It looks like LF Corp. (KRX:093050) is about to go ex-dividend in the next three days. This means that investors who purchase shares on or after the 29th of December will not receive the dividend, which will be paid on the 17th of April.

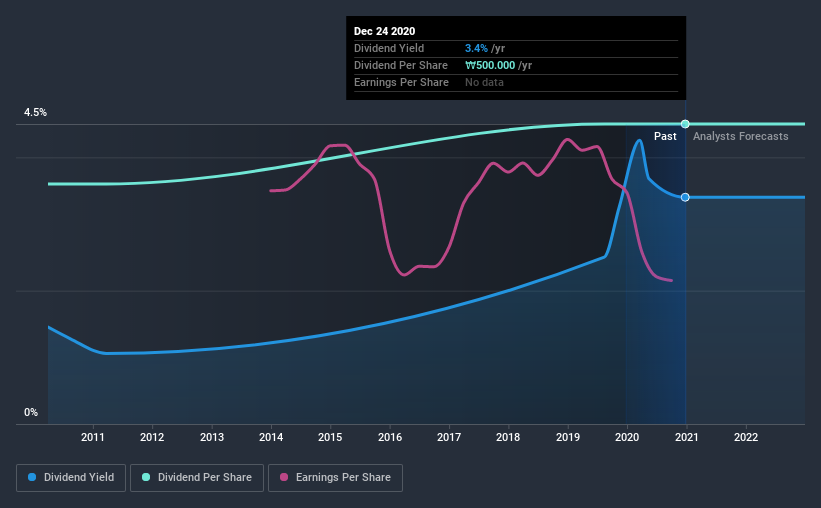

LF's next dividend payment will be ₩500 per share, on the back of last year when the company paid a total of ₩500 to shareholders. Last year's total dividend payments show that LF has a trailing yield of 3.4% on the current share price of ₩14700. If you buy this business for its dividend, you should have an idea of whether LF's dividend is reliable and sustainable. As a result, readers should always check whether LF has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for LF

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. That's why it's good to see LF paying out a modest 35% of its earnings. A useful secondary check can be to evaluate whether LF generated enough free cash flow to afford its dividend. The good news is it paid out just 6.6% of its free cash flow in the last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see LF's earnings per share have dropped 12% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, LF has increased its dividend at approximately 2.3% a year on average.

The Bottom Line

Is LF an attractive dividend stock, or better left on the shelf? LF has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

So while LF looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. In terms of investment risks, we've identified 2 warning signs with LF and understanding them should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade LF, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A093050

LF

Engages in the manufacture and sale of ready-to-wear apparel products in South Korea, China, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion