- South Korea

- /

- Consumer Durables

- /

- KOSE:A192400

Hansae Yes24 Holdings And 2 Other KRX Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

The South Korea stock market recently paused its two-day rally, with the KOSPI index experiencing a modest decline amid mixed performances across various sectors. Despite this, expectations for a rebound remain strong due to positive global forecasts and easing concerns about the U.S. economy. In such fluctuating markets, dividend stocks can offer stability and consistent returns, making them an attractive option for investors looking to bolster their portfolios.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.50% | ★★★★★★ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.60% | ★★★★★☆ |

| NH Investment & Securities (KOSE:A005940) | 5.99% | ★★★★★☆ |

| Hyundai Steel (KOSE:A004020) | 3.91% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 3.89% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.25% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.33% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 6.92% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.37% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 6.49% | ★★★★☆☆ |

Click here to see the full list of 66 stocks from our Top KRX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

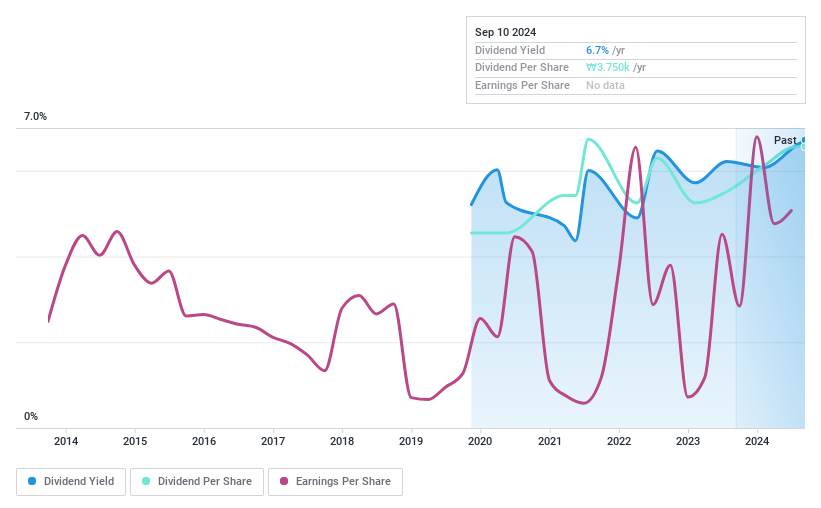

Hansae Yes24 Holdings (KOSE:A016450)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hansae Yes24 Holdings Co., Ltd., with a market cap of ₩179.12 billion, produces and sells fabrics in South Korea and internationally through its subsidiaries.

Operations: Hansae Yes24 Holdings Co., Ltd. generates revenue primarily from clothing manufacturing (₩1.71 billion), electronic commerce (₩650.53 million), clothing sales (₩297.72 million), and publication printing (₩104.54 million).

Dividend Yield: 5.5%

Hansae Yes24 Holdings offers a dividend yield of 5.48%, placing it in the top 25% of dividend payers in South Korea. Despite a high level of debt, its dividends are well-covered by earnings (payout ratio: 17.9%) and cash flows (cash payout ratio: 6%). The company has a low price-to-earnings ratio of 3.3x compared to the KR market average of 11.6x, indicating good value. However, it has only been paying dividends for five years and reported decreased sales and net income for Q1 2024 compared to last year.

- Click to explore a detailed breakdown of our findings in Hansae Yes24 Holdings' dividend report.

- In light of our recent valuation report, it seems possible that Hansae Yes24 Holdings is trading beyond its estimated value.

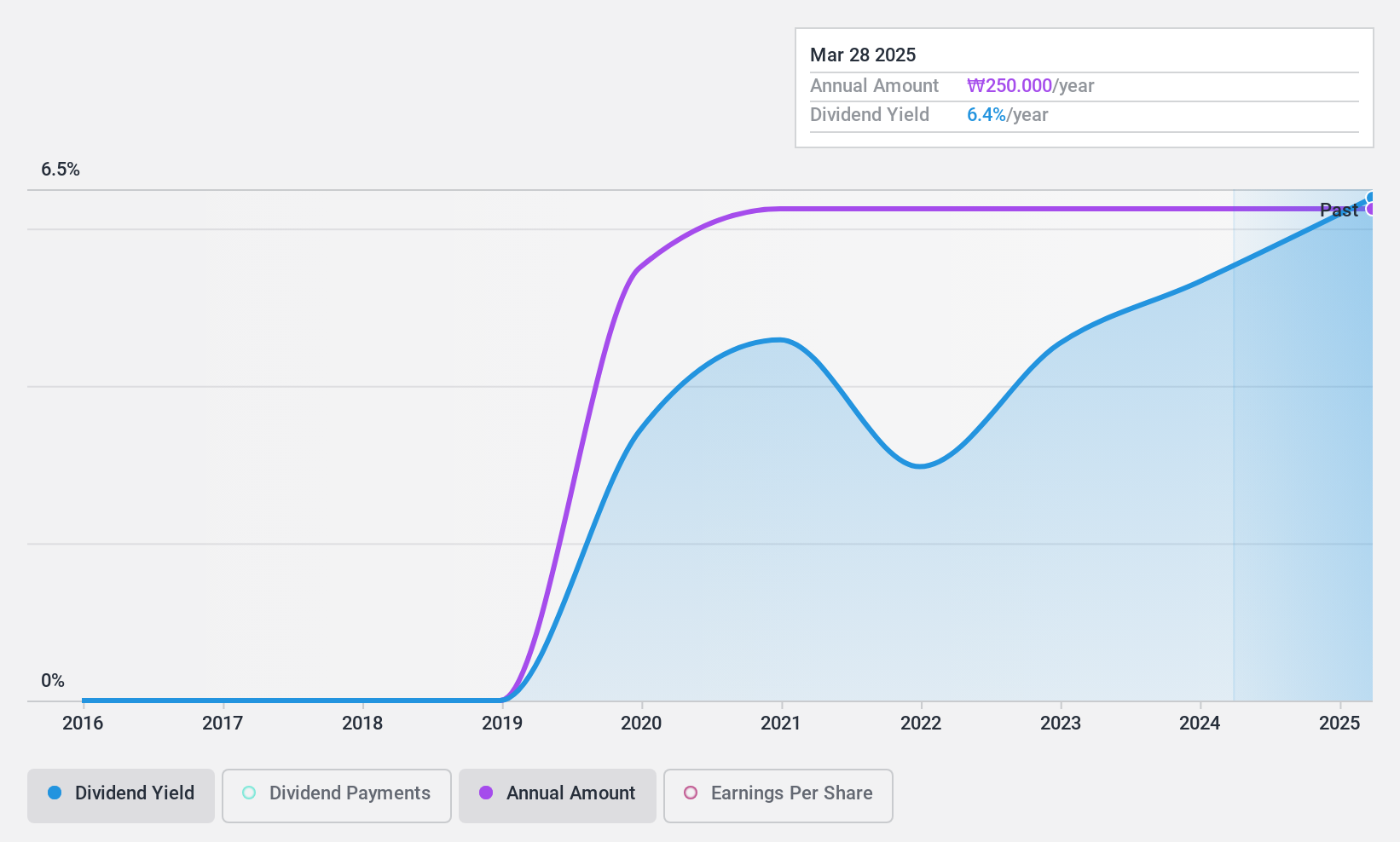

KPX Holdings (KOSE:A092230)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KPX Holdings Co., Ltd., with a market cap of ₩227.62 billion, manufactures and sells chemical products through its subsidiaries.

Operations: KPX Holdings Co., Ltd. derives its revenue primarily from Polypropylene Glycol (₩1.23 billion), followed by the Automotive Parts Division (₩129.81 million), Real Estate Leases (₩10.55 million), and the Holding Division (₩34.59 million).

Dividend Yield: 6.5%

KPX Holdings' dividend yield of 6.48% ranks in the top 25% of South Korean dividend payers. Its dividends are well-covered by earnings (payout ratio: 23.4%) and cash flows (cash payout ratio: 21.8%). However, the company has an unstable dividend history over its five-year payment period, with notable volatility. Q1 2024 results showed increased sales (KRW 4.92 billion) but significantly lower net income (KRW 13.65 million) compared to last year’s figures.

- Take a closer look at KPX Holdings' potential here in our dividend report.

- Upon reviewing our latest valuation report, KPX Holdings' share price might be too pessimistic.

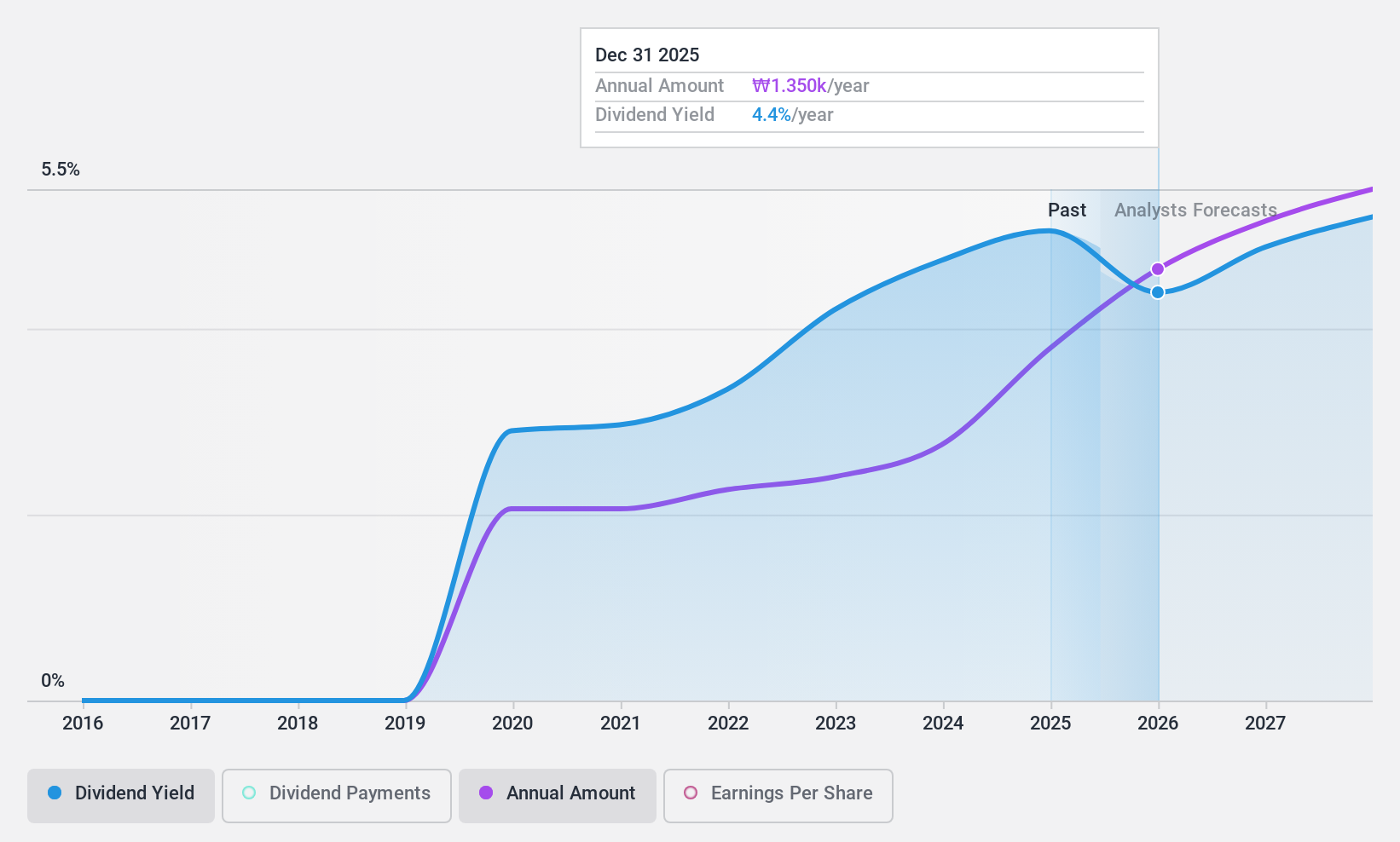

Cuckoo Holdings (KOSE:A192400)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cuckoo Holdings Co., Ltd., with a market cap of ₩671.29 billion, manufactures and sells electric heaters and daily necessities both in South Korea and internationally through its subsidiaries.

Operations: Cuckoo Holdings Co., Ltd. generates revenue primarily from its electric heating appliances segment, which amounts to ₩788.35 billion.

Dividend Yield: 5.1%

Cuckoo Holdings' dividend yield of 5.09% places it in the top 25% of South Korean dividend payers. The company's dividends are well-covered by earnings (payout ratio: 28%) and cash flows (cash payout ratio: 40.5%). While its dividend payments have been stable, Cuckoo Holdings has only a five-year history of paying dividends, indicating limited reliability over the long term. Earnings have grown at an annual rate of 9.6% over the past five years, supporting future payouts.

- Dive into the specifics of Cuckoo Holdings here with our thorough dividend report.

- Our valuation report here indicates Cuckoo Holdings may be undervalued.

Turning Ideas Into Actions

- Discover the full array of 66 Top KRX Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A192400

Cuckoo Holdings

Manufactures and sells electric heaters and daily necessities in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives