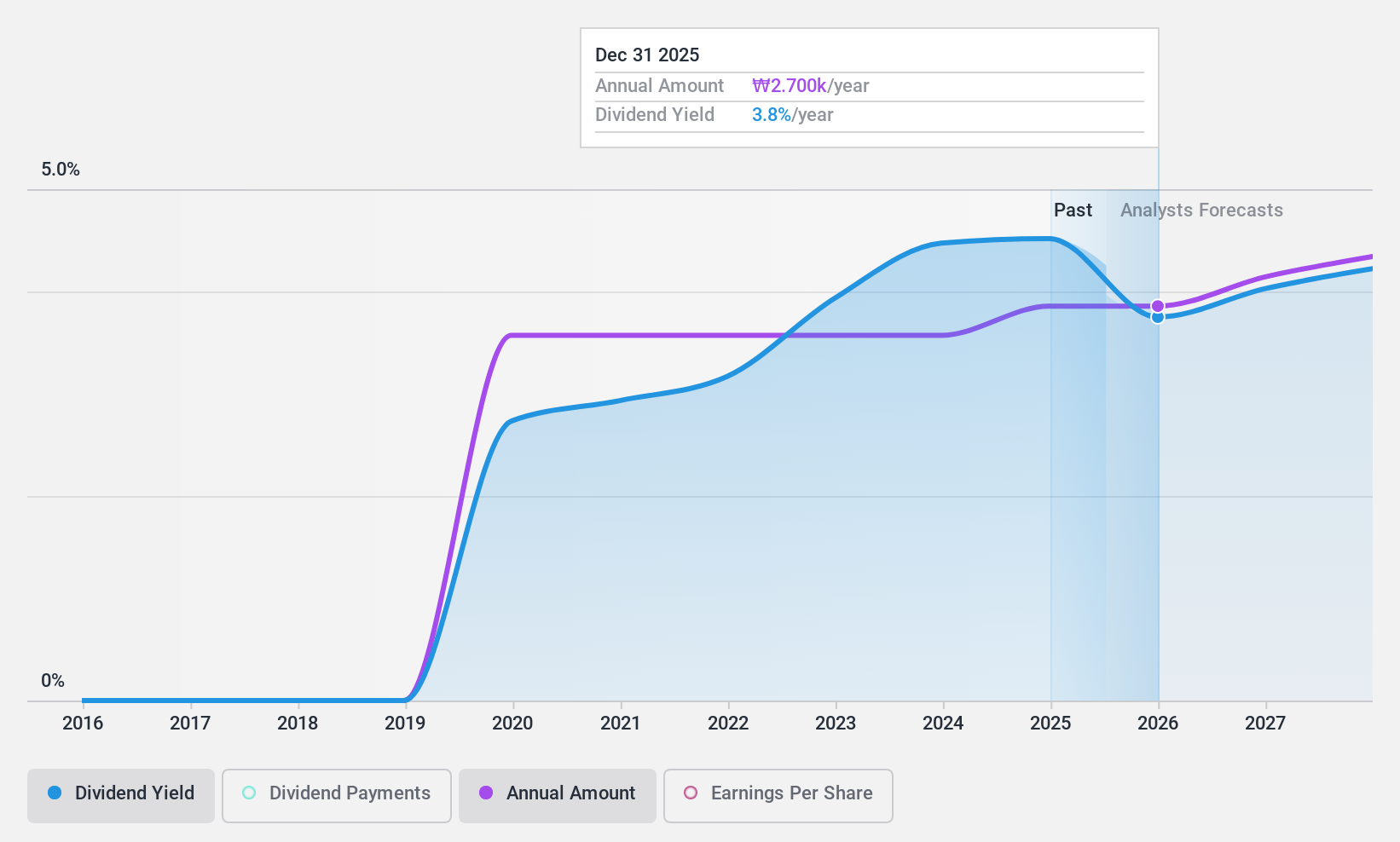

HDC I-Controls (KOSE:A039570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HDC I-Controls Co., Ltd. specializes in construction IT solutions across South Korea, Southeast Asia, and the Middle East, with a market capitalization of approximately ₩202.40 billion.

Operations: HDC I-Controls Co., Ltd. generates revenue through four primary segments: Smart Home (₩128.82 billion), Landscaping and Interior (₩89.72 billion), Electrical and Electronics (₩146.79 billion), and Comprehensive Real Estate Management (₩251.20 billion).

Dividend Yield: 5.1%

HDC I-Controls, despite a short dividend history of 8 years, offers a competitive yield of 5.11%, ranking in the top 25% in the South Korean market. The dividends are well-supported with an earnings payout ratio of 85.1% and a cash payout ratio of 64.1%. However, its share price has shown high volatility recently, and there's been a noticeable decline in net income from KRW 2.77 billion to KRW 1.76 billion as reported in Q1 2024, which could raise concerns about future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of HDC I-Controls.

- Upon reviewing our latest valuation report, HDC I-Controls' share price might be too optimistic.

Taking Advantage

- Explore the 71 names from our Top KRX Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HDC I-Controls might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A039570

HDC I-Controls

Provides construction IT solutions in South Korea, Southeast Asia, and the Middle East.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives