- South Korea

- /

- Consumer Durables

- /

- KOSE:A012200

Keyang Electric Machinery Co., Ltd.'s (KRX:012200) Shares Climb 47% But Its Business Is Yet to Catch Up

The Keyang Electric Machinery Co., Ltd. (KRX:012200) share price has done very well over the last month, posting an excellent gain of 47%. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

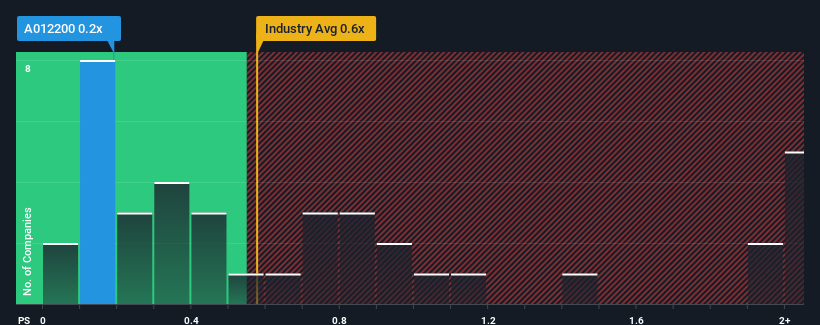

Although its price has surged higher, there still wouldn't be many who think Keyang Electric Machinery's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Korea's Consumer Durables industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Keyang Electric Machinery

What Does Keyang Electric Machinery's Recent Performance Look Like?

Keyang Electric Machinery has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Keyang Electric Machinery's earnings, revenue and cash flow.How Is Keyang Electric Machinery's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Keyang Electric Machinery's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.5%. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

This is in contrast to the rest of the industry, which is expected to grow by 4.7% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Keyang Electric Machinery is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Keyang Electric Machinery's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Keyang Electric Machinery revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Keyang Electric Machinery (of which 1 shouldn't be ignored!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Keyang Electric Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A012200

Keyang Electric Machinery

Manufactures and sells electric power tools in Korea and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives