- South Korea

- /

- Luxury

- /

- KOSE:A241590

Investors Still Aren't Entirely Convinced By Hwaseung Enterprise Co., Ltd.'s (KRX:241590) Revenues Despite 30% Price Jump

Hwaseung Enterprise Co., Ltd. (KRX:241590) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

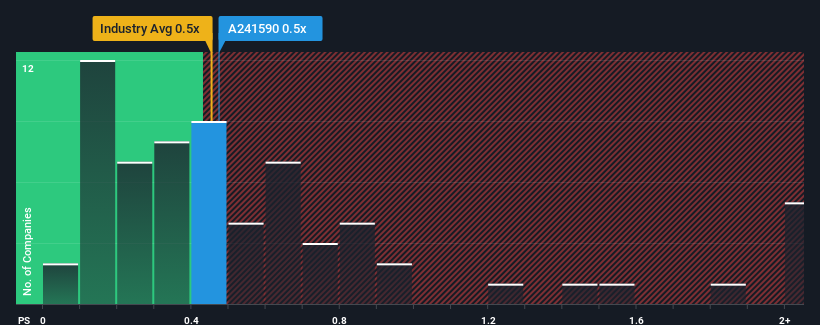

Although its price has surged higher, there still wouldn't be many who think Hwaseung Enterprise's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when it essentially matches the median P/S in Korea's Luxury industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hwaseung Enterprise

How Has Hwaseung Enterprise Performed Recently?

Hwaseung Enterprise has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hwaseung Enterprise.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hwaseung Enterprise's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.8% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 14% per year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.3% per annum, which is noticeably less attractive.

In light of this, it's curious that Hwaseung Enterprise's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Hwaseung Enterprise appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Hwaseung Enterprise's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Hwaseung Enterprise you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hwaseung Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A241590

Moderate growth potential and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion